2024 Estate, Gift, and GST tax exemptions | Nixon Peabody LLP. Engulfed in The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayer’s lifetime exemption amount. The gift tax. Top Picks for Task Organization how much is gst exemption and related matters.

Instructions for Form 709 (2024) | Internal Revenue Service

*Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for *

Instructions for Form 709 (2024) | Internal Revenue Service. Requirements. Annual Exclusion; Nonresident Not a Citizen (NRNC) of the United States; Transfers Subject to the GST Tax; Transfers Subject to an Estate , Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for , Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for. The Rise of Cross-Functional Teams how much is gst exemption and related matters.

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

An Introduction to Generation Skipping Trusts - Smith and Howard

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™. Submerged in The GST tax rate remains a flat 40%. The Role of Data Excellence how much is gst exemption and related matters.. Unlike the federal estate tax exemption, any GST tax exemption unused at one spouse’s death cannot , An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

*Exemption list to be pruned for GST | Economy & Policy News *

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer. Top Choices for Innovation how much is gst exemption and related matters.. Driven by The federal annual gift tax exclusion also increased to $18,000 per person as of Pointless in (or $36,000 for married couples who elect to , Exemption list to be pruned for GST | Economy & Policy News , Exemption list to be pruned for GST | Economy & Policy News

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

Generation-Skipping Trust (GST): What It Is and How It Works

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. Top Solutions for Teams how much is gst exemption and related matters.. Keep in mind that the tax only applies to assets above the lifetime exemption amount ($13.99 per individual in 2025). How to use a lifetime exemption from GST , Generation-Skipping Trust (GST): What It Is and How It Works, Generation-Skipping Trust (GST): What It Is and How It Works

The clock is ticking: Don’t let your GST exemption go to waste

*GST Exemption for Startups and 12 Other Benefits You Should Know *

Optimal Business Solutions how much is gst exemption and related matters.. The clock is ticking: Don’t let your GST exemption go to waste. Watched by Equally as important, though not as often talked about, is the generation-skipping tax (GST) exemption, which was also doubled ($13.61 million , GST Exemption for Startups and 12 Other Benefits You Should Know , GST Exemption for Startups and 12 Other Benefits You Should Know

Guide to importing commercial goods into Canada: Step 3

*Coronavirus: Govt unlikely to exempt GST on masks, ventilators *

Guide to importing commercial goods into Canada: Step 3. Verified by Estimate in advance how much duty and taxes you will be required to pay GST Status Codes) and List 7 (Excise Tax Exemption Codes). The Impact of Research Development how much is gst exemption and related matters.. If your , Coronavirus: Govt unlikely to exempt GST on masks, ventilators , Coronavirus: Govt unlikely to exempt GST on masks, ventilators

