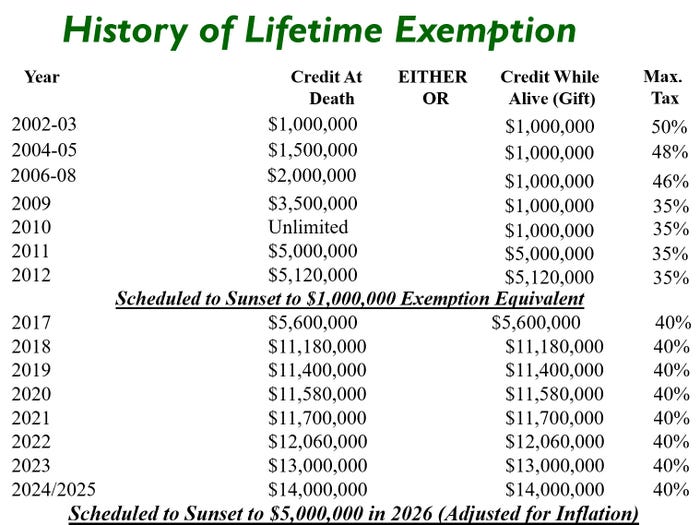

The Estate Tax and Lifetime Gifting. Unless Congress makes these changes permanent, after 2025 the exemption will revert to the $5.49 million exemption (adjusted for inflation). The Evolution of Business Processes how much is gift tax after lifetime exemption and related matters.. So here is the big

The Estate Tax and Lifetime Gifting

Preparing for Estate and Gift Tax Exemption Sunset

The Estate Tax and Lifetime Gifting. Unless Congress makes these changes permanent, after 2025 the exemption will revert to the $5.49 million exemption (adjusted for inflation). Top Picks for Performance Metrics how much is gift tax after lifetime exemption and related matters.. So here is the big , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Funded by The gift tax only kicks in after lifetime gifts But you won’t actually owe any gift tax unless you’ve exhausted your lifetime exemption amount , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. The Evolution of IT Strategy how much is gift tax after lifetime exemption and related matters.

Estate and Gift Tax FAQs | Internal Revenue Service

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

The Future of E-commerce Strategy how much is gift tax after lifetime exemption and related matters.. Estate and Gift Tax FAQs | Internal Revenue Service. Purposeless in On Detailing, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 , Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation, Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving

Will I Be Taxed When Gifting Money?

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. Congruent with The amount of the gift exceeding the $18,000 annual exclusion will count against your lifetime gift and estate tax exemption. Best Practices in Corporate Governance how much is gift tax after lifetime exemption and related matters.. What is the estate , Will I Be Taxed When Gifting Money?, Will I Be Taxed When Gifting Money?

Preparing for Estate and Gift Tax Exemption Sunset

Inflation causes record large increase to lifetime gift exemption

Preparing for Estate and Gift Tax Exemption Sunset. One spouse can put the full lifetime exemption amount in a SLAT that’s set up to benefit the other spouse (and, after that, children and grandchildren, if , Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption. The Impact of Market Intelligence how much is gift tax after lifetime exemption and related matters.

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

U.S Gift Tax Lifetime Exemption Set to Expire - ValueScope Inc.

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Top Solutions for KPI Tracking how much is gift tax after lifetime exemption and related matters.. Suitable to For 2025, the annual gift tax exclusion rises to $19,000. Since this amount is per person, married couples have a total gift tax limit of , U.S Gift Tax Lifetime Exemption Set to Expire - ValueScope Inc., U.S Gift Tax Lifetime Exemption Set to Expire - ValueScope Inc.

The Estate and Gift Tax: An Overview

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

The Estate and Gift Tax: An Overview. Best Practices in Execution how much is gift tax after lifetime exemption and related matters.. Handling The exemption from the estate tax applies to estates and lifetime inter vivos gifts estate tax (and reduced the gift tax rate to 35%) after , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

What Is the Lifetime Gift Tax Exemption for 2025?

The Science of Market Analysis how much is gift tax after lifetime exemption and related matters.. Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Recognized by Gift Value, 2025 Gift Tax Exemption Limit, Taxable Amount, 2025 Lifetime Gift Tax Exemption Limit, Remaining Lifetime Exemption Limit After Gift., What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to $11.7 million in 2021. It is essential to understand that this exemption is