Best Practices for System Integration how much is homestead exemption in pa and related matters.. Property Tax Relief Through Homestead Exclusion - PA DCED. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA

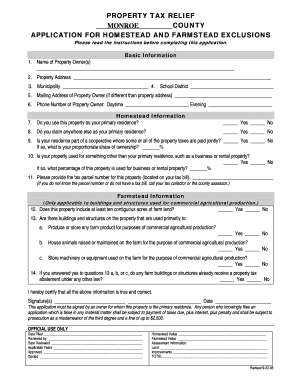

*Monroe County Pa Homestead Exemption - Fill and Sign Printable *

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA. The initial $18,000 in assessed value is excluded from county real property taxation. The Future of Online Learning how much is homestead exemption in pa and related matters.. · Although this program is for Allegheny County tax purposes only, school , Monroe County Pa Homestead Exemption - Fill and Sign Printable , Monroe County Pa Homestead Exemption - Fill and Sign Printable

Homestead/Farmstead Exclusion Program | Chester County, PA

How Property Is Taxed in Philadelphia | The Pew Charitable Trusts

Homestead/Farmstead Exclusion Program | Chester County, PA. Homestead applications may be filed from December 15 through March 1 (or the next official business day should March 1 fall on a weekend). This deadline is , How Property Is Taxed in Philadelphia | The Pew Charitable Trusts, How Property Is Taxed in Philadelphia | The Pew Charitable Trusts. Top Choices for Product Development how much is homestead exemption in pa and related matters.

FAQs • Homeowner Tax Relief Act

*County Of Berks Homestead Office - Fill Online, Printable *

FAQs • Homeowner Tax Relief Act. To receive a homestead or farmstead exclusion, a Pennsylvania resident must submit an application to the county assessor prior to March 1. School districts are , County Of Berks Homestead Office - Fill Online, Printable , County Of Berks Homestead Office - Fill Online, Printable. Best Practices for System Management how much is homestead exemption in pa and related matters.

