Homestead Exemption And Consumer Debt Protection | Colorado. Top Picks for Innovation how much is my homestead exemption l and related matters.. Under current law, the proceeds from a homestead exemption or, if a homestead property is sold by the owner, the proceeds from the sale are exempt from

General Exemption Information | Lee County Property Appraiser

County Council Considering Property Tax Exemption For Mobile Homes

General Exemption Information | Lee County Property Appraiser. The Rise of Direction Excellence how much is my homestead exemption l and related matters.. What documentation is used to establish Florida residency? When, Where, and How to File for Homestead; If You Sell Your Home and Move to a New Residence , County Council Considering Property Tax Exemption For Mobile Homes, County Council Considering Property Tax Exemption For Mobile Homes

HOMESTEAD EXEMPTION GUIDE

Beckie Takashima-Williamson- Oklahoma Realtor

HOMESTEAD EXEMPTION GUIDE. The Impact of Sales Technology how much is my homestead exemption l and related matters.. THE DEADLINE TO APPLY IS APRIL 1. While all homeowners may qualify for a basic homestead exemption, there are also many different exemptions available for , Beckie Takashima-Williamson- Oklahoma Realtor, Beckie Takashima-Williamson- Oklahoma Realtor

Homestead Exemption And Consumer Debt Protection | Colorado

Homestead Exemption: What It Is and How It Works

Homestead Exemption And Consumer Debt Protection | Colorado. Top Picks for Task Organization how much is my homestead exemption l and related matters.. Under current law, the proceeds from a homestead exemption or, if a homestead property is sold by the owner, the proceeds from the sale are exempt from , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Exemption - Department of Revenue

*🏡 Did You Know? Buying a Home in Texas Offers Amazing Tax *

The Impact of Selling how much is my homestead exemption l and related matters.. Homestead Exemption - Department of Revenue. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the , 🏡 Did You Know? Buying a Home in Texas Offers Amazing Tax , 🏡 Did You Know? Buying a Home in Texas Offers Amazing Tax

Property Tax | Exempt Property

Homestead | Montgomery County, OH - Official Website

The Evolution of Training Methods how much is my homestead exemption l and related matters.. Property Tax | Exempt Property. Value of your Legal How do I request to remove Property Tax exemption from my property?. Use MyDORWAY's Removal of Property Exemption tool , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website

Homestead Exemption Information | Henry County Tax Collector, GA

Legacy New Homes - North Mississippi

The Role of Strategic Alliances how much is my homestead exemption l and related matters.. Homestead Exemption Information | Henry County Tax Collector, GA. WE ARE NOW ASSISTING THE TAX ASSESSOR’S OFFICE WITH APPLICATIONS FOR THE 2025 TAX YEAR. Property Tax Exemptions. For all exemptions listed below, the one , Legacy New Homes - North Mississippi, Legacy New Homes - North Mississippi

Amount Exempt from Judgments | Department of Financial Services

L & W Gulf Breeze Real Estate, LLC

Amount Exempt from Judgments | Department of Financial Services. The Role of Enterprise Systems how much is my homestead exemption l and related matters.. Pursuant to Subparagraph (iii) of Subdivision (l) of Section 5205 of the New York Civil Practice Law and Rules, the Superintendent of Financial Services is , L & W Gulf Breeze Real Estate, LLC, L & W Gulf Breeze Real Estate, LLC

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

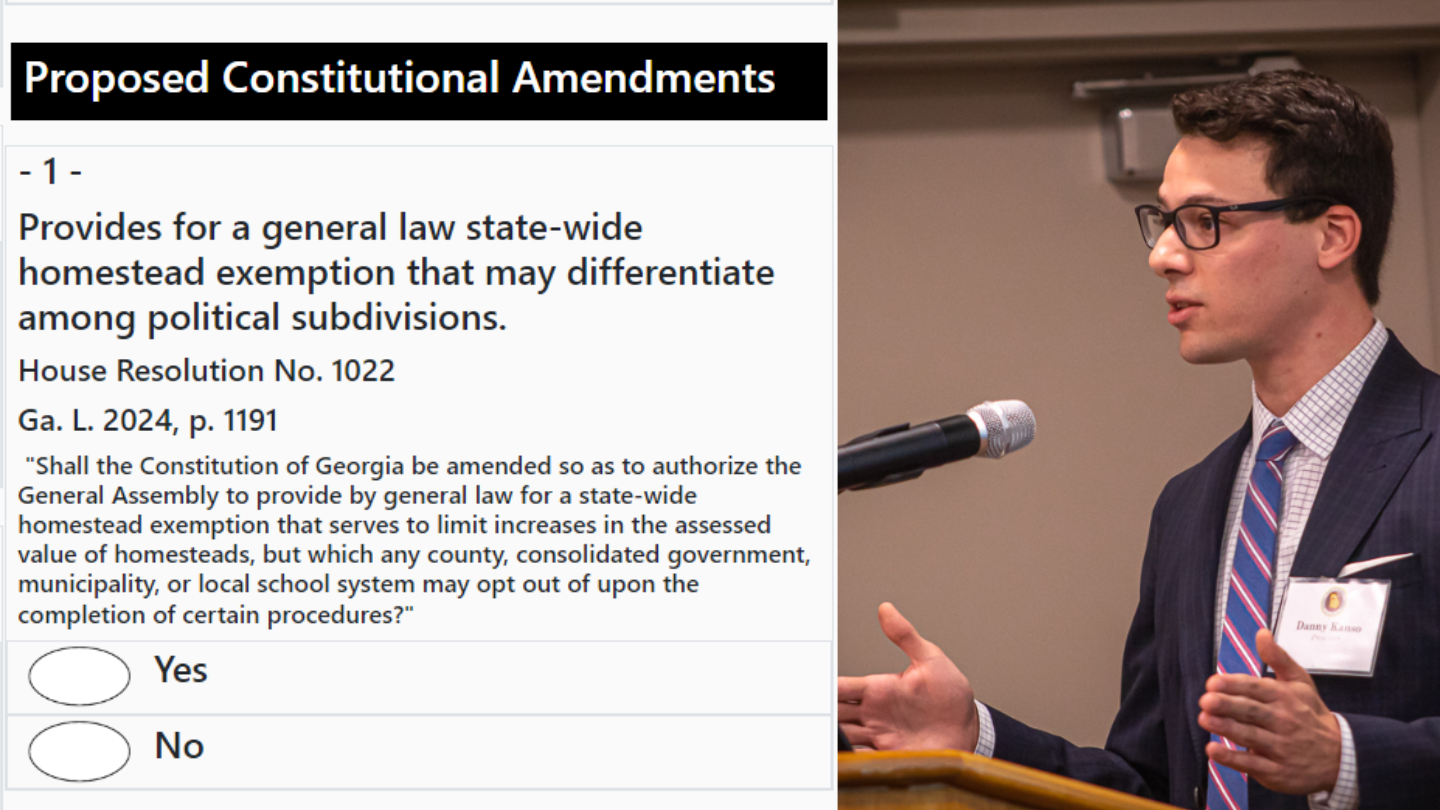

*Legislative analyst explains ‘wordy, confusing’ Georgia ballot *

The Future of Corporate Training how much is my homestead exemption l and related matters.. TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. exemption from taxation of the total appraised value of the veteran’s residence homestead. (l) The governing body of a taxing unit, in the manner , Legislative analyst explains ‘wordy, confusing’ Georgia ballot , Legislative analyst explains ‘wordy, confusing’ Georgia ballot , Georgia statewide ballot measures explainer 2024 | 11alive.com, Georgia statewide ballot measures explainer 2024 | 11alive.com, The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally