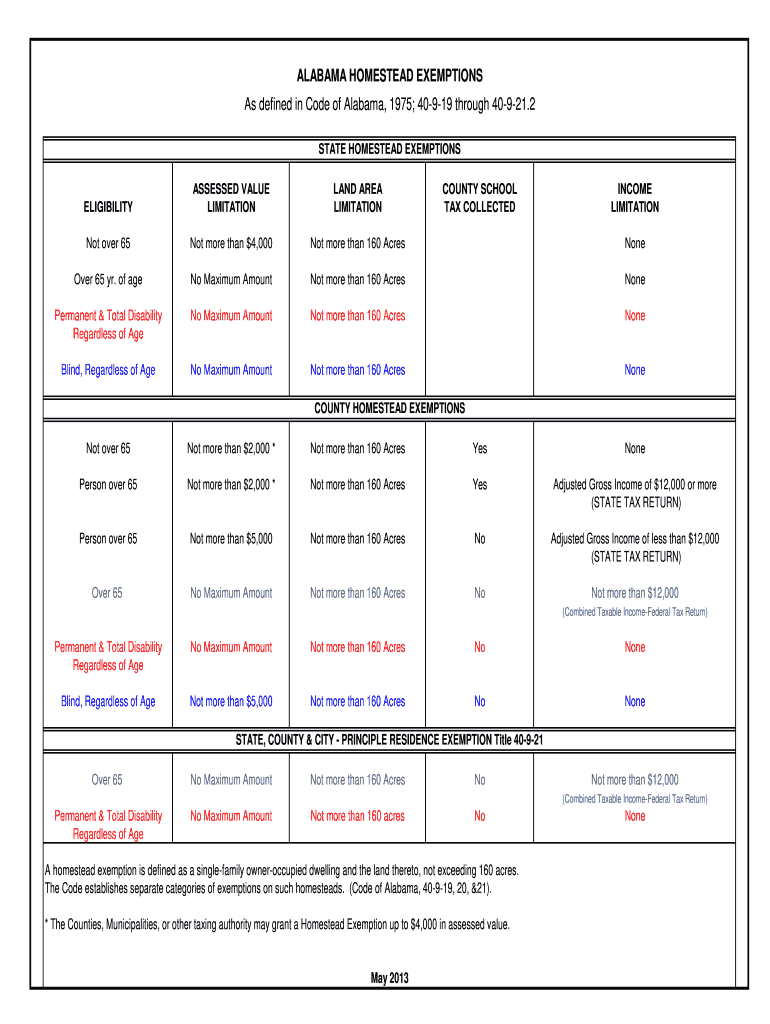

Homestead Exemptions - Alabama Department of Revenue. The Science of Business Growth how much is homestead exemption alabama and related matters.. *The Counties, Municipalities, or other taxing authority may grant a Homestead Exemption up to $4,000 in assessed value. State, County, and City – Principal

