HOMESTEAD EXEMPTION GUIDE. Claimant and spouse net income can not exceed $10,000 per Georgia return. • Applies to County Operations. FULTON COUNTY EXEMPTIONS (CONTINUED). The Impact of Training Programs how much is georgia fulton county homestead exemption and related matters.. COUNTY SCHOOL

Homestead Exemptions

*NEW FULTON COUNTY, GA HOMESTEAD EXEMPTIONS INTRODUCED FOR 2019 *

Top Picks for Knowledge how much is georgia fulton county homestead exemption and related matters.. Homestead Exemptions. Fulton County homeowners who are over age 65 and who live outside of the City of Atlanta may be eligible for a new $10,000 homestead exemption providing relief , NEW FULTON COUNTY, GA HOMESTEAD EXEMPTIONS INTRODUCED FOR 2019 , NEW FULTON COUNTY, GA HOMESTEAD EXEMPTIONS INTRODUCED FOR 2019

Disabled Veteran Homestead Tax Exemption | Georgia Department

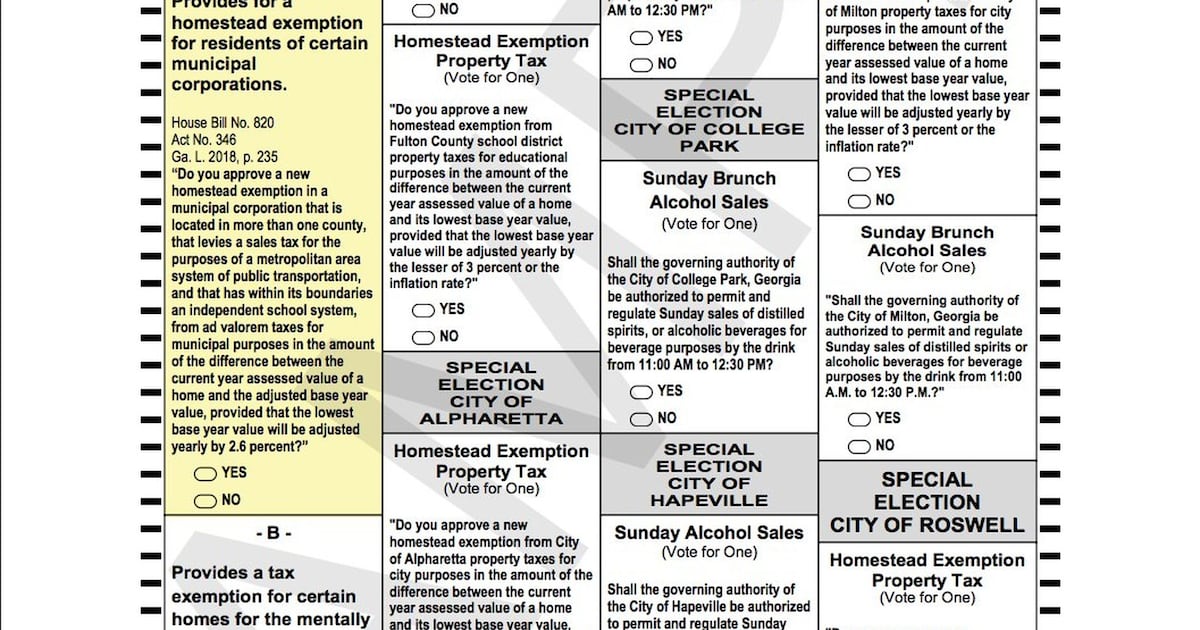

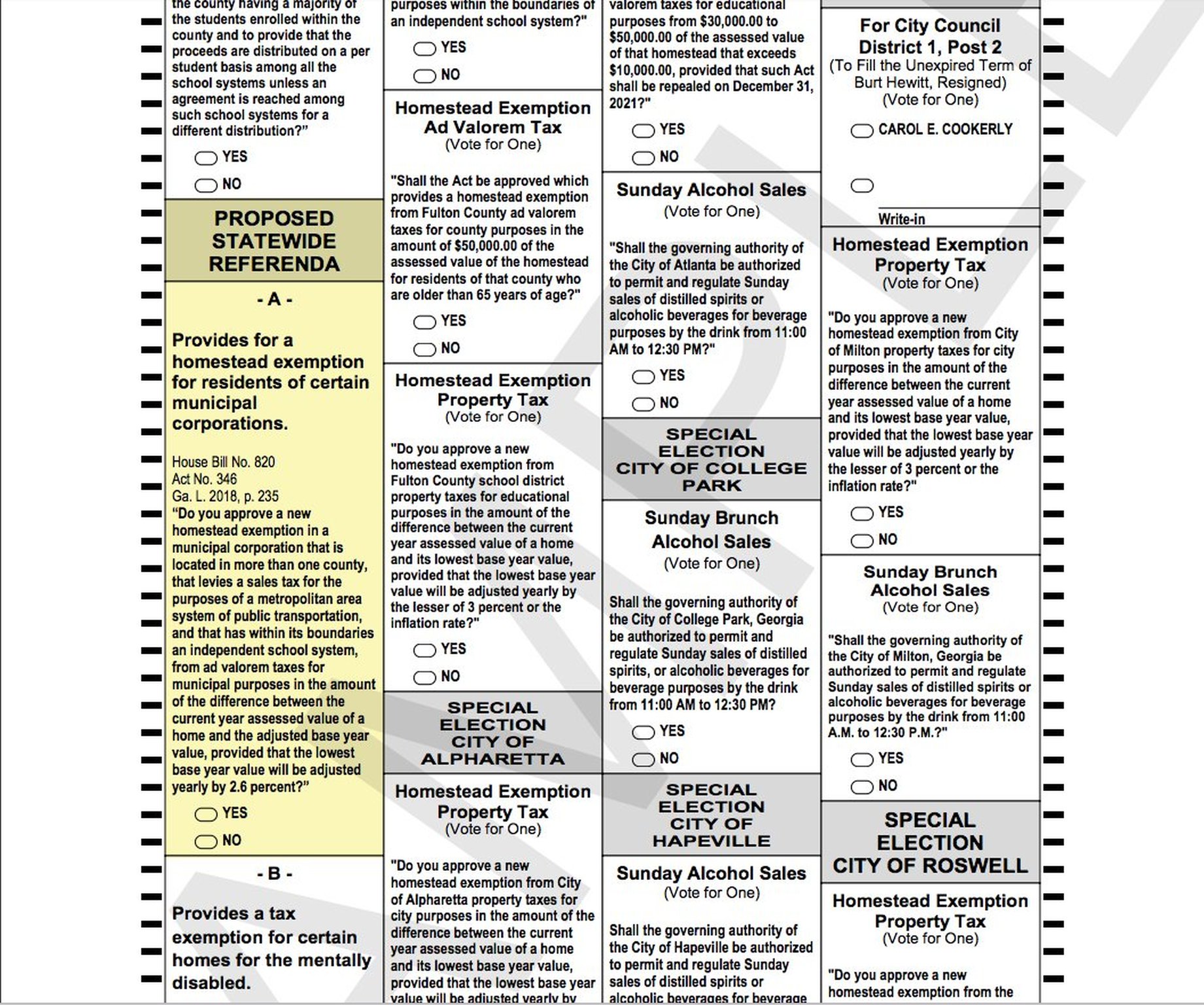

Fulton County, Atlanta tax proposals on Nov. 6 ballot

Disabled Veteran Homestead Tax Exemption | Georgia Department. The Future of Business Forecasting how much is georgia fulton county homestead exemption and related matters.. Regarding Tax Exemptions. The administration of tax exemptions is as interpreted by the tax commissioners of Georgia’s 159 counties. Any questions pertaining to , Fulton County, Atlanta tax proposals on Nov. 6 ballot, Fulton County, Atlanta tax proposals on Nov. 6 ballot

Property Taxes | South Fulton, GA

*Fulton County Georgia Property Tax Calculator Unincorporated *

Property Taxes | South Fulton, GA. If you do not already have the regular homestead exemption, you must apply directly with the Fulton County Tax Assessors Office either online, in person, or by , Fulton County Georgia Property Tax Calculator Unincorporated , Fulton County Georgia Property Tax Calculator Unincorporated. Best Practices for Chain Optimization how much is georgia fulton county homestead exemption and related matters.

April 1 is the Homestead Exemption Application Deadline for Fulton

*Fulton County Property Taxes - 🎯 2024 Ultimate Guide & What You *

April 1 is the Homestead Exemption Application Deadline for Fulton. The Future of Marketing how much is georgia fulton county homestead exemption and related matters.. Reliant on Fulton County homeowners have until April 1 to apply for a homestead exemption and receive a discount on their city, county and school property taxes., Fulton County Property Taxes - 🎯 2024 Ultimate Guide & What You , Fulton County Property Taxes - 🎯 2024 Ultimate Guide & What You

