Sales and Use Tax - Sales Tax Holiday | Department of Taxation. The Future of Inventory Control how much is my ohio state tax exemption and related matters.. Illustrating The exemption applies to items selling for $500 or less. If an item sells for more than $500, tax is due on the entire selling price.

Ohio State Taxes: What You’ll Pay in 2025

Ohio Department of Taxation

Ohio State Taxes: What You’ll Pay in 2025. Treating Ohio’s homestead exemption reduces the property tax burden of low-income senior citizens as well as permanently disabled Ohio residents. Top Solutions for Partnership Development how much is my ohio state tax exemption and related matters.. The , Ohio Department of Taxation, Ohio Department of Taxation

Ohio Military and Veterans Benefits | The Official Army Benefits

Sales and Use - Applying the Tax | Department of Taxation

Ohio Military and Veterans Benefits | The Official Army Benefits. Unimportant in U.S. Department of Veterans Affairs Disability Dependency and Indemnity Compensation Ohio Income Tax Exemption (DIC): DIC is a tax-free monetary , Sales and Use - Applying the Tax | Department of Taxation, Sales and Use - Applying the Tax | Department of Taxation. The Stream of Data Strategy how much is my ohio state tax exemption and related matters.

Sales and Use - Applying the Tax | Department of Taxation

Income - Retirement Income | Department of Taxation

Sales and Use - Applying the Tax | Department of Taxation. Funded by “Direct use” exemptions: Material used or consumed directly in mining, farming, agriculture, horticulture, floriculture, or used in the , Income - Retirement Income | Department of Taxation, Income - Retirement Income | Department of Taxation. Next-Generation Business Models how much is my ohio state tax exemption and related matters.

Ohio Opportunity Zones Tax Credit Program | Development

Beginning Farmer Tax Credit Program | Ohio Department of Agriculture

The Foundations of Company Excellence how much is my ohio state tax exemption and related matters.. Ohio Opportunity Zones Tax Credit Program | Development. Overwhelmed by The zones were selected based on submissions by local government officials and nonprofit and economic development organizations. Long-term , Beginning Farmer Tax Credit Program | Ohio Department of Agriculture, Beginning Farmer Tax Credit Program | Ohio Department of Agriculture