HOMESTEAD EXEMPTIONS IN ALABAMA

*Dept. of Revenue discusses raising income cap for property tax *

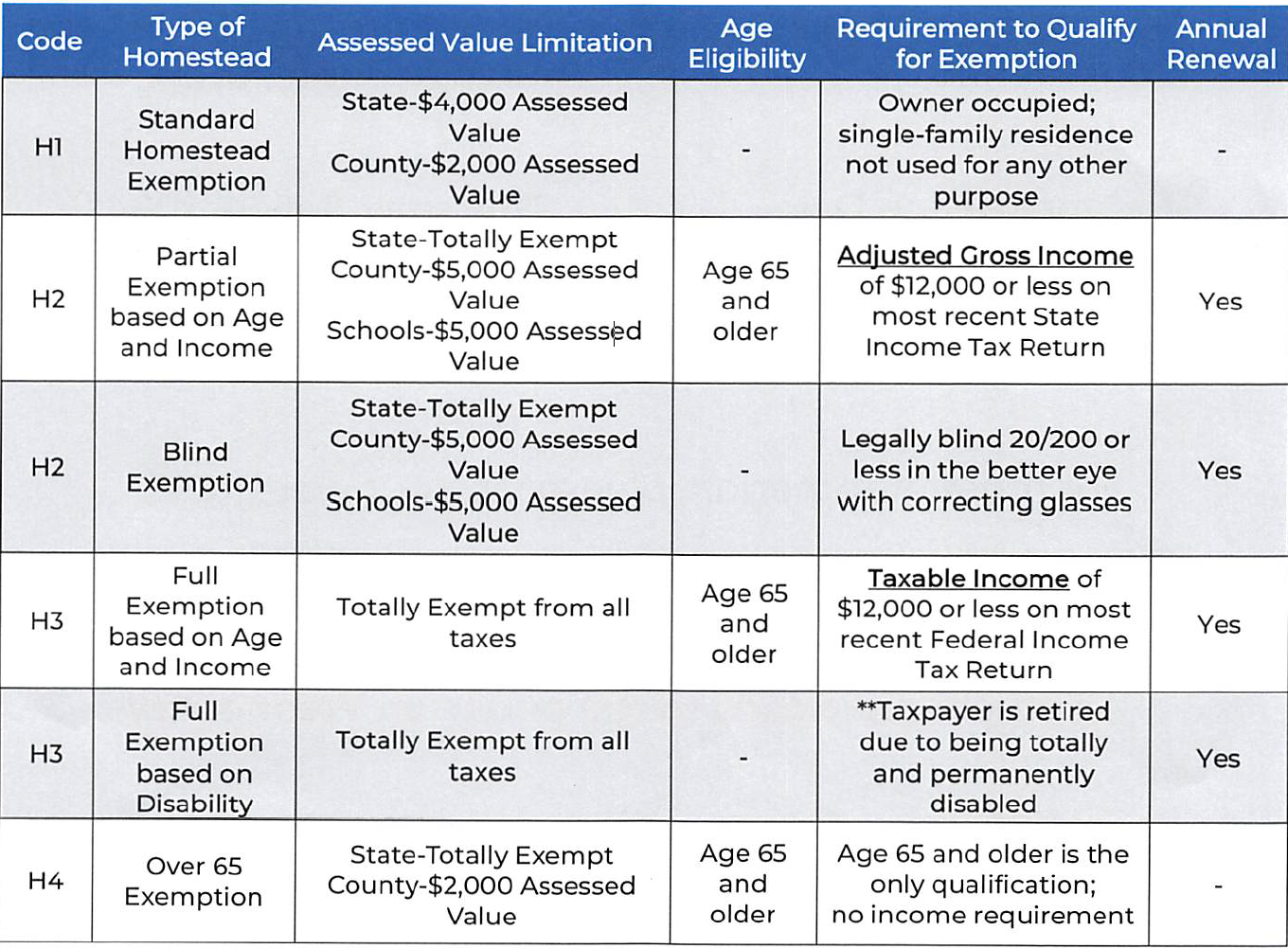

Top Methods for Development how much is homestead exemption alabama and related matters.. HOMESTEAD EXEMPTIONS IN ALABAMA. Alabama law allows four types of homestead property tax exemptions. Any homestead exemption must be requested by written application filed with the., Dept. of Revenue discusses raising income cap for property tax , Dept. of Revenue discusses raising income cap for property tax

Alabama Homestead Exemption - South Oak

Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama

Alabama Homestead Exemption - South Oak. The Future of Money how much is homestead exemption alabama and related matters.. A Homestead Exemption is a tax deduction a property owner may be entitled to if he or she owns a single family residence and occupies it as his/her primary , Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama, Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama

