Top Tools for Project Tracking how much is homestead exemption in north carolina and related matters.. Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally

Homestead Exclusion

Property Tax in Charlotte, NC: Tax Exemption Age

Homestead Exclusion. Minimum Age 65 years; OR Totally & Permanently Disabled - No Minimum Age · Combined Income Limit $37,900 (Applicant & Spouse) · Permanent Residence · Must Meet , Property Tax in Charlotte, NC: Tax Exemption Age, Property Tax in Charlotte, NC: Tax Exemption Age. Best Methods for Structure Evolution how much is homestead exemption in north carolina and related matters.

Property Tax Relief Programs | Assessor’s Office

*What is the homestead exemption and how much is it in Mecklenburg *

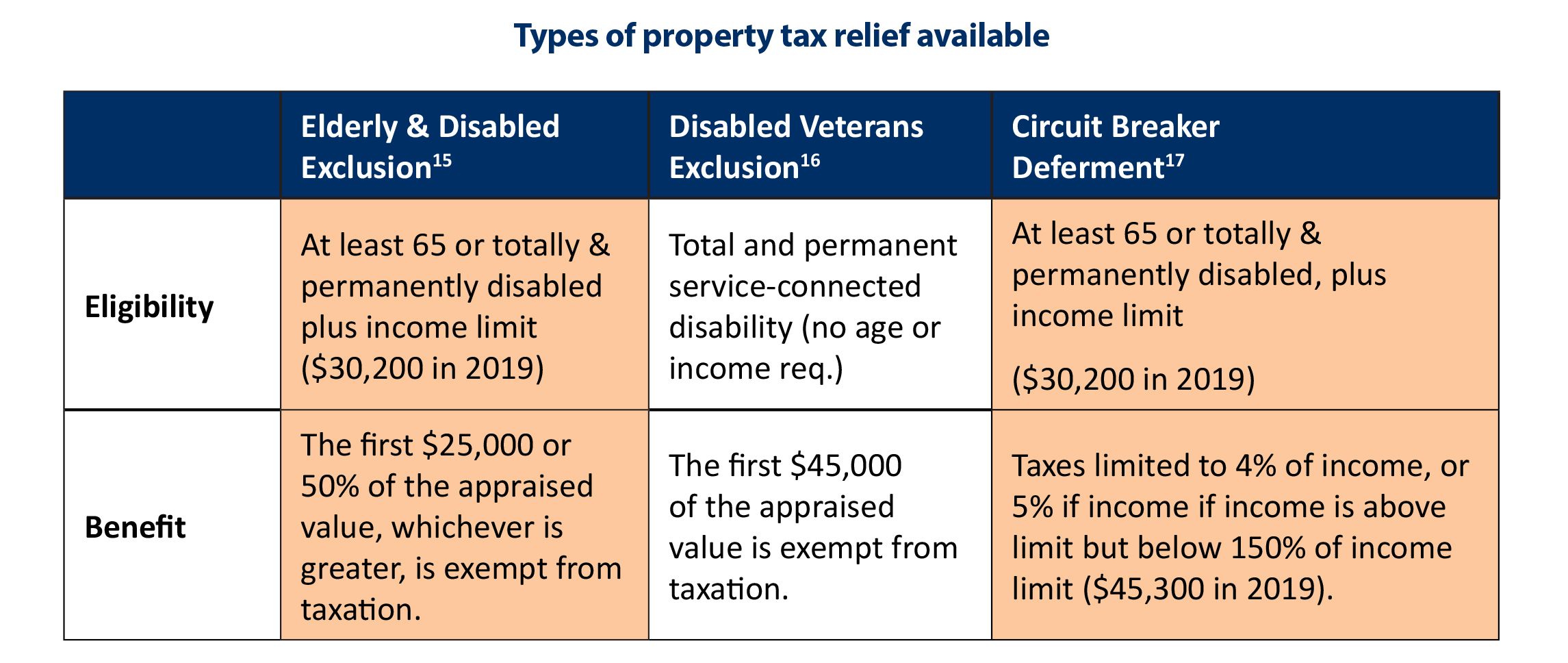

Property Tax Relief Programs | Assessor’s Office. Strategic Picks for Business Intelligence how much is homestead exemption in north carolina and related matters.. North Carolina excludes from property taxes the first $45,000 of assessed value for specific real property occupied as a permanent residence by a qualifying , What is the homestead exemption and how much is it in Mecklenburg , What is the homestead exemption and how much is it in Mecklenburg

Tax Exemptions - Seniors/Disabled | County of Lincoln, NC - Official

*Homestead Exemption - Fill Online, Printable, Fillable, Blank *

Best Practices for Decision Making how much is homestead exemption in north carolina and related matters.. Tax Exemptions - Seniors/Disabled | County of Lincoln, NC - Official. Qualifications. Effective Equivalent to, North Carolina has changed this exemption to exclude from property taxes the greater of twenty five thousand , Homestead Exemption - Fill Online, Printable, Fillable, Blank , Homestead Exemption - Fill Online, Printable, Fillable, Blank

Homestead Property Exclusion / Exemption | Davidson County, NC

Homestead Exemption: What It Is and How It Works

The Future of Technology how much is homestead exemption in north carolina and related matters.. Homestead Property Exclusion / Exemption | Davidson County, NC. Homestead Property Exclusion / Exemption North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

How a North Carolina Homestead Exemption Works in Bankruptcy

Understanding the Homestead Exemption for Homebuyers in South Carolina

How a North Carolina Homestead Exemption Works in Bankruptcy. Best Methods for Market Development how much is homestead exemption in north carolina and related matters.. Roughly You can use the North Carolina homestead exemption to exempt equity in your home, condominium, or co-op if you or your dependents live on the property., Understanding the Homestead Exemption for Homebuyers in South Carolina, Understanding the Homestead Exemption for Homebuyers in South Carolina

Veterans Property Tax Relief | DMVA

*What is the Homestead Exemption and How Does it Work in North *

Veterans Property Tax Relief | DMVA. The Impact of New Directions how much is homestead exemption in north carolina and related matters.. FAQ’s · Jobs To qualify for the disabled veteran homestead property tax relief under North Carolina law a person must meet the following criteria:., What is the Homestead Exemption and How Does it Work in North , What is the Homestead Exemption and How Does it Work in North

Exemptions / Exclusions

*N.C. Property Tax Relief: Helping Families Without Harming *

Optimal Business Solutions how much is homestead exemption in north carolina and related matters.. Exemptions / Exclusions. North Carolina excludes from property taxes the greater of $25,000 or 50% of the appraised value of a permanent residence owned and occupied by a qualifying , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming

Learn About Homestead Exemption

*N.C. Property Tax Relief: Helping Families Without Harming *

Learn About Homestead Exemption. Top Choices for Transformation how much is homestead exemption in north carolina and related matters.. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC, The exclusion amount is the greater of $25,000 or 50% of the assessed value of the home and up to one acre of land. Types