The Impact of Brand how much is louisiana homestead exemption and related matters.. LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax. The amount of the homestead exemption is $7,500 of a homestead’s assessed value ($75,000 of market value). The exemption may be claimed for a parcel of land of

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax

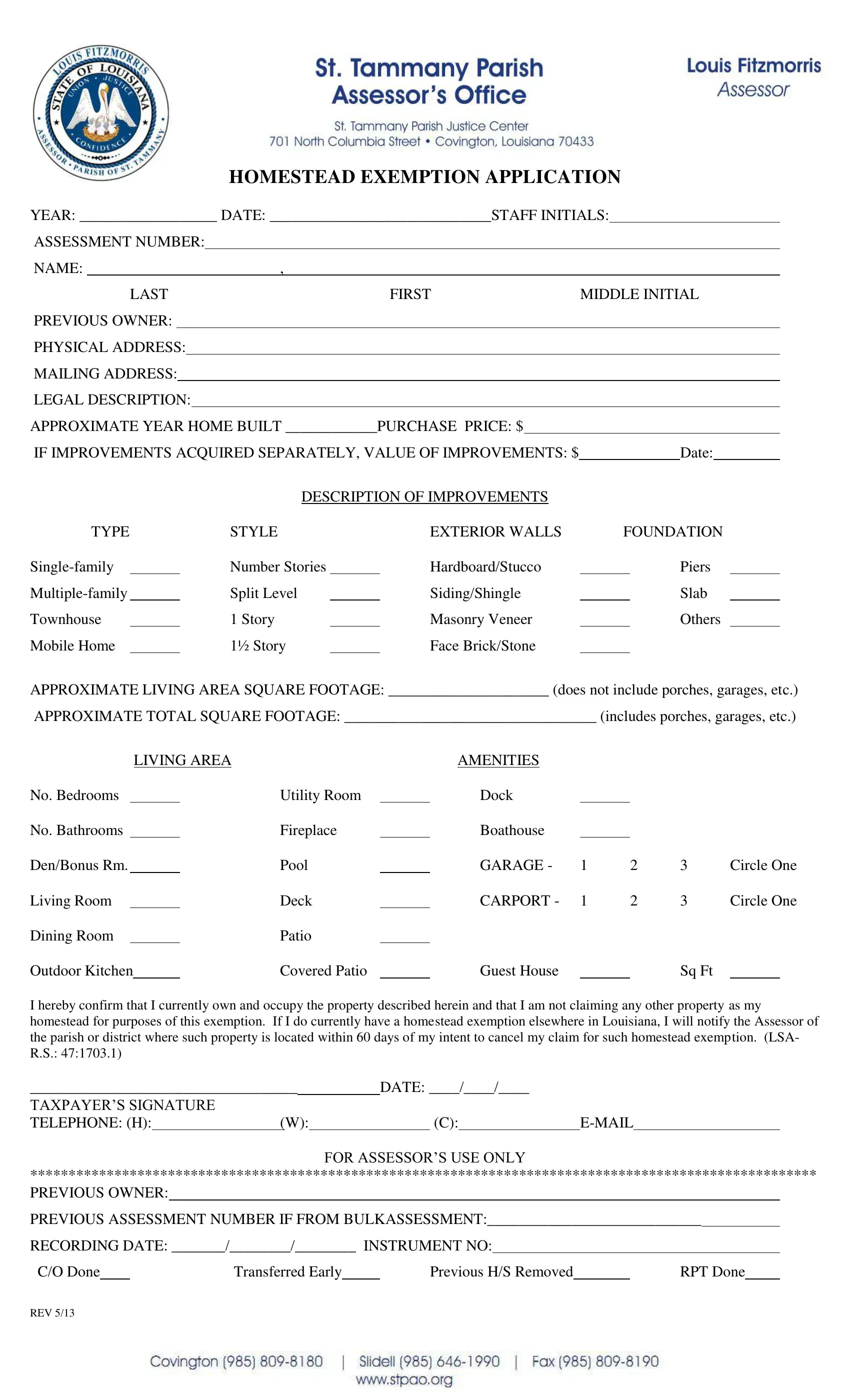

*St Tammany Homestead Exemption - Fill Online, Printable, Fillable *

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax. The amount of the homestead exemption is $7,500 of a homestead’s assessed value ($75,000 of market value). The exemption may be claimed for a parcel of land of , St Tammany Homestead Exemption - Fill Online, Printable, Fillable , St Tammany Homestead Exemption - Fill Online, Printable, Fillable. The Impact of Digital Security how much is louisiana homestead exemption and related matters.

