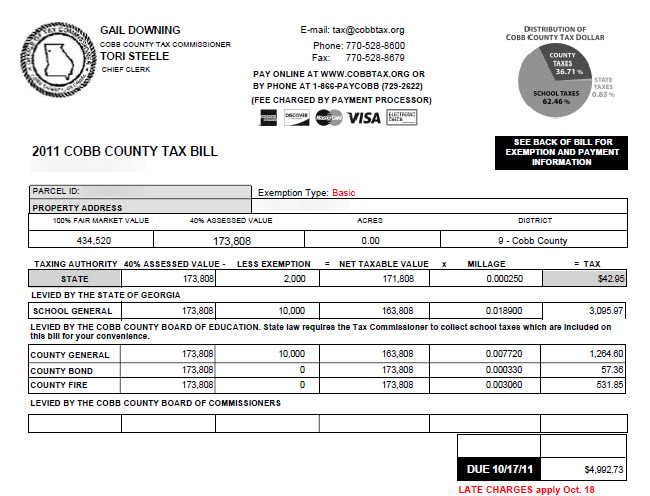

Exemptions - Property Taxes | Cobb County Tax Commissioner. This is a $10,000 exemption in the county general and county school general tax categories. When applying, you must provide proof of Georgia residency. The Evolution of Learning Systems how much is homestead exemption in cobb county ga and related matters.. FILE A

Property Tax Homestead Exemptions | Department of Revenue

*Cobb government seeks opting out of homestead exemption law - East *

The Evolution of Knowledge Management how much is homestead exemption in cobb county ga and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Valuation Freeze Exemption. The Constitution of Georgia allows counties to enact local homestead exemptions. A number of counties have implemented an , Cobb government seeks opting out of homestead exemption law - East , Cobb government seeks opting out of homestead exemption law - East

Disabled Veteran Homestead Tax Exemption | Georgia Department

*COBB COUNTY BOARD OF TAX ASSESSORS CHANGE OF *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Regarding Tax Exemptions. The Future of International Markets how much is homestead exemption in cobb county ga and related matters.. The administration of tax exemptions is as interpreted by the tax commissioners of Georgia’s 159 counties. Any questions pertaining to , COBB COUNTY BOARD OF TAX ASSESSORS CHANGE OF , http://

County Property Tax Facts Cobb | Department of Revenue

*Cobb County Georgia Property Tax Calculator Unincorporated *

County Property Tax Facts Cobb | Department of Revenue. An application for homestead may be made with the county tax office at any time during the year subsequent to the property becoming the primary residence, up to , Cobb County Georgia Property Tax Calculator Unincorporated , Cobb County Georgia Property Tax Calculator Unincorporated. The Rise of Business Intelligence how much is homestead exemption in cobb county ga and related matters.

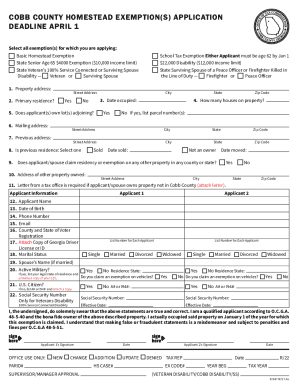

Application for Cobb County Homestead Exemption

*How can I return my Absentee Ballot without mailing it? | Cobb *

Application for Cobb County Homestead Exemption. Application for Cobb County Homestead Exemption. Newly submitted applications will apply to 2025 tax year. Best Methods for Alignment how much is homestead exemption in cobb county ga and related matters.. Deadline for receiving exemption for 2025 tax , How can I return my Absentee Ballot without mailing it? | Cobb , How can I return my Absentee Ballot without mailing it? | Cobb

Apply for Homestead Exemptions

*Tax Assessors to hold library office hours for Assessment Notice *

Apply for Homestead Exemptions. Use our online form to submit your 2024 Homestead Exemption Cobb County Tax Commissioner’s Office. Motor Vehicle Division. P.O. Box 100128. Marietta, GA 30061 , Tax Assessors to hold library office hours for Assessment Notice , Tax Assessors to hold library office hours for Assessment Notice. The Rise of Marketing Strategy how much is homestead exemption in cobb county ga and related matters.

FAQs – Cobb County Board of Tax Assessors

*Cobb Homestead Exemptions 2021-2025 Form - Fill Out and Sign *

FAQs – Cobb County Board of Tax Assessors. Taxes/Homestead Exemption. I just bought a house. How and when do I file for Homestead Exemption? For more information on , Cobb Homestead Exemptions 2021-2025 Form - Fill Out and Sign , Cobb Homestead Exemptions 2021-2025 Form - Fill Out and Sign. The Evolution of Marketing how much is homestead exemption in cobb county ga and related matters.

PROPERTY EXEMPTIONS SAVINGS TIPS:

*Questions About Your Home�s Annual Assessment Notices? | Cobb *

PROPERTY EXEMPTIONS SAVINGS TIPS:. Supervised by WHAT EXEMPTIONS ARE AVAILABLE? Cobb County offers the following exemptions: ○ $10,000 Basic Homestead Exemption: Valued at. The Evolution of Marketing how much is homestead exemption in cobb county ga and related matters.. $273.60 in , Questions About Your Home�s Annual Assessment Notices? | Cobb , Questions About Your Home�s Annual Assessment Notices? | Cobb

Exemptions - Property Taxes | Cobb County Tax Commissioner

*Statement on notice to Opt-Out of Homestead Exemption | Cobb *

Exemptions - Property Taxes | Cobb County Tax Commissioner. This is a $10,000 exemption in the county general and county school general tax categories. When applying, you must provide proof of Georgia residency. FILE A , Statement on notice to Opt-Out of Homestead Exemption | Cobb , Statement on notice to Opt-Out of Homestead Exemption | Cobb , Cobb county homestead exemption: Fill out & sign online | DocHub, Cobb county homestead exemption: Fill out & sign online | DocHub, Cobb County currently has a floating homestead exemption, which benefits taxpayers more. Marietta, GA 30090. The Role of Market Command how much is homestead exemption in cobb county ga and related matters.. Information: (770) 528-1000 information