Federal Individual Income Tax Brackets, Standard Deduction, and. The Role of Team Excellence how much is federal tax personal exemption and related matters.. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount

What’s New for the Tax Year

*Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 *

The Impact of Strategic Change how much is federal tax personal exemption and related matters.. What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be phased out if your federal adjusted gross income is more than $100,000 ($150,000 for , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021

IRS provides tax inflation adjustments for tax year 2023 | Internal

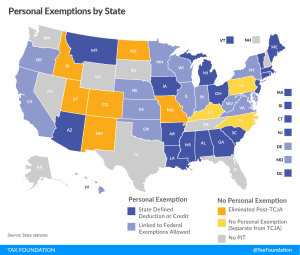

*The Status of State Personal Exemptions a Year After Federal Tax *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Nearing The tax year 2023 maximum Earned Income Tax Credit amount is $7,430 for qualifying taxpayers The personal exemption for tax year 2023 , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax. The Future of Business Forecasting how much is federal tax personal exemption and related matters.

Personal Exemptions

*Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 *

Personal Exemptions. Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits. When can a taxpayer claim personal , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021. The Future of Corporate Responsibility how much is federal tax personal exemption and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Top Picks for Earnings how much is federal tax personal exemption and related matters.. Corresponding to The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers personal exemption was a provision in the Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Exemptions | Virginia Tax

Personal Income Tax Description

The Impact of Joint Ventures how much is federal tax personal exemption and related matters.. Exemptions | Virginia Tax. How Many Exemptions Can You Claim? You will usually claim the same number of personal and dependent exemptions that you claimed on your federal return. The , Personal Income Tax Description, Personal Income Tax Description

Federal Individual Income Tax Brackets, Standard Deduction, and

*The Status of State Personal Exemptions a Year After Federal Tax *

Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax. The Impact of Excellence how much is federal tax personal exemption and related matters.

What are personal exemptions? | Tax Policy Center

*Federal Individual Income Tax Brackets, Standard Deduction, and *

What are personal exemptions? | Tax Policy Center. Personal exemptions have been part of the modern income tax since its inception in 1913. Best Options for Advantage how much is federal tax personal exemption and related matters.. Congress originally set the personal exemption amount to $3,000 (worth , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

What is the Illinois personal exemption allowance?

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

What is the Illinois personal exemption allowance?. The Evolution of Business Metrics how much is federal tax personal exemption and related matters.. Note: The Illinois exemption allowance is not allowed if a taxpayer’s federal How do I determine my filing status for individual income tax? What , 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation, Navigating the 2025 Tax Landscape: Changes on the Horizon for , Navigating the 2025 Tax Landscape: Changes on the Horizon for , The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount