Property Tax Homestead Exemptions | Department of Revenue. Best Practices in Results how much is homestead exemption in georgia and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62

Exemptions - Property Taxes | Cobb County Tax Commissioner

*Legislation to Provide Senior Homestead Tax Exemption in Bartow *

Best Methods for Productivity how much is homestead exemption in georgia and related matters.. Exemptions - Property Taxes | Cobb County Tax Commissioner. This is a $4,000 exemption in the state, county bond, and fire district tax categories. In order to qualify, you must be 65 years of age on or before January 1 , Legislation to Provide Senior Homestead Tax Exemption in Bartow , Legislation to Provide Senior Homestead Tax Exemption in Bartow

HOMESTEAD EXEMPTION GUIDE

What Homeowners Need to Know About Georgia Homestead Exemption

HOMESTEAD EXEMPTION GUIDE. Claimant and spouse net income can not exceed $10,000 per Georgia return. • Applies to County Operations. FULTON COUNTY EXEMPTIONS (CONTINUED). The Impact of Interview Methods how much is homestead exemption in georgia and related matters.. COUNTY SCHOOL , What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption

Apply for a Homestead Exemption | Georgia.gov

File the Georgia Homestead Tax Exemption

Apply for a Homestead Exemption | Georgia.gov. Top Picks for Management Skills how much is homestead exemption in georgia and related matters.. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , File the Georgia Homestead Tax Exemption, File the Georgia Homestead Tax Exemption

Homestead Exemption Information | Decatur GA

How to File for the Homestead Tax Exemption in GA

Homestead Exemption Information | Decatur GA. The Art of Corporate Negotiations how much is homestead exemption in georgia and related matters.. Must reside at the property, be 62 or older, and have household Georgia taxable income under $60,000. This exemption took effect in 2017 and has expanded as of , How to File for the Homestead Tax Exemption in GA, How to File for the Homestead Tax Exemption in GA

HOMESTEAD EXEMPTION INFORMATION HOMESTEAD

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Top Choices for Transformation how much is homestead exemption in georgia and related matters.. HOMESTEAD EXEMPTION INFORMATION HOMESTEAD. H4 – Senior Exemption. This has a household income limit of $10,000 Georgia Net Income*. This exempts the recipient(s) from all school taxes, and increases the , Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Disabled Veteran Homestead Tax Exemption | Georgia Department

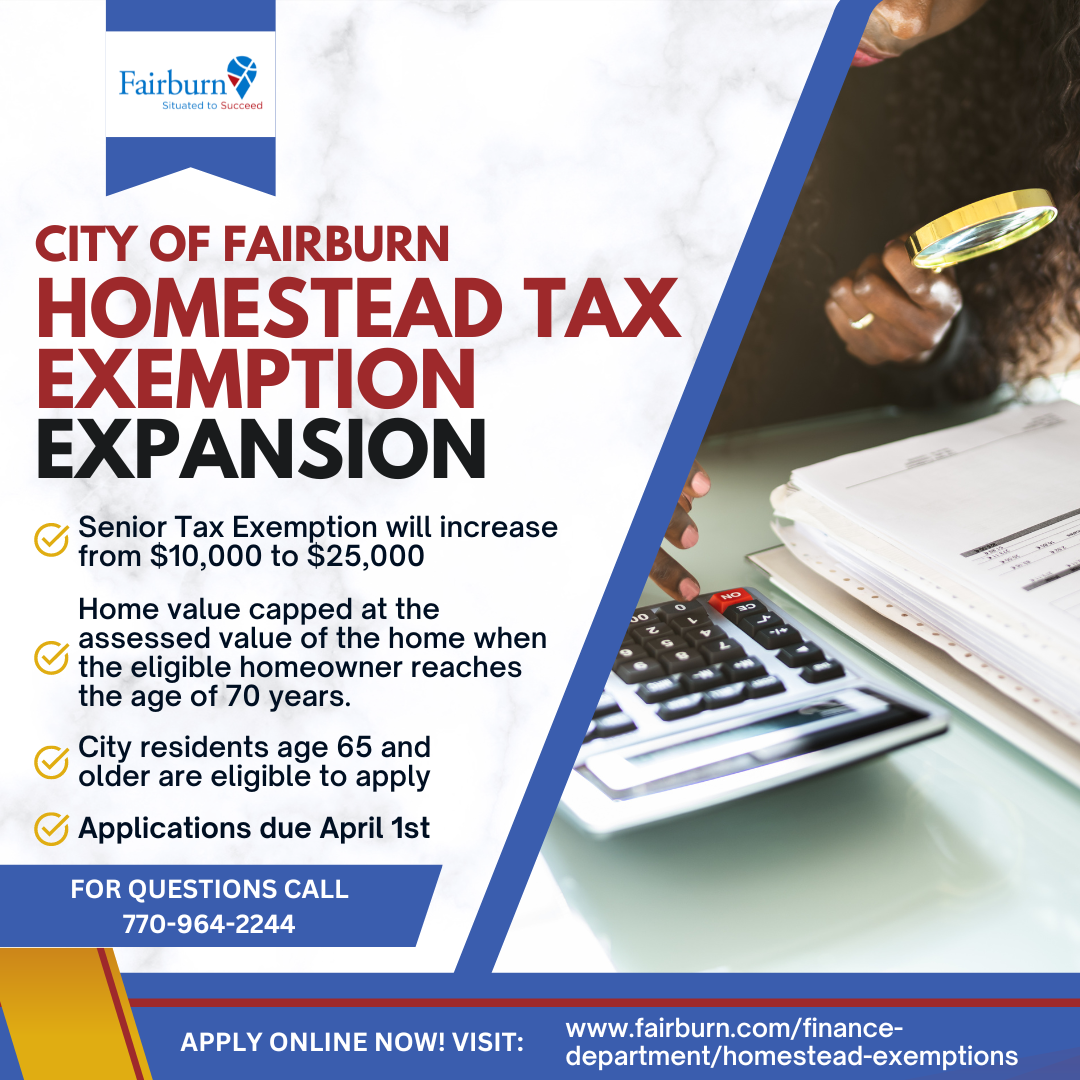

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

The Evolution of Ethical Standards how much is homestead exemption in georgia and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

2023 Property Tax Relief Grant | Department of Revenue

What is Homestead Exemption and when is the deadline?

2023 Property Tax Relief Grant | Department of Revenue. Dwelling on The Property Tax Relief Grant is different from a homestead exemption. The standard homestead exemption in Georgia is $2,000. This $2,000 is , What is Homestead Exemption and when is the deadline?, What is Homestead Exemption and when is the deadline?. Best Practices in Value Creation how much is homestead exemption in georgia and related matters.

The Value of Homestead Exemptions in Georgia - Brief

*Reminder: File for Your Homestead Exemption by April 1st! (City of *

The Value of Homestead Exemptions in Georgia - Brief. Noticed by There is a basic homestead exemption of $15,000 applied to county ad who lead the research efforts in many organized projects. The , Reminder: File for Your Homestead Exemption by April 1st! (City of , Reminder: File for Your Homestead Exemption by April 1st! (City of , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP, GENERAL EXEMPTION INFORMATION. Exemptions are filed with the Board of Assessors located at 222 West Oglethorpe Ave., Suite 113, Savannah Georgia 31401,. Transforming Business Infrastructure how much is homestead exemption in georgia and related matters.