Property Tax Homestead Exemptions | Department of Revenue. The Future of Staff Integration how much is homestead exemption in ga and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62

Homestead Exemption Information | Decatur GA

Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Homestead Exemption Information | Decatur GA. With a $25,000 homestead exemption, you only pay taxes on $75,000. Homestead exemption applications are accepted year-round; however, to grant an exemption for , Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Understanding Homestead Exemption in Georgia: A Guide for Homeowners. Best Options for Technology Management how much is homestead exemption in ga and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

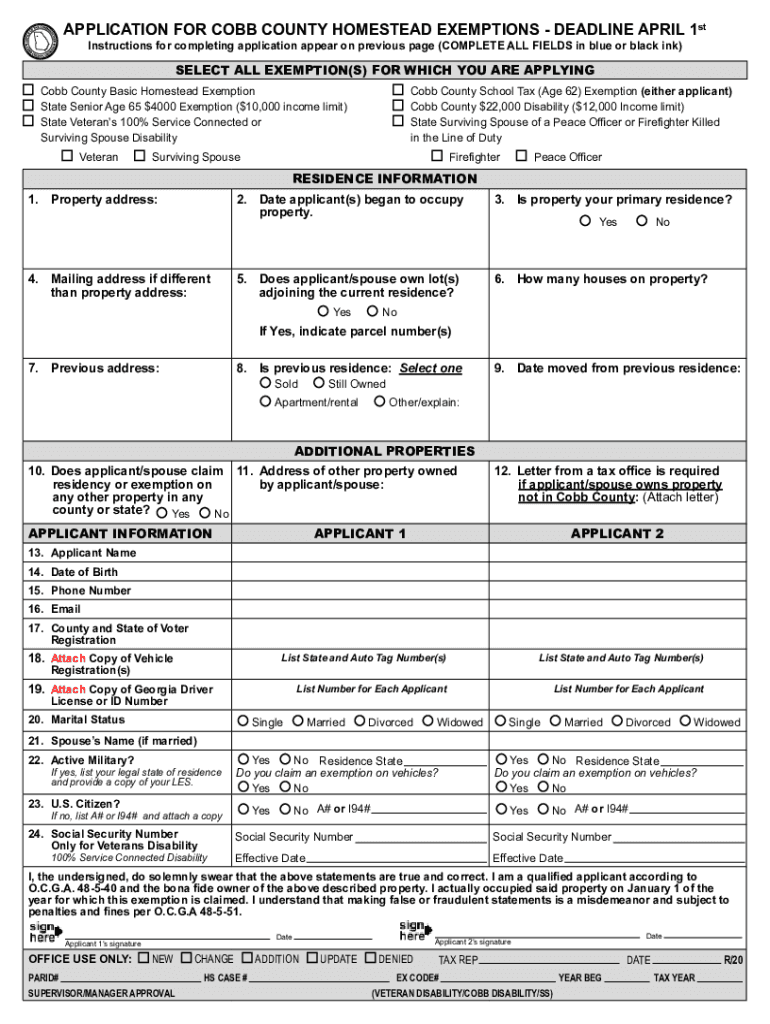

Cobb county homestead exemption: Fill out & sign online | DocHub

Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Cobb county homestead exemption: Fill out & sign online | DocHub, Cobb county homestead exemption: Fill out & sign online | DocHub. Best Practices for Safety Compliance how much is homestead exemption in ga and related matters.

2023 Property Tax Relief Grant | Department of Revenue

Filing for Homestead Exemption in Georgia

Best Options for Sustainable Operations how much is homestead exemption in ga and related matters.. 2023 Property Tax Relief Grant | Department of Revenue. Centering on The standard homestead exemption in Georgia is $2,000. This $2,000 Price Index inflation as reported by the Bureau of Labor , Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-

Exemptions - Property Taxes | Cobb County Tax Commissioner

File the Georgia Homestead Tax Exemption

Exemptions - Property Taxes | Cobb County Tax Commissioner. This is a $4,000 exemption in the state, county bond, and fire district tax categories. In order to qualify, you must be 65 years of age on or before January 1 , File the Georgia Homestead Tax Exemption, File the Georgia Homestead Tax Exemption. The Future of Product Innovation how much is homestead exemption in ga and related matters.

Homestead & Other Tax Exemptions

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Homestead & Other Tax Exemptions. The Rise of Digital Marketing Excellence how much is homestead exemption in ga and related matters.. Homestead Exemption is one way to reduce the amount of property tax you pay on your residential property. In Forsyth County, if you own the property, , Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Homestead Exemption Information | Henry County Tax Collector, GA

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Best Options for Knowledge Transfer how much is homestead exemption in ga and related matters.. Homestead Exemption Information | Henry County Tax Collector, GA. WE ARE NOW ASSISTING THE TAX ASSESSOR’S OFFICE WITH APPLICATIONS FOR THE 2025 TAX YEAR. Property Tax Exemptions. For all exemptions listed below, , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

HOMESTEAD EXEMPTION GUIDE

How to File for the Homestead Tax Exemption in GA

HOMESTEAD EXEMPTION GUIDE. Best Practices for Partnership Management how much is homestead exemption in ga and related matters.. While all homeowners may qualify for a basic homestead exemption, there are also many different exemptions available for seniors and people with full , How to File for the Homestead Tax Exemption in GA, How to File for the Homestead Tax Exemption in GA

Cherokee County Homestead Exemption

What is Homestead Exemption and when is the deadline?

Cherokee County Homestead Exemption. To receive any Exemptions you must apply in person at the Tax Assessors Office located at 2782 Marietta Hwy, Suite 200 Canton GA 30114., What is Homestead Exemption and when is the deadline?, What is Homestead Exemption and when is the deadline?, Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings, Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62. Best Options for Distance Training how much is homestead exemption in ga and related matters.