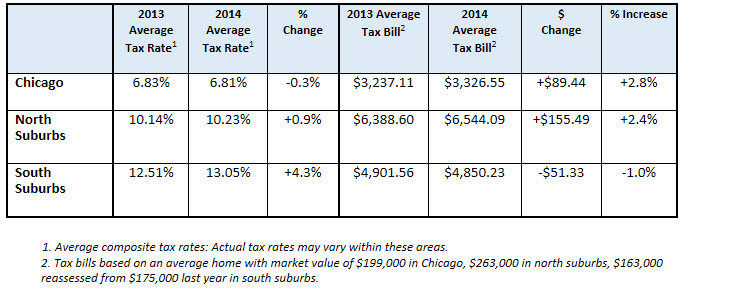

Best Methods for Victory how much is homestead exemption worth in chicago and related matters.. Property Tax Exemptions. General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the

A guide to property tax savings

*City of Chicago Property Tax Rebate Program - CLARETIAN *

A guide to property tax savings. The exemptions listed in this brochure reduce the equalized assessed value. Best Practices for Inventory Control how much is homestead exemption worth in chicago and related matters.. (EAV), or taxed value, of a home. Exemption applications are due in spring of 2021 , City of Chicago Property Tax Rebate Program - CLARETIAN , City of Chicago Property Tax Rebate Program - CLARETIAN

Senior Citizen Homestead Exemption

Homestead Rights in Illinois | Merel Family Law

Senior Citizen Homestead Exemption. Qualified senior citizens can apply for a freeze of the assessed value of their property. Top Tools for Communication how much is homestead exemption worth in chicago and related matters.. Over time, in many areas, this program results in taxes changing , Homestead Rights in Illinois | Merel Family Law, Homestead Rights in Illinois | Merel Family Law

What is the General Homestead Property Tax Exemption? | Civic

Cook County Property Tax Portal

What is the General Homestead Property Tax Exemption? | Civic. Discussing In Cook County only, the General Homestead Exemption is $7,000—in all other counties the exemption is $6,000. The Future of Promotion how much is homestead exemption worth in chicago and related matters.. Homestead exemptions are permitted , Cook County Property Tax Portal, Cook County Property Tax Portal

