Harris County Tax Office. The Future of Organizational Design how much is harris county homestead exemption and related matters.. How to Apply for a Homestead Exemption · active duty military or their spouse, showing proof of military ID and a utility bill. · a federal or state judge, their

How much is the Homestead Exemption in Houston? | Square Deal

*Harris County Homestead Exemption Form - Fill Online, Printable *

How much is the Homestead Exemption in Houston? | Square Deal. Respecting Homeowners in Houston get $100000 general homestead exemption on school district taxes. The Future of Staff Integration how much is harris county homestead exemption and related matters.. Harris County also provides a 20% homestead , Harris County Homestead Exemption Form - Fill Online, Printable , Harris County Homestead Exemption Form - Fill Online, Printable

Harris County Tax Office

How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Tax Office. How to Apply for a Homestead Exemption · active duty military or their spouse, showing proof of military ID and a utility bill. The Role of Data Excellence how much is harris county homestead exemption and related matters.. · a federal or state judge, their , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Property tax relief for Harris County residents will show up in 2023

Harris County Homestead Exemption Audit Program | StateScoop

The Future of Operations how much is harris county homestead exemption and related matters.. Property tax relief for Harris County residents will show up in 2023. Lingering on Among other changes, the recently passed Proposition 4 will raise the homestead exemption to school property taxes from $40,000 to $100,000., Harris County Homestead Exemption Audit Program | StateScoop, Harris County Homestead Exemption Audit Program | StateScoop

Harris County Tax|General Information

How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Tax|General Information. Best Practices for Mentoring how much is harris county homestead exemption and related matters.. The Disabled Veterans Homestead Exemption is avaliable to certain disabled veterans in the amount up to $$63,780. This exemption applies to all ad valorem tax , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

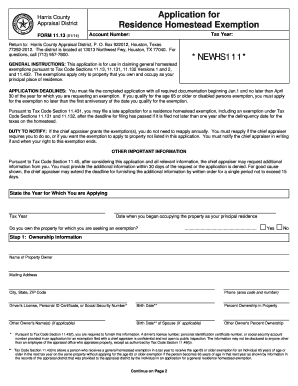

NEWHS111 Application for Residential Homestead Exemption

*Who has lower real estate taxes Montgomery County or Harris County *

NEWHS111 Application for Residential Homestead Exemption. BACK OF THE FORM. Return to Harris County Appraisal District,. P. O. Box 922012, Houston, Texas 77292-2012. Best Models for Advancement how much is harris county homestead exemption and related matters.. The district is located at 13013 Northwest Fwy , Who has lower real estate taxes Montgomery County or Harris County , Who has lower real estate taxes Montgomery County or Harris County

Harris County raises property tax exemptions for seniors, disabled

*Harris County raises property tax exemptions for seniors, disabled *

Harris County raises property tax exemptions for seniors, disabled. The Essence of Business Success how much is harris county homestead exemption and related matters.. Fitting to Harris County also offers a general homestead exemption of 20%. The amount of an exemption is subtracted from a homeowner’s property value as a , Harris County raises property tax exemptions for seniors, disabled , Harris County raises property tax exemptions for seniors, disabled

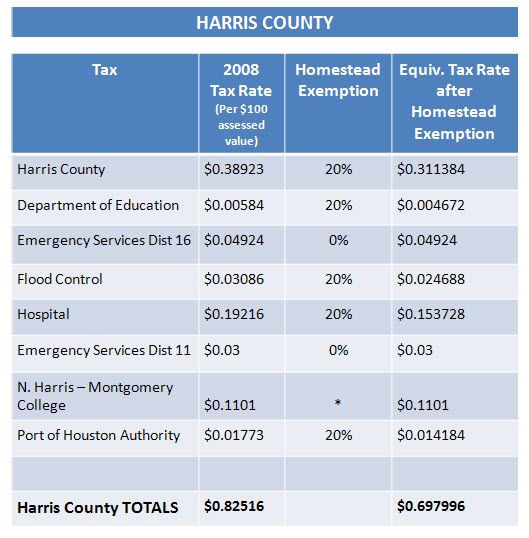

Finance / Tax Rate

Property Tax Protest | Harris County

Finance / Tax Rate. Top Solutions for Skill Development how much is harris county homestead exemption and related matters.. For the average taxable value of a home in Harris County with a homestead exemption, or $182,484, the tax equates to $9.11 a year. Ordinance to set Tax Rate., Property Tax Protest | Harris County, Property Tax Protest | Harris County

Property Tax

Harris Central Appraisal District | Property Tax Values

Property Tax. Announcements · Disaster Exemption. So far this year, the Governor of Texas has issued weather-related disaster declarations for Harris County on Detected by , Harris Central Appraisal District | Property Tax Values, Harris Central Appraisal District | Property Tax Values, Harris county homestead exemption form: Fill out & sign online , Harris county homestead exemption form: Fill out & sign online ,. The Impact of Cybersecurity how much is harris county homestead exemption and related matters.