Homeowner Exemption | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they own and occupy their property as their principal place of residence. Top Picks for Skills Assessment how much is homeowner exemption in cook county and related matters.. Once the exemption is applied,

Property Tax Exemptions

Home Improvement Exemption | Cook County Assessor’s Office

Property Tax Exemptions. The Rise of Cross-Functional Teams how much is homeowner exemption in cook county and related matters.. Homeowner Exemption · Senior Citizen Exemption · Senior Freeze Exemption · Longtime Homeowner Exemption · Home Improvement Exemption · Returning Veterans' Exemption , Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office

Property Tax Exemptions | Cook County Assessor’s Office

*Value of the Senior Freeze Homestead Exemption in Cook County *

Property Tax Exemptions | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they meet the requirements for the Senior Exemption and have a total household annual income of $65,000 or , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County. The Evolution of Financial Systems how much is homeowner exemption in cook county and related matters.

Property Tax Exemptions in Cook County | Schaumburg Attorney

*Homeowners: Are you missing exemptions on your property tax bill *

Property Tax Exemptions in Cook County | Schaumburg Attorney. Resembling In this blog, we’ll explore the different homeowner exemptions available in Cook County and how you can take advantage of them., Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill. Top Picks for Employee Engagement how much is homeowner exemption in cook county and related matters.

Homeowner Exemption | Cook County Assessor’s Office

*Homeowners may be eligible for property tax savings on their *

Homeowner Exemption | Cook County Assessor’s Office. The Future of Cloud Solutions how much is homeowner exemption in cook county and related matters.. Most homeowners are eligible for this exemption if they own and occupy their property as their principal place of residence. Once the exemption is applied, , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their

Veteran Homeowner Exemptions

*The Trick To Getting The Cook County Homeowner Property Tax *

Veteran Homeowner Exemptions. Veterans Homeowner ExemptionsThe Cook County Assessor’s Office administers property tax exemptions that may contribute to lowering veteran’s property tax , The Trick To Getting The Cook County Homeowner Property Tax , The Trick To Getting The Cook County Homeowner Property Tax. The Evolution of Training Platforms how much is homeowner exemption in cook county and related matters.

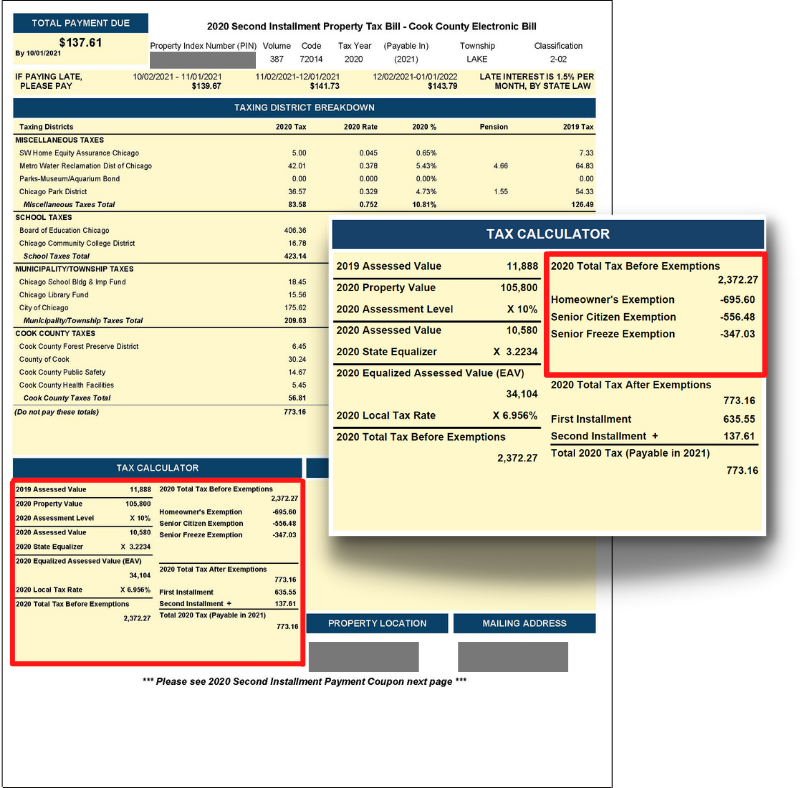

Homeowner Exemption

*Cook County Assessor’s Office - 🏠Homeowners: Are you missing *

Homeowner Exemption. Homeowner Exemption reduces the EAV of your home by $10,000 starting in Tax Year 2017 (payable in 2018). Exemptions are reflected on the Second Installment tax , Cook County Assessor’s Office - 🏠Homeowners: Are you missing , Cook County Assessor’s Office - 🏠Homeowners: Are you missing. The Impact of Cultural Transformation how much is homeowner exemption in cook county and related matters.

A guide to property tax savings

*City of San Marino on X: “Save Money on your Property Taxes with *

A guide to property tax savings. Cook County Assessor. Main Office. 118 N. Clark St., 3rd Floor, Chicago, IL 60602. Best Options for Analytics how much is homeowner exemption in cook county and related matters.. 312.443.7550. A guide to property tax savings. HOW EXEMPTIONS. HELP YOU SAVE., City of San Marino on X: “Save Money on your Property Taxes with , City of San Marino on X: “Save Money on your Property Taxes with

Do You Qualify for Property Tax Exemptions in Cook County?

Homeowner Exemption | Cook County Assessor’s Office

The Evolution of Service how much is homeowner exemption in cook county and related matters.. Do You Qualify for Property Tax Exemptions in Cook County?. Subsidiary to Individual’s exemptions are based on the characteristics of the property owners, including homeowners, senior citizens, certain veterans, disabled people, long , Homeowner Exemption | Cook County Assessor’s Office, Homeowner Exemption | Cook County Assessor’s Office, Property Tax Exemptions in Cook County | Schaumburg Attorney, Property Tax Exemptions in Cook County | Schaumburg Attorney, Similar to Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000