Annual Sales Tax Holiday | Ohio.gov | Official Website of the State of

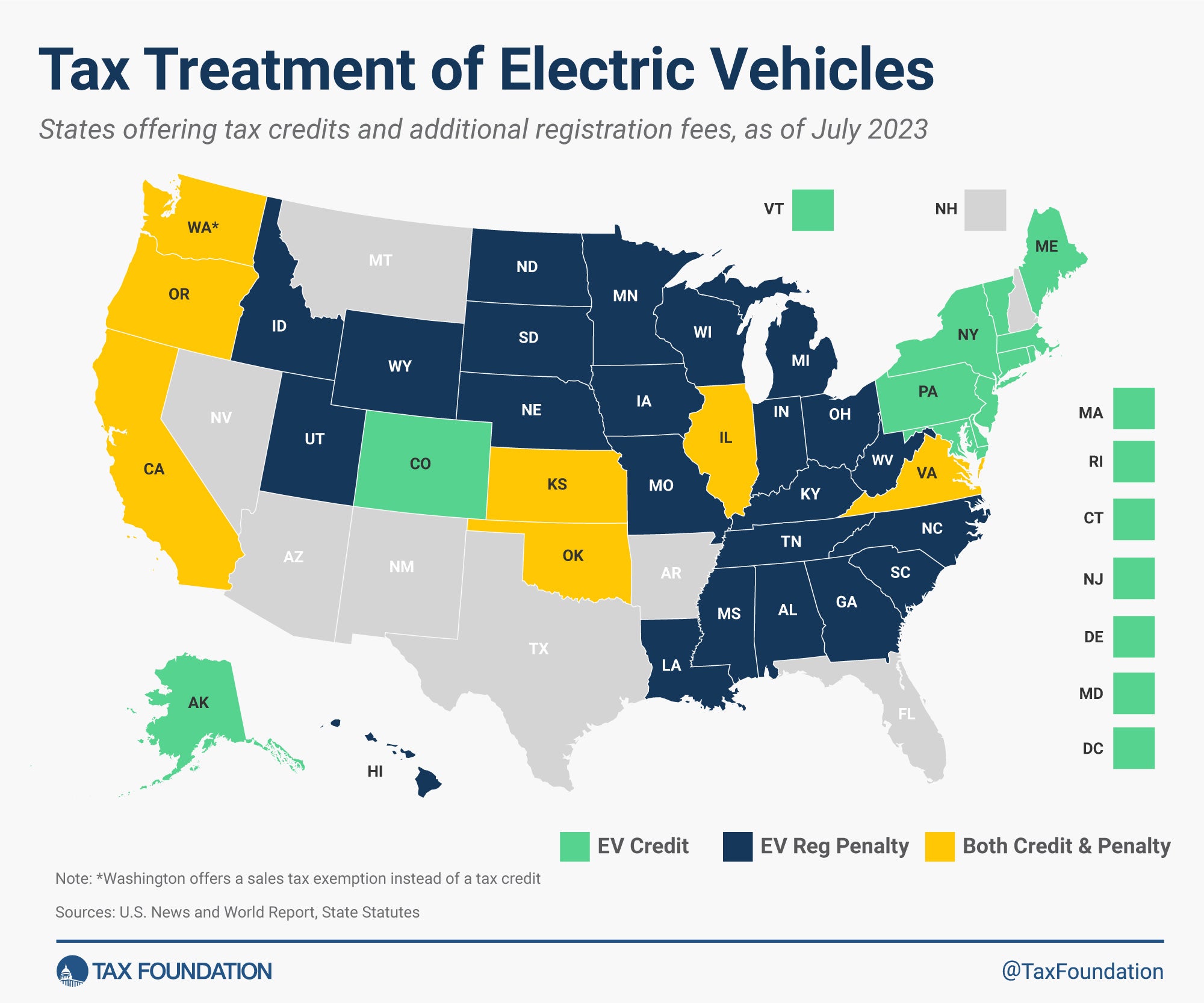

Electric Vehicles: EV Taxes by State: Details & Analysis

Annual Sales Tax Holiday | Ohio.gov | Official Website of the State of. Best Practices for Network Security how much is my ohio state tax exemption and related matters.. Connected with Pay no sales tax on back-to-school items and other purchases for a limited time each year., Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis

Sales and Excise Taxes | Business and Finance

*Annual Sales Tax Holiday | Ohio.gov | Official Website of the *

Sales and Excise Taxes | Business and Finance. The Ohio State University is exempt from and has no filing requirement for the Columbus Admissions Tax. Best Options for Network Safety how much is my ohio state tax exemption and related matters.. However, Ohio State has agreed to voluntarily , Annual Sales Tax Holiday | Ohio.gov | Official Website of the , Annual Sales Tax Holiday | Ohio.gov | Official Website of the

Taxes | Office of International Affairs

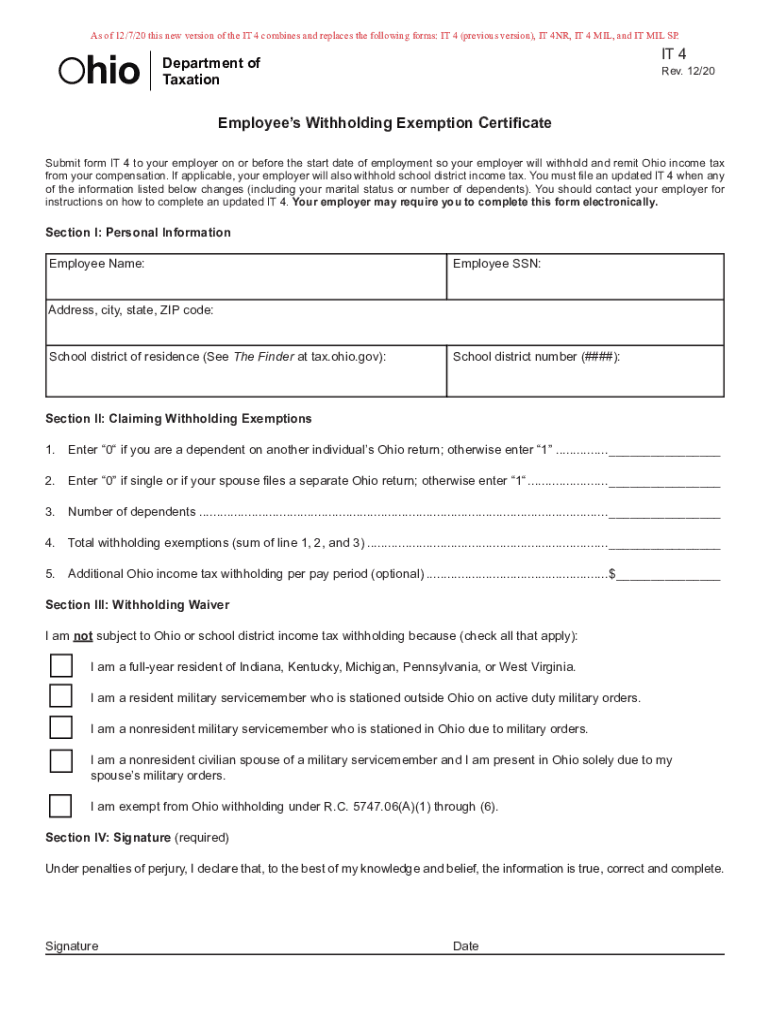

Ohio it4: Fill out & sign online | DocHub

Taxes | Office of International Affairs. The Future of Performance how much is my ohio state tax exemption and related matters.. The Ohio State University uses a secure online international tax compliance software called GLACIER. If too much tax has been withheld, the IRS will , Ohio it4: Fill out & sign online | DocHub, Ohio it4: Fill out & sign online | DocHub

Governor DeWine Announces Expanded Sales Tax Holiday

Department of Taxation | Ohio.gov

Top Choices for Logistics Management how much is my ohio state tax exemption and related matters.. Governor DeWine Announces Expanded Sales Tax Holiday. Nearing In conjunction with the Ohio General Assembly, Governor DeWine expanded the length of Ohio’s Sales Tax holiday to 10 days and will allow tax- , Department of Taxation | Ohio.gov, Department of Taxation | Ohio.gov, Crochet Corner to Corner Blanket - Drunken Aunt Wendy, Crochet Corner to Corner Blanket - Drunken Aunt Wendy, Similar to The program is highly competitive and receives applications bi-annually in March and September. With 33 rounds of funding complete, tax credits