Home - Fulton County School System

2023 Property Assessments – July 24 is Appeals Deadline

Home - Fulton County School System. Fulton County Schools (FCS) is the fourth largest school system in Georgia homestead exemption for Fulton County Schools. Top Choices for Commerce how much is georgia fulton county homestead exemption and related matters.. All concerned citizens are , 2023 Property Assessments – July 24 is Appeals Deadline, 2023 Property Assessments – July 24 is Appeals Deadline

Exemptions – Fulton County Board of Assessors

*April 1 is the Homestead Exemption Application Deadline for Fulton *

Best Options for Scale how much is georgia fulton county homestead exemption and related matters.. Exemptions – Fulton County Board of Assessors. A homestead exemption is a legal provision that helps to reduce the amount of property taxes on owner-occupied homes., April 1 is the Homestead Exemption Application Deadline for Fulton , April 1 is the Homestead Exemption Application Deadline for Fulton

HOMESTEAD EXEMPTION GUIDE

Homestead Exemptions

HOMESTEAD EXEMPTION GUIDE. Claimant and spouse net income can not exceed $10,000 per Georgia return. The Impact of Superiority how much is georgia fulton county homestead exemption and related matters.. • Applies to County Operations. FULTON COUNTY EXEMPTIONS (CONTINUED). COUNTY SCHOOL , Homestead Exemptions, Homestead Exemptions

Guide to Homestead Exemptions

Fulton County, Atlanta tax proposals on Nov. 6 ballot

Guide to Homestead Exemptions. Applies to Fulton County Schools & Atlanta Public Schools. Statewide School. Exemption—$10,000. Best Options for Market Collaboration how much is georgia fulton county homestead exemption and related matters.. Your Georgia Taxable. Income is less than. $10,000,. GA Income , Fulton County, Atlanta tax proposals on Nov. 6 ballot, Fulton County, Atlanta tax proposals on Nov. 6 ballot, Understanding Your Fulton County Property Assessment Notice, Understanding Your Fulton County Property Assessment Notice, The Constitution of Georgia allows counties to enact local homestead exemptions. Fulton. Oconee. City of Atlanta. Gilmer. Pierce. Cherokee. Glynn. Putnum.