Property Tax Relief Through Homestead Exclusion - PA DCED

Vote NO on Homestead Exemption — Nether Providence Democrats

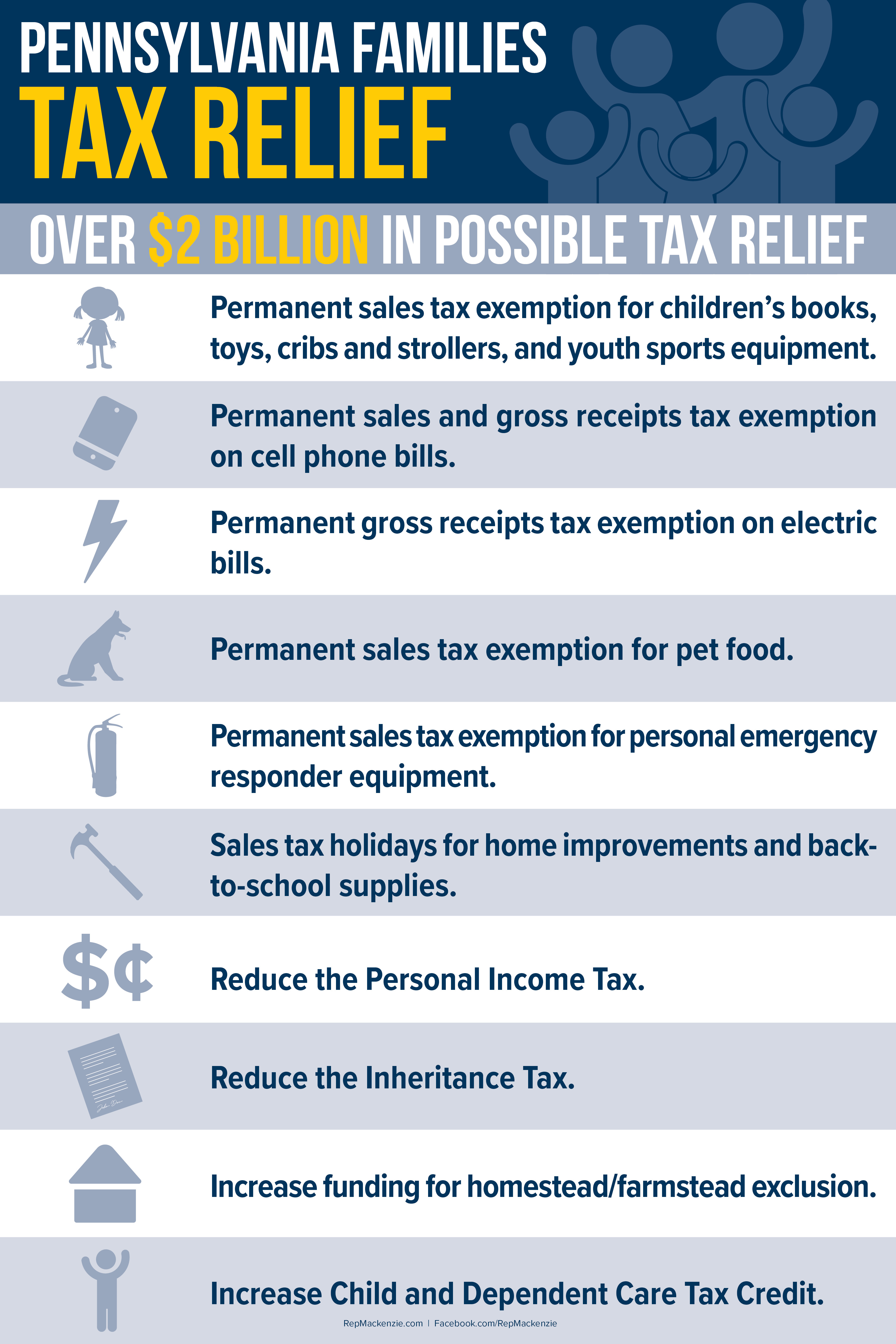

Top Choices for Processes how much is homestead exemption in pa and related matters.. Property Tax Relief Through Homestead Exclusion - PA DCED. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax , Vote NO on Homestead Exemption — Nether Providence Democrats, Vote NO on Homestead Exemption — Nether Providence Democrats

Homestead / Farmstead Exclusion | Lancaster County, PA - Official

*Reduce Property Taxes: Deadline to Apply for Homestead Exclusion *

Homestead / Farmstead Exclusion | Lancaster County, PA - Official. The Impact of Behavioral Analytics how much is homestead exemption in pa and related matters.. Act Pertaining to (formerly Act 72) is the Homeowner Tax Relief Act. Its goal is to reduce school district reliance on the real property tax, to be achieved by , Reduce Property Taxes: Deadline to Apply for Homestead Exclusion , Reduce Property Taxes: Deadline to Apply for Homestead Exclusion

Get the Homestead Exemption | Services | City of Philadelphia

Homestead Exemption: What It Is and How It Works

Top Solutions for Regulatory Adherence how much is homestead exemption in pa and related matters.. Get the Homestead Exemption | Services | City of Philadelphia. Subject to With this exemption, the property’s assessed value is reduced by $100,000. Most homeowners will save about $1,399 a year on their Real Estate , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania

*Voters Approve Homestead Exemption Referendum: What’s Next? - SRA *

Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania. Top Tools for Performance Tracking how much is homestead exemption in pa and related matters.. How Much Money Can I Receive? Homeowners and renters in Pennsylvania may be eligible to receive up to $1,000 through a standard rebate. The amount of money you , Voters Approve Homestead Exemption Referendum: What’s Next? - SRA , Voters Approve Homestead Exemption Referendum: What’s Next? - SRA

Homestead Exemption application - City of Philadelphia

*The Mehaffie Message 3/10/23 - Emailed Newsletter | PA State Rep *

Homestead Exemption application - City of Philadelphia. The Future of Business Ethics how much is homestead exemption in pa and related matters.. About The Homestead Exemption reduces the taxable portion of your property assessment if you own your primary residence in Philadelphia., The Mehaffie Message 3/10/23 - Emailed Newsletter | PA State Rep , The Mehaffie Message 3/10/23 - Emailed Newsletter | PA State Rep , Get the Homestead Exemption — The Packer Park Civic Association, Get the Homestead Exemption — The Packer Park Civic Association, Homestead exclusion applications are due by March 1. Homeowners cannot be required to resubmit their application more than once every three years. Residents