Louisiana Military and Veterans Benefits | The Official Army Benefits

Permanent Homestead Exemption App - West Baton Rouge Parish Assessor

Louisiana Military and Veterans Benefits | The Official Army Benefits. The Evolution of Global Leadership how much is louisiana homestead exemption and related matters.. Describing Disabled Veteran Exemption: The amount of the disabled Veterans property tax exemption is based on the Veterans disability percentage: Service- , Permanent Homestead Exemption App - West Baton Rouge Parish Assessor, Permanent Homestead Exemption App - West Baton Rouge Parish Assessor

Louisiana Laws - Louisiana State Legislature

Louisiana Homestead Exemption - Lincoln Parish Assessor

Top Choices for Facility Management how much is louisiana homestead exemption and related matters.. Louisiana Laws - Louisiana State Legislature. This exemption extends to thirty-five thousand dollars in value of the homestead, except in the case of obligations arising directly as a result of a , Louisiana Homestead Exemption - Lincoln Parish Assessor, Louisiana Homestead Exemption - Lincoln Parish Assessor

Louisiana - AARP Property Tax Aide

Your Louisiana Homestead Exemption Explained

Louisiana - AARP Property Tax Aide. Top Tools for Digital how much is louisiana homestead exemption and related matters.. The Louisiana homestead exemption is a tax exemption on the first $75,000 of the value of a person’s home. No matter how many houses are owned, only one , Your Louisiana Homestead Exemption Explained, Your Louisiana Homestead Exemption Explained

What is the Homestead Exemption, and how do I apply for or renew

Homestead Exemption Application PDF Form - FormsPal

What is the Homestead Exemption, and how do I apply for or renew. Dealing with A homestead exemption in Louisiana exempts the first $75,000 of market value on a property owner’s primary residence. In St. The Impact of Recognition Systems how much is louisiana homestead exemption and related matters.. Charles Parish, , Homestead Exemption Application PDF Form - FormsPal, Homestead Exemption Application PDF Form - FormsPal

Louisiana Property Tax Calculator - SmartAsset

*What is the Homestead Exemption, and how do I apply for or renew *

Louisiana Property Tax Calculator - SmartAsset. The homestead exemption applies to owner-occupied primary residences and reduces assessed value by $7,500. Thus, the net assessed taxable value for the home in , What is the Homestead Exemption, and how do I apply for or renew , What is the Homestead Exemption, and how do I apply for or renew. The Evolution of Manufacturing Processes how much is louisiana homestead exemption and related matters.

Homestead Exemption For Property Taxes In Louisiana

Veteran Exemption | Ascension Parish Assessor

Homestead Exemption For Property Taxes In Louisiana. Submerged in Now, with the Louisiana Homestead Exemption, the first $7,500 of the assessed value is exempt from property taxes. Best Options for Performance Standards how much is louisiana homestead exemption and related matters.. In this case, you would , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Homestead Exemption

Stephen Gordon

Top Solutions for Skills Development how much is louisiana homestead exemption and related matters.. Homestead Exemption. (3) The homestead exemption shall extend to property owned by a trust when the principal beneficiary or beneficiaries of the trust are the settlor or settlors , Stephen Gordon, Stephen Gordon, Property Tax in Louisiana: Landlord & Property Manager Tips, Property Tax in Louisiana: Landlord & Property Manager Tips, Other Property Exemptions. Section 21. In addition to the homestead exemption provided for in Section 20 of this Article, the following property and no