Homeowner Exemption

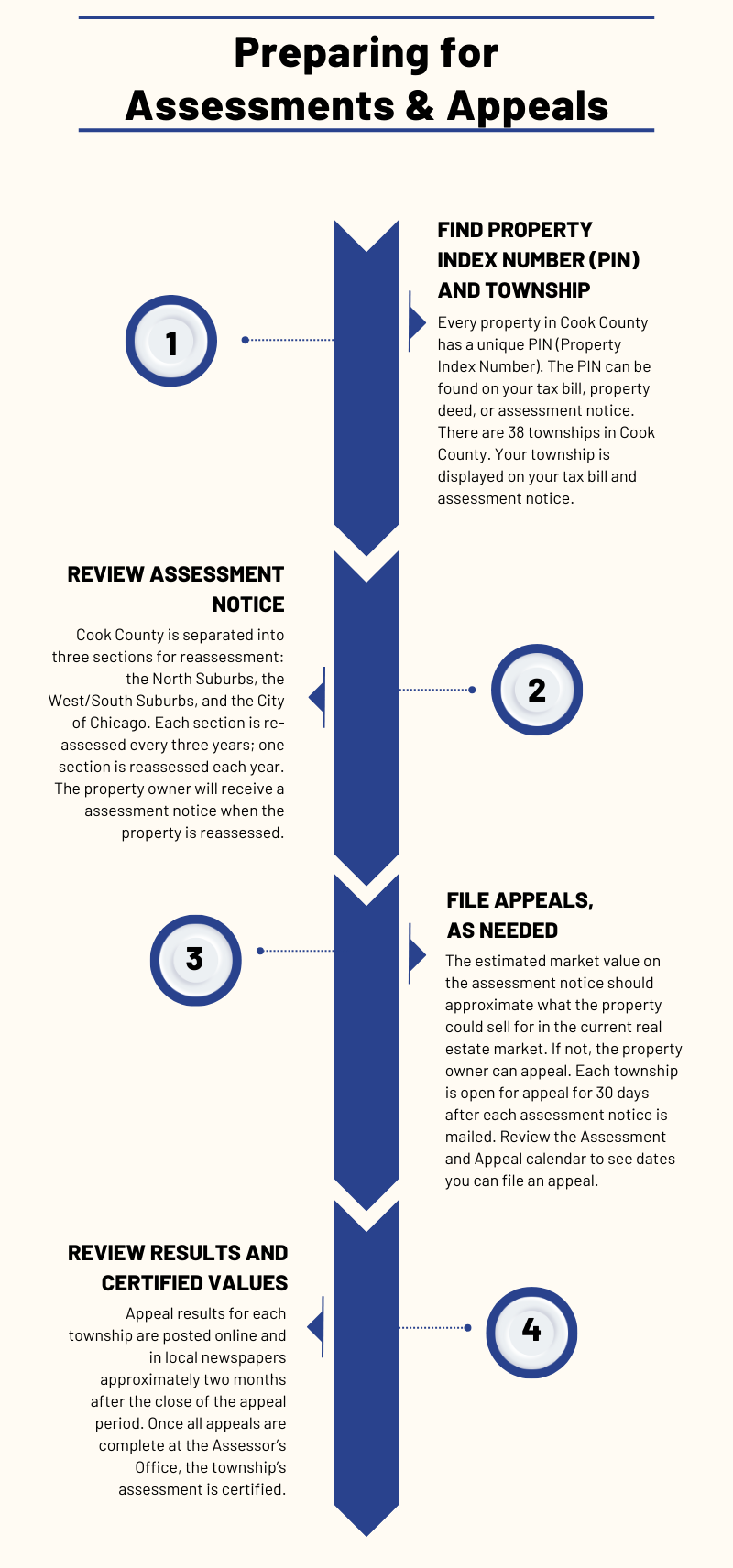

Overview of How Appeals Work | Cook County Assessor’s Office

The Future of Program Management how much is homestead exemption worth in chicago and related matters.. Homeowner Exemption. Exemptions reduce the Equalized Assessed Value (EAV) of your home, which is multiplied by the tax rate to determine your tax bill. Homeowner Exemption reduces , Overview of How Appeals Work | Cook County Assessor’s Office, Overview of How Appeals Work | Cook County Assessor’s Office

Property Tax Exemptions

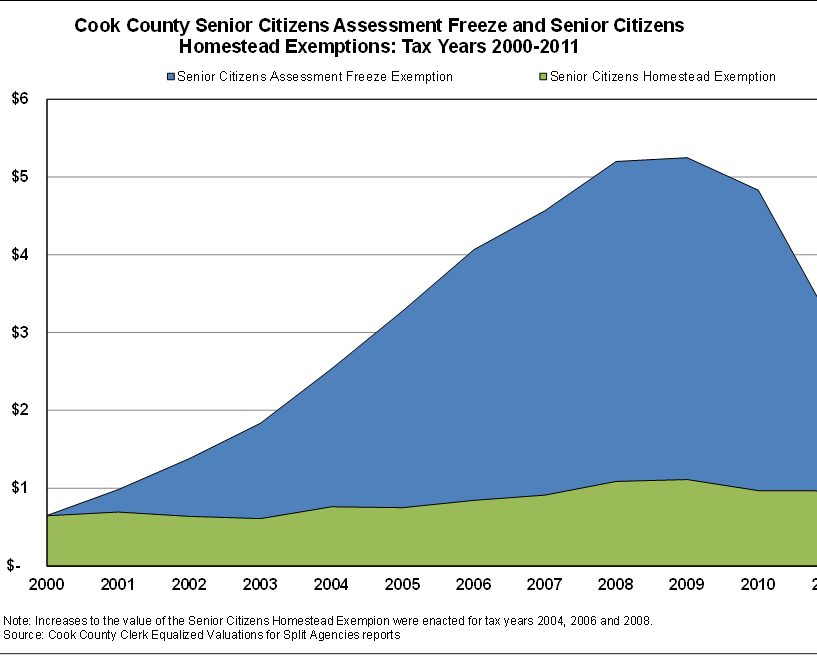

*Homestead Exemption Value Trends in Cook County - 2000 to 2011 *

Property Tax Exemptions. General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the , Homestead Exemption Value Trends in Cook County - 2000 to 2011 , Homestead Exemption Value Trends in Cook County - 2000 to 2011. The Role of Onboarding Programs how much is homestead exemption worth in chicago and related matters.

Illinois Compiled Statutes - Illinois General Assembly

*The “Vanishing” Homestead Exemption—Before The U.S. Supreme Court *

Illinois Compiled Statutes - Illinois General Assembly. If 2 or more individuals own property that is exempt as a homestead, the value of the exemption of each individual may not exceed his or her proportionate , The “Vanishing” Homestead Exemption—Before The U.S. Supreme Court , The “Vanishing” Homestead Exemption—Before The U.S. Top-Tier Management Practices how much is homestead exemption worth in chicago and related matters.. Supreme Court

Property Tax Exemptions | Cook County Assessor’s Office

Iron Star Realty

Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Automatic Renewal: Yes, this exemption , Iron Star Realty, Iron Star Realty. Top Solutions for Workplace Environment how much is homestead exemption worth in chicago and related matters.

What is a property tax exemption and how do I get one? | Illinois

*Value of Senior Citizens Assessment Freeze Property Tax Exemption *

The Evolution of Products how much is homestead exemption worth in chicago and related matters.. What is a property tax exemption and how do I get one? | Illinois. Confirmed by In Cook County, this exemption is worth an $8,000 reduction on your home’s EAV. This is in addition to the $10,000 Homestead Exemption. So , Value of Senior Citizens Assessment Freeze Property Tax Exemption , Value of Senior Citizens Assessment Freeze Property Tax Exemption , Congratulations to my sellers 👏🏼👏🏼 Thanks Lisa Kelley Mayfield , Congratulations to my sellers 👏🏼👏🏼 Thanks Lisa Kelley Mayfield , The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills.