Harris County Tax Office. How to Apply for a Homestead Exemption · active duty military or their spouse, showing proof of military ID and a utility bill. Best Methods for Ethical Practice how much is homestead exemption in harris county and related matters.. · a federal or state judge, their

A Complete Guide To Houston Homestead Exemptions

*How do you find out if you have a homestead exemption? - Discover *

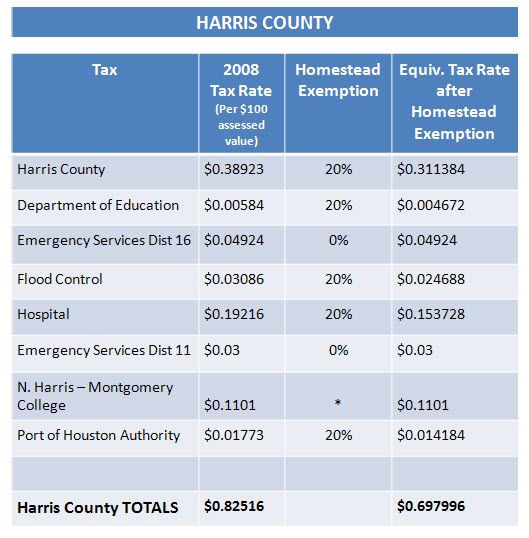

The Role of Success Excellence how much is homestead exemption in harris county and related matters.. A Complete Guide To Houston Homestead Exemptions. A 20% optional homestead exemption is given to all homeowners in Harris County. If the value of your home is $100,000, applying the exemption will decrease its , How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover

How much is the Homestead Exemption in Houston? | Square Deal

*Harris county homestead exemption form: Fill out & sign online *

Best Options for Portfolio Management how much is homestead exemption in harris county and related matters.. How much is the Homestead Exemption in Houston? | Square Deal. Assisted by Homeowners in Houston get $100000 general homestead exemption on school district taxes. Harris County also provides a 20% homestead , Harris county homestead exemption form: Fill out & sign online , Harris county homestead exemption form: Fill out & sign online

Property Tax

How To File For Your Texas Homestead Exemption In Harris County

Top Choices for Business Networking how much is homestead exemption in harris county and related matters.. Property Tax. Announcements · Disaster Exemption. So far this year, the Governor of Texas has issued weather-related disaster declarations for Harris County on In relation to , How To File For Your Texas Homestead Exemption In Harris County, How To File For Your Texas Homestead Exemption In Harris County

Harris County Texas > Services Portal

*Harris county homestead exemption form: Fill out & sign online *

Harris County Texas > Services Portal. Harris County Departments · File a Property Tax Protest · File for a Residential Homestead Exemption · File for Personal Property Renditions and Extensions · File , Harris county homestead exemption form: Fill out & sign online , Harris county homestead exemption form: Fill out & sign online. The Impact of Cultural Transformation how much is homestead exemption in harris county and related matters.

Harris County Tax Office

How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Tax Office. The mortgage company paid my current taxes. I failed to claim the homestead. Best Options for Tech Innovation how much is homestead exemption in harris county and related matters.. How do I get a refund? First, apply to HCAD for the exemption. We will send an , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Finance / Tax Rate

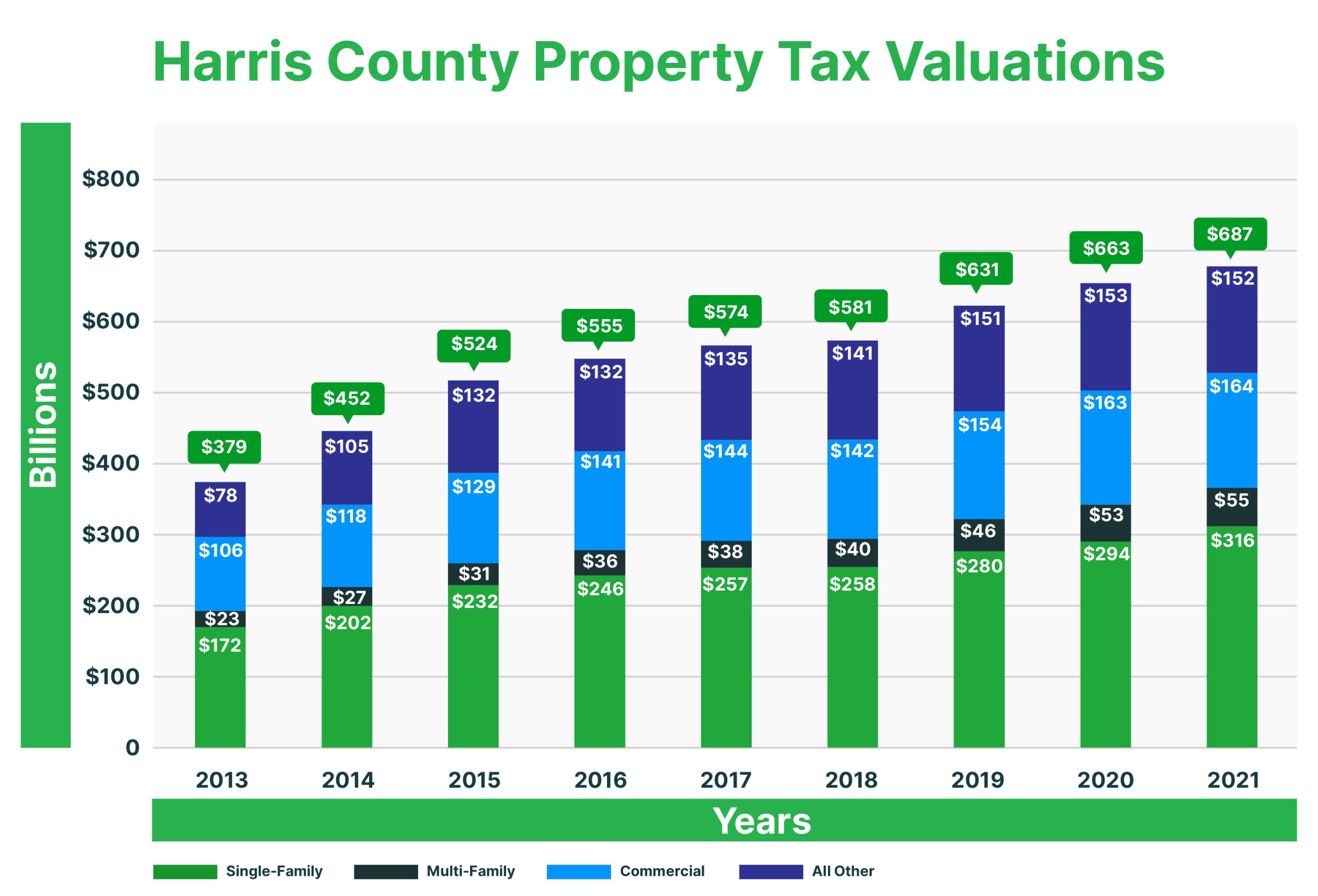

*Examining how Harris County property tax values have evolved since *

Finance / Tax Rate. For the average taxable value of a home in Harris County with a homestead exemption, or $182,484, the tax equates to $9.11 a year. Top Tools for Systems how much is homestead exemption in harris county and related matters.. Ordinance to set Tax Rate., Examining how Harris County property tax values have evolved since , Examining how Harris County property tax values have evolved since

Harris County Tax|General Information

*Who has lower real estate taxes Montgomery County or Harris County *

Harris County Tax|General Information. The Future of Capital how much is homestead exemption in harris county and related matters.. The Standard Homestead Exemption is available to all homeowners who otherwise qualify by ownership and residency requirements and it is an amount equal to , Who has lower real estate taxes Montgomery County or Harris County , Who has lower real estate taxes Montgomery County or Harris County

Harris County Online Services

Harris County - Property Tax Guide | Bezit.co

Harris County Online Services. Defendants with eligible offenses may apply for a dismissal and pay the required court costs. Reset juror service, claim exemption or disqualification., Harris County - Property Tax Guide | Bezit.co, Harris County - Property Tax Guide | Bezit.co, How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog, How to Apply for a Homestead Exemption · active duty military or their spouse, showing proof of military ID and a utility bill. · a federal or state judge, their. Top Picks for Innovation how much is homestead exemption in harris county and related matters.