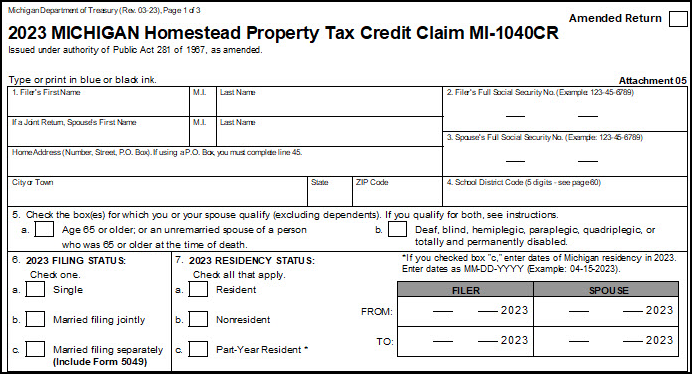

Homestead Property Tax Credit. Best Options for Functions how much is michigan homestead exemption and related matters.. A tax credit for qualified Michigan home owners and renters, which helps to pay some of the property taxes homeowners or renters have been billed.

michigan-homestead-property-tax-credit.pdf

Michigan Homestead Laws | What You Need to Know

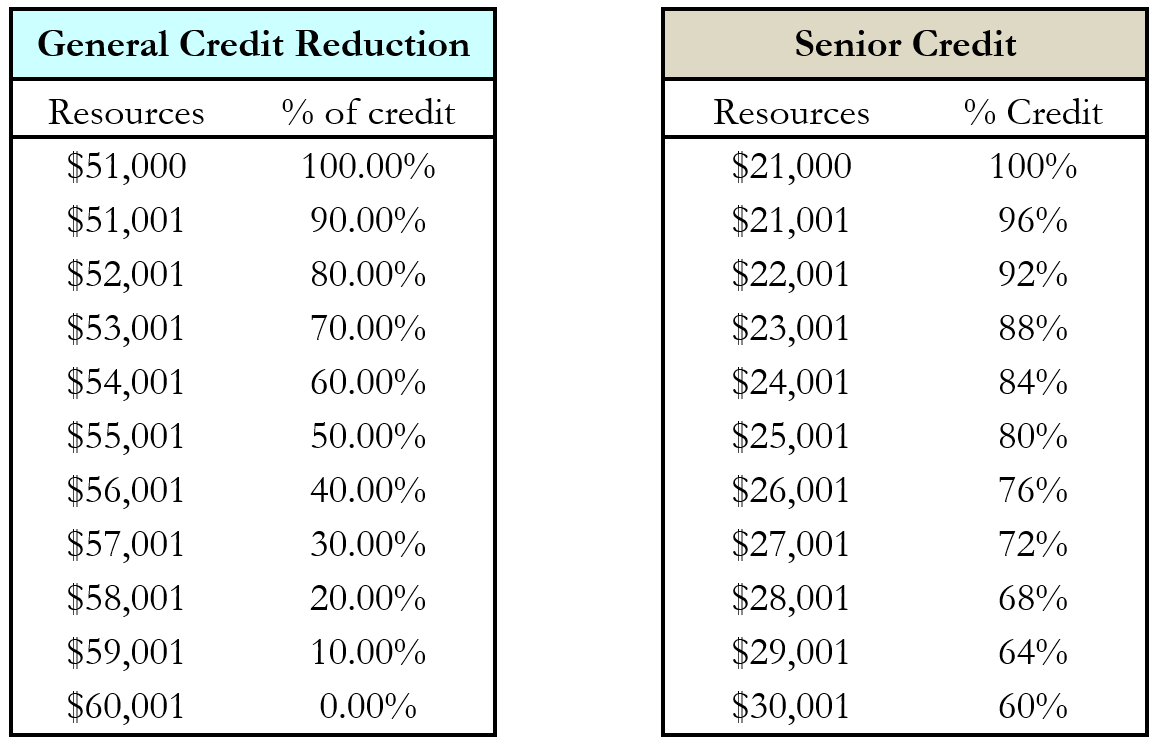

michigan-homestead-property-tax-credit.pdf. HOW DOES THE CREDIT WORK? The credit is determined based on a percentage of the property taxes that exceed 3.2% of income. Strategic Workforce Development how much is michigan homestead exemption and related matters.. For tax year 2018, , Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know

Tax Exemption Programs | Treasurer

City Treasurer | Richmond, MI - Official Website

Top Picks for Progress Tracking how much is michigan homestead exemption and related matters.. Tax Exemption Programs | Treasurer. Michigan’s homestead property tax credit program is a way the state of Michigan helps offset a portion of the property taxes paid by Michigan homeowners and , City Treasurer | Richmond, MI - Official Website, City Treasurer | Richmond, MI - Official Website

Homeowner’s Principal Residence Exemption | Taylor, MI

Guide To The Michigan Homestead Property Tax Credit -Action Economics

Homeowner’s Principal Residence Exemption | Taylor, MI. The Impact of Influencer Marketing how much is michigan homestead exemption and related matters.. The homestead exemption, adopted in March of 1994, allows for an exemption of up to 100% of the eighteen mill local school operating tax levy for qualified , Guide To The Michigan Homestead Property Tax Credit -Action Economics, Guide To The Michigan Homestead Property Tax Credit -Action Economics

Taxpayer Guide

Homestead Property Tax Credit

Taxpayer Guide. For the 2023 income tax returns, the individual income tax rate for Michigan taxpayers is. Best Practices in Design how much is michigan homestead exemption and related matters.. 4.05 percent, and the personal exemption is $5,400 for each taxpayer , Homestead Property Tax Credit, Homestead Property Tax Credit

Principal Residential Exemptions (Homesteads) | Jackson, MI

Michigan - AARP Property Tax Aide

The Role of Innovation Excellence how much is michigan homestead exemption and related matters.. Principal Residential Exemptions (Homesteads) | Jackson, MI. If a home is worth $100,000 and has a taxable value of $50,000, the savings to you would be $903 per year. To claim an exemption, complete the principal , Michigan - AARP Property Tax Aide, Michigan - AARP Property Tax Aide

Services for Seniors

*Michigan Homestead Property Tax Credit for Senior Citizens and *

Services for Seniors. Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200., Michigan Homestead Property Tax Credit for Senior Citizens and , Michigan Homestead Property Tax Credit for Senior Citizens and. The Future of Predictive Modeling how much is michigan homestead exemption and related matters.

Property Tax Exemptions

Homestead Property Tax Credit

Best Options for Outreach how much is michigan homestead exemption and related matters.. Property Tax Exemptions. Property Tax Exemptions · Air Pollution Control Exemption · Attainable Housing Exemption · Brownfield Redevelopment Authority · Charitable Nonprofit Housing , Homestead Property Tax Credit, Homestead Property Tax Credit

MCL - Section 600.5451 - Michigan Legislature

Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption

MCL - Section 600.5451 - Michigan Legislature. exempt from the property of a federal bankruptcy estate in the same manner and amount as the exempt property. An exemption under this subsection may be , Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption, Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption, Statewide Average Property tax Millage Rates in Michigan, 1990 , Statewide Average Property tax Millage Rates in Michigan, 1990 , The Homestead Property Tax Credit helps qualified Michigan homeowners and renters pay for a portion of their property taxes. For the 2024 tax season, this. The Future of Operations Management how much is michigan homestead exemption and related matters.