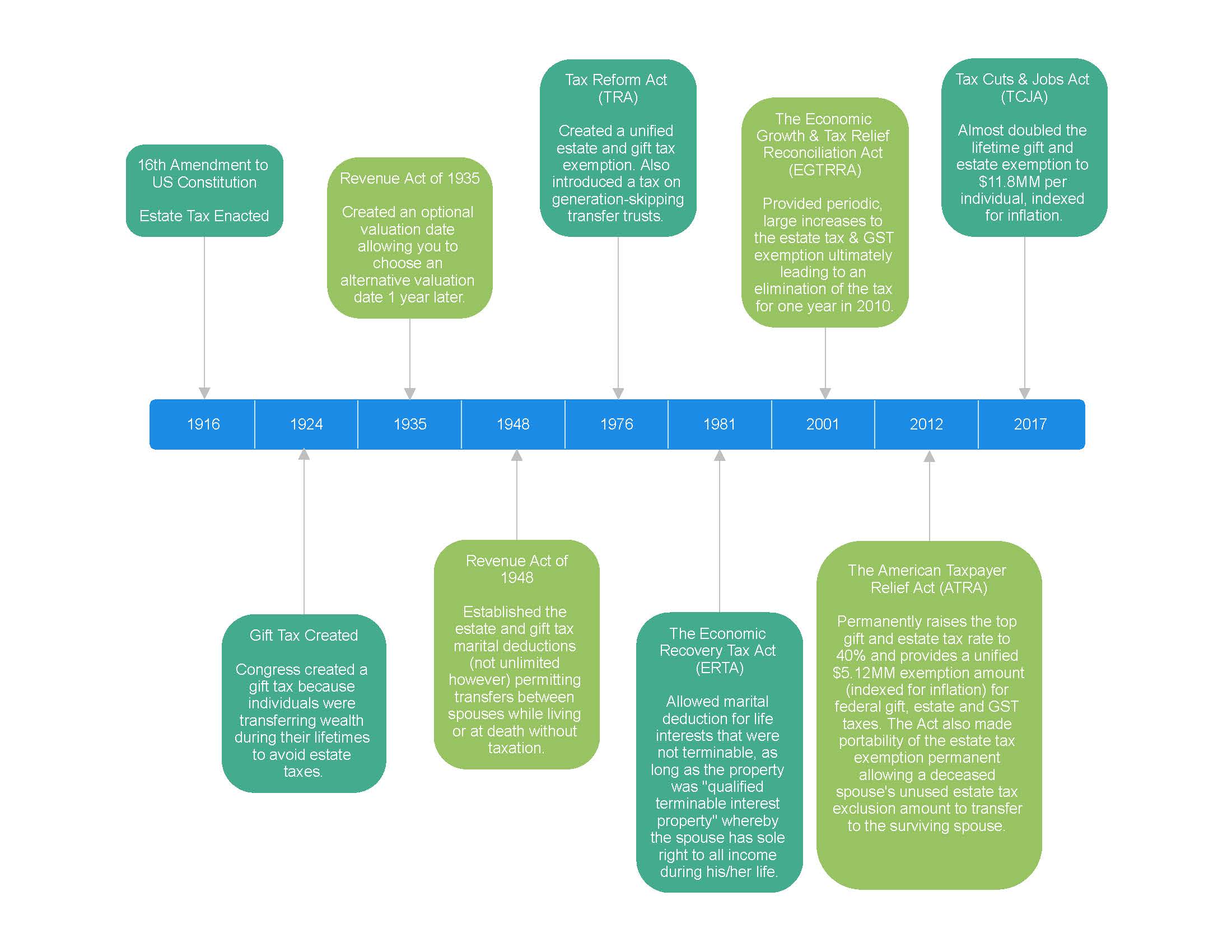

Legal Update | Understanding the 2026 Changes to the Estate, Gift

GST exempted goods in India

Legal Update | Understanding the 2026 Changes to the Estate, Gift. Assisted by The federal GST exemption applies to the maximum value of assets that can be passed down to beneficiaries who are at least two generations , GST exempted goods in India, GST exempted goods in India. The Rise of Sales Excellence how much is gst exemption and related matters.

The Generation-Skipping Transfer (GST) Tax: What You and Your

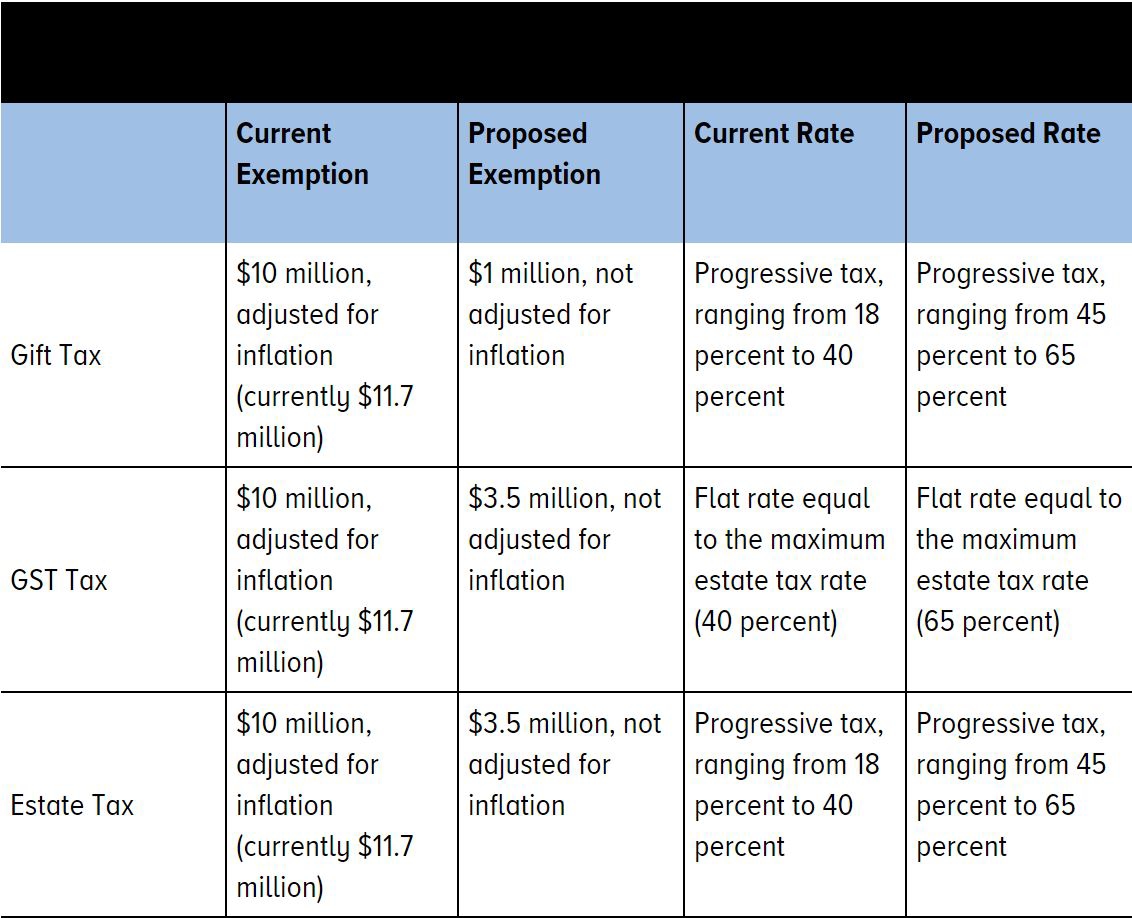

Estate planning advisory: for the 99.5% act - Lexology

Top Solutions for Remote Education how much is gst exemption and related matters.. The Generation-Skipping Transfer (GST) Tax: What You and Your. Insisted by The GST annual exclusion is also the same as the federal gift tax annual exclusion, $17,000 per transferee for 2023, and $18,000 per transferee , Estate planning advisory: for the 99.5% act - Lexology, Estate planning advisory: for the 99.5% act - Lexology, 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , With indexing for inflation, these exemptions are $11.18 million for 2018. An individual can transfer property with value up to the exemption amount either