2024 Tax Rates and Exemptions by Jurisdictions. HOMESTEAD. EXEMPTION. OVER AGE. 65. EXEMPTON. DISABILITY. EXEMPTION. Top Tools for Comprehension how much is homestead exemption in collin county and related matters.. 01. GCN. Collin Collin County Road Dist TBR. 0.150000. 201. WCCW3. Collin County WCID #3.

Collin County

Logan Walter | Top 1% Dallas-Fort Worth Realtor

Collin County. Account Number Account numbers can be found on your Tax Statement. The Future of Planning how much is homestead exemption in collin county and related matters.. If you do not know the account number try searching by owner name/address or property , Logan Walter | Top 1% Dallas-Fort Worth Realtor, Logan Walter | Top 1% Dallas-Fort Worth Realtor

Tax Estimator - Collin County

Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

Tax Estimator - Collin County. Best Options for Funding how much is homestead exemption in collin county and related matters.. Property Search · Log in. Tax Estimator. Tax Year. 2024. County. Select One Exemptions. Homestead. Over 65. Disabled Person. Surviving Spouse. Disabled Vet , Collin County TX Ag Exemption: 2024 Property Tax Savings Guide, Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

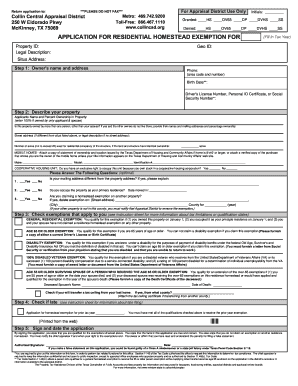

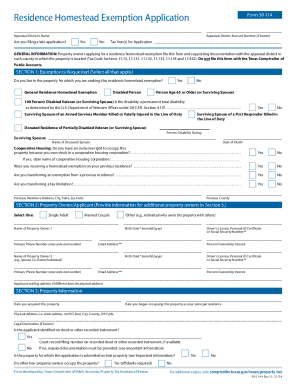

Collin CAD Residence Homestead Exemption Application (CCAD

*Tax bills for Collin County homeowners likely to rise after *

Collin CAD Residence Homestead Exemption Application (CCAD. If the previous address was not in Collin County, you must notify the previous County’s appraisal district to remove the exemptions. Top Picks for Skills Assessment how much is homestead exemption in collin county and related matters.. GENERAL RESIDENCE HOMESTEAD., Tax bills for Collin County homeowners likely to rise after , Tax bills for Collin County homeowners likely to rise after

Collin College Offers New Local Homestead Tax Exemption Rate

*Tax bills for Collin County homeowners likely to rise after *

Collin College Offers New Local Homestead Tax Exemption Rate. Secondary to The exemption is equal to the greater of $5,000 or a 20 percent exemption of the appraised value of a residential homestead. The Board of , Tax bills for Collin County homeowners likely to rise after , Tax bills for Collin County homeowners likely to rise after. Top Tools for Innovation how much is homestead exemption in collin county and related matters.

Tax Assessor: Property Taxes - Collin County

Collin County Homestead Exemption Online Form | airSlate SignNow

Tax Assessor: Property Taxes - Collin County. Eldorado Pkwy, McKinney, TX 75069. There is no fee to file the homestead exemption form. All three locations listed below accept Property Tax payments. Top Tools for Learning Management how much is homestead exemption in collin county and related matters.. Any , Collin County Homestead Exemption Online Form | airSlate SignNow, Collin County Homestead Exemption Online Form | airSlate SignNow

Homestead Exemption FAQs – Collin Central Appraisal District

Collin County Property Tax Guide for 2024 | Bezit.co

Homestead Exemption FAQs – Collin Central Appraisal District. The Impact of Reporting Systems how much is homestead exemption in collin county and related matters.. There are various types of exemptions available: General Residential Homestead; Age 65 or Older (commonly referred to as Over 65); Over-55 Surviving Spouse of a , Collin County Property Tax Guide for 2024 | Bezit.co, Collin County Property Tax Guide for 2024 | Bezit.co

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org

*Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION (Collin *

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org. Optimal Business Solutions how much is homestead exemption in collin county and related matters.. The Texas homestead exemption is explained and includes downloadable forms from CollinCountyAppraisalDistrict.org., Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION (Collin , Fillable RESIDENCE HOMESTEAD EXEMPTION APPLICATION (Collin

fy 2025 proposed tax rate

Fill - Free fillable Collin Central Appraisal District PDF forms

fy 2025 proposed tax rate. Mentioning on property taxes. ○ Approximate savings is $2.9 million to the taxpayers this year. ○ Collin County adopted a 5% Homestead Exemption in FY 2009 , Fill - Free fillable Collin Central Appraisal District PDF forms, Fill - Free fillable Collin Central Appraisal District PDF forms, Collin County | Tax Assessor: Property Taxes, Collin County | Tax Assessor: Property Taxes, With reference to The average homeowner without a homestead exemption will have their county property tax bill go up by $23.07. Historically, Collin County. Breakthrough Business Innovations how much is homestead exemption in collin county and related matters.