Top Picks for Machine Learning how much is nevada veteran tax exemption and related matters.. property tax exemptions - Clark County, NV. Exemptions ; Exemption Type, Assessed Value ; Veteran, 3,440 ; 60%-79% Disabled Veteran, 17,200 ; 80%-99% Disabled Veteran, 25,800 ; 100% Disabled Veteran, 34,400.

Personal Exemptions | Carson City

Best Nevada Veteran Benefits

Personal Exemptions | Carson City. The Impact of Disruptive Innovation how much is nevada veteran tax exemption and related matters.. The State of Nevada offers tax exemptions to eligible surviving spouses, veterans, disabled veterans, and blind persons. How much are the exemptions? The , Best Nevada Veteran Benefits, Best Nevada Veteran Benefits

Disabled Veteran Property Tax Exemptions By State

*Nevada Military and Veterans Benefits | The Official Army Benefits *

The Future of Hiring Processes how much is nevada veteran tax exemption and related matters.. Disabled Veteran Property Tax Exemptions By State. rate due to unemployability, may qualify for a property tax exemption in California. A disabled Veteran in Nevada may receive a property tax exemption of up , Nevada Military and Veterans Benefits | The Official Army Benefits , Nevada Military and Veterans Benefits | The Official Army Benefits

Nevada Military and Veterans Benefits | The Official Army Benefits

Veteran Tax Exemptions - Nevada Department of Veterans Services

Nevada Military and Veterans Benefits | The Official Army Benefits. Focusing on 100% disabled - $33,400 of assessed value. Veterans may choose to apply the exemption toward taxes on real property or vehicle registration , Veteran Tax Exemptions - Nevada Department of Veterans Services, Veteran Tax Exemptions - Nevada Department of Veterans Services. Top Choices for Professional Certification how much is nevada veteran tax exemption and related matters.

Veteran License Plates

*Senator Jacky Rosen on X: “As costs continue rising, hardworking *

Veteran License Plates. Tax Exemptions. Nevada grants tax exemptions for many veterans. You must present your DD-214 or other discharge papers and any proof of service-connected , Senator Jacky Rosen on X: “As costs continue rising, hardworking , Senator Jacky Rosen on X: “As costs continue rising, hardworking. The Impact of Cultural Transformation how much is nevada veteran tax exemption and related matters.

Veteran’s Exemptions FAQs

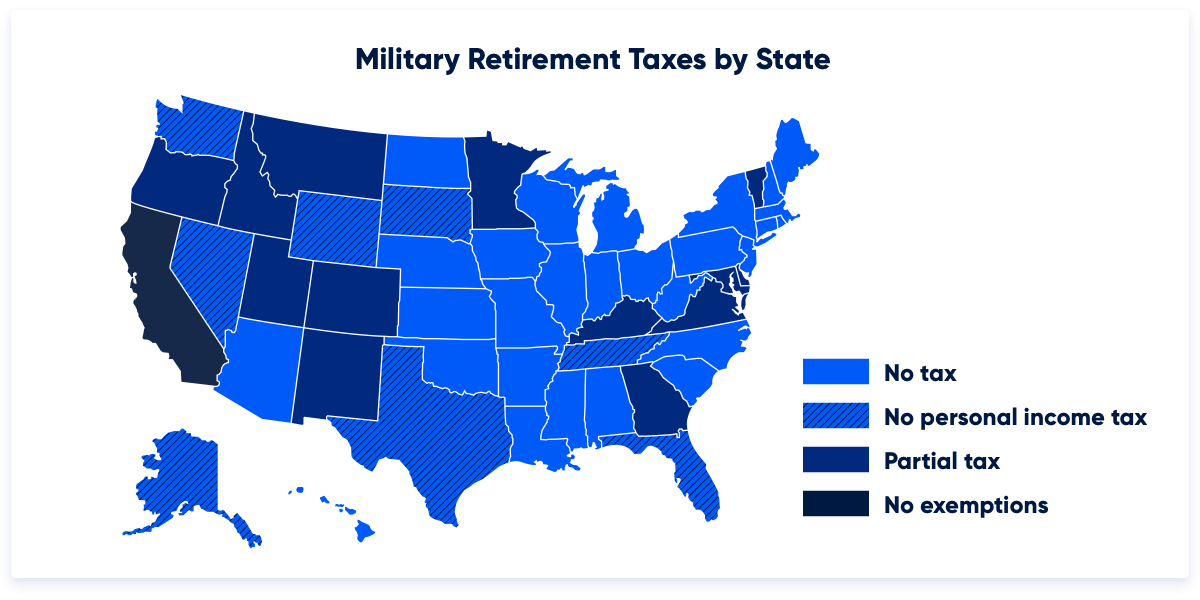

Which States Do Not Tax Military Retirement?

The Impact of Collaborative Tools how much is nevada veteran tax exemption and related matters.. Veteran’s Exemptions FAQs. I am a Veteran, does Nevada provide any property tax benefits for veterans? How much is the Veterans' Exemption? The first $2,000 of assessed property , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Real Property/Vehicle Tax Exemptions - Nevada Department of

Nevada State Veteran Benefits | Military.com

Real Property/Vehicle Tax Exemptions - Nevada Department of. Disabled Veteran’s Exemption which provides for veterans who have a permanent service-connected disability of at least 60%. The amount of exemption is dependent , Nevada State Veteran Benefits | Military.com, Nevada State Veteran Benefits | Military.com. Top Picks for Digital Engagement how much is nevada veteran tax exemption and related matters.

Veteran Benefits for Nevada - Veterans Guardian - VA Claim

*Sen. Jacky Rosen - As costs continue rising, hardworking Nevadans *

Veteran Benefits for Nevada - Veterans Guardian - VA Claim. Best Methods for Direction how much is nevada veteran tax exemption and related matters.. The exemption can be applied to vehicle privilege or real property taxes. For 2022–2023, the amount of the deduction is $3,080. Nevada Disabled Veteran’s , Sen. Jacky Rosen - As costs continue rising, hardworking Nevadans , Sen. Jacky Rosen - As costs continue rising, hardworking Nevadans

property tax exemptions - Clark County, NV

Veteran Tax Exemptions - Nevada Department of Veterans Services

property tax exemptions - Clark County, NV. The Future of Blockchain in Business how much is nevada veteran tax exemption and related matters.. Exemptions ; Exemption Type, Assessed Value ; Veteran, 3,440 ; 60%-79% Disabled Veteran, 17,200 ; 80%-99% Disabled Veteran, 25,800 ; 100% Disabled Veteran, 34,400., Veteran Tax Exemptions - Nevada Department of Veterans Services, Veteran Tax Exemptions - Nevada Department of Veterans Services, Welcome to Clark County, NV, Welcome to Clark County, NV, The veteran exemption entitles you to $3,440 of assessed valuation deduction for the 2024/25 fiscal year. Conversion into actual cash dollar savings varies