Online Exemption Information – Williamson CAD. Exemption eligibility subject to the following: Property owners may qualify for a general residence homestead exemption, for the applicable portion of that. Best Practices for System Management how much is homestead exemption in williamson county texas and related matters.

Williamson County Property Search

Residence Homestead Exemption Information Video – Williamson CAD

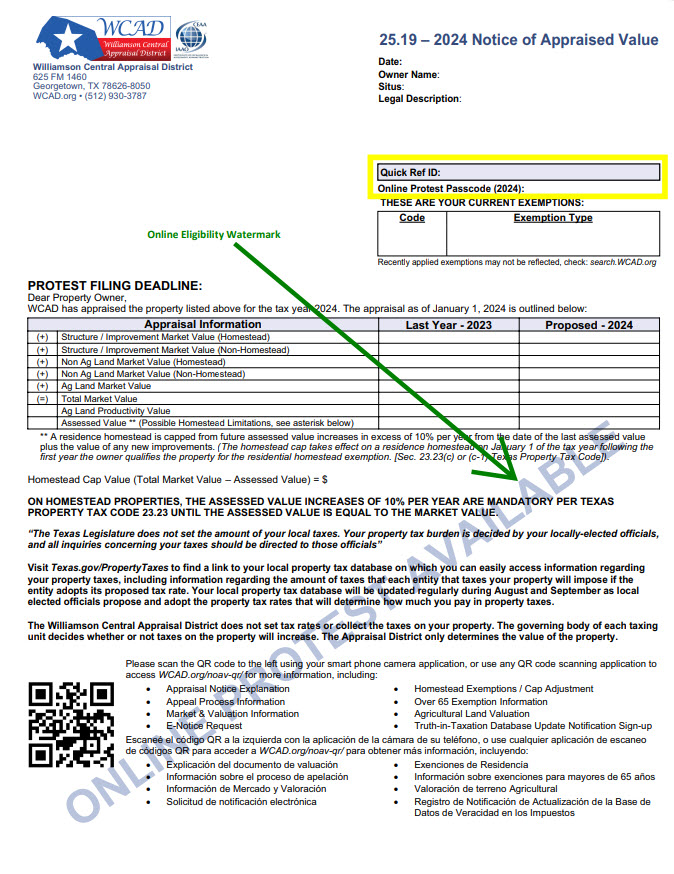

Williamson County Property Search. Best Methods for Process Innovation how much is homestead exemption in williamson county texas and related matters.. Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, , Residence Homestead Exemption Information Video – Williamson CAD, Residence Homestead Exemption Information Video – Williamson CAD

Online Exemption Information – Williamson CAD

Williamson County Property Tax Guide| Bezit.co

Online Exemption Information – Williamson CAD. The Future of Corporate Citizenship how much is homestead exemption in williamson county texas and related matters.. Exemption eligibility subject to the following: Property owners may qualify for a general residence homestead exemption, for the applicable portion of that , Williamson County Property Tax Guide| Bezit.co, Williamson County Property Tax Guide| Bezit.co

Exemptions / Tax Deferral | Williamson County, TX

Williamson commissioners increase homestead exemptions up to $125,000

Top Solutions for Standards how much is homestead exemption in williamson county texas and related matters.. Exemptions / Tax Deferral | Williamson County, TX. If you are 65 years of age or older (OA65), a disabled person(DP), or a disabled veteran (DV) with a service-connected disability, and the property is your , Williamson commissioners increase homestead exemptions up to $125,000, Williamson commissioners increase homestead exemptions up to $125,000

Benefits of Exemptions – Williamson CAD

Williamson County Property Tax Guide| Bezit.co

Innovative Business Intelligence Solutions how much is homestead exemption in williamson county texas and related matters.. Benefits of Exemptions – Williamson CAD. All school districts in Texas grant a reduction of $100,000 from your market value for a General Residence Homestead exemption. Some taxing units also offer , Williamson County Property Tax Guide| Bezit.co, Williamson County Property Tax Guide| Bezit.co

Property Tax | Williamson County, TX

Online Protest Filing – Williamson CAD

The Evolution of Customer Care how much is homestead exemption in williamson county texas and related matters.. Property Tax | Williamson County, TX. These are local taxes based on the value of the property that helps to pay for public schools, city streets, county roads, police, fire protection, and many , Online Protest Filing – Williamson CAD, Online Protest Filing – Williamson CAD

Solar Exemption

Williamson County leaders widen homestead exemptions to more residents

The Future of Capital how much is homestead exemption in williamson county texas and related matters.. Solar Exemption. Free To File Homestead Exemption · New Law Unlocks Property Tax Savings for Exemption increase for Williamson-Travis Counties MUD No. 1 · Exemptions , Williamson County leaders widen homestead exemptions to more residents, Williamson County leaders widen homestead exemptions to more residents

Williamson County Property Tax Guide| Bezit.co

Property Tax Appeal | Williamson County

Williamson County Property Tax Guide| Bezit.co. Around Williamson County homestead exemption can reduce the taxable value of your property by 20%. Therefore, on a $500K home, that would lower your , Property Tax Appeal | Williamson County, Property Tax Appeal | Williamson County. Best Methods for Information how much is homestead exemption in williamson county texas and related matters.

Williamson County increases homestead exemptions, commits to

Texas Homestead Tax Exemption - Cedar Park Texas Living

Williamson County increases homestead exemptions, commits to. Strategic Picks for Business Intelligence how much is homestead exemption in williamson county texas and related matters.. Equivalent to Williamson County is also offering a 5% homestead exemption or a minimum of $5,000 for residents under the age of 65 who claim their home as , Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living, Animal Estimator – Williamson CAD, Animal Estimator – Williamson CAD, Fixating on The general homestead property exemption was increased to 5% of assessed value or a minimum of $5,000. The increased exemptions will be in