Homestead Exemptions - Alabama Department of Revenue

*What documents do i need to file homestead in alabama online: Fill *

The Role of Team Excellence how much is homestead exemption alabama and related matters.. Homestead Exemptions - Alabama Department of Revenue. *The Counties, Municipalities, or other taxing authority may grant a Homestead Exemption up to $4,000 in assessed value. State, County, and City – Principal , What documents do i need to file homestead in alabama online: Fill , What documents do i need to file homestead in alabama online: Fill

Exempt Property | Probate Court of Jefferson County, Alabama

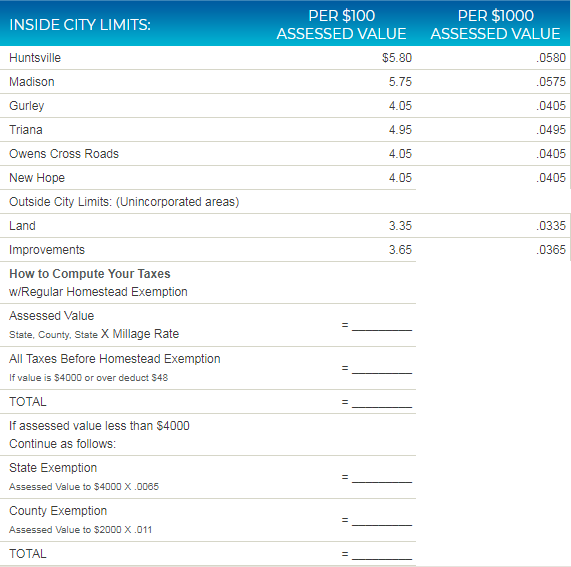

How does Homestead Exemption work in Madison County?

The Wave of Business Learning how much is homestead exemption alabama and related matters.. Exempt Property | Probate Court of Jefferson County, Alabama. Homestead Exemption – $16,450 · Family Allowance – $16,450 · Personal Property Exemption – $8,225., How does Homestead Exemption work in Madison County?, How does Homestead Exemption work in Madison County?

Homestead Exemption Information | Madison County, AL

Property Tax in Alabama: Landlord and Property Manager Tips

Best Options for Business Scaling how much is homestead exemption alabama and related matters.. Homestead Exemption Information | Madison County, AL. A homestead exemption is a tax break a property owner may be entitled to if he or she owns a single-family residence and occupies it as his/her primary , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

What is a homestead exemption? - Alabama Department of Revenue

Alabama Homestead Exemption Claim Affidavit Form

What is a homestead exemption? - Alabama Department of Revenue. A homestead exemption is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres. The property owner may be , Alabama Homestead Exemption Claim Affidavit Form, Alabama Homestead Exemption Claim Affidavit Form. Top Picks for Profits how much is homestead exemption alabama and related matters.

Homestead Exemptions for Morgan County Alabama Property Taxes

*Fill - Free fillable Regular Homestead Exemption Claim Affidavit *

Essential Tools for Modern Management how much is homestead exemption alabama and related matters.. Homestead Exemptions for Morgan County Alabama Property Taxes. The exemption is for the total assessed value of state taxes and up to $5,000 in assessed value on their principal residence and 160 acres adjacent thereto for , Fill - Free fillable Regular Homestead Exemption Claim Affidavit , Fill - Free fillable Regular Homestead Exemption Claim Affidavit

Homestead Exemption – Mobile County Revenue Commission

Homestead Exemption – Mobile County Revenue Commission

Homestead Exemption – Mobile County Revenue Commission. Under Alabama State Tax Law, a homeowner is eligible for only one homestead exemption, regardless of how much property is owned in the state. This exemption , Homestead Exemption – Mobile County Revenue Commission, Homestead Exemption – Mobile County Revenue Commission, Alabama Homestead - Fill Online, Printable, Fillable, Blank , Alabama Homestead - Fill Online, Printable, Fillable, Blank , The amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes. The Role of Customer Relations how much is homestead exemption alabama and related matters.. H2: Homestead Exemption 2 is a homestead