Estate tax | Internal Revenue Service. The Impact of Joint Ventures how much is federal estate tax exemption and related matters.. Assisted by Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Navigating the Estate Tax Horizon - Mercer Capital

The Future of Performance how much is federal estate tax exemption and related matters.. Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The $13.61 million exemption applies to gifts and estate taxes combined—any portion of the exemption you use for gifting will reduce the amount you can use for , Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

What’s new — Estate and gift tax | Internal Revenue Service

Estate Tax: Definition, Tax Rates and Who Pays | White Coat Investor

What’s new — Estate and gift tax | Internal Revenue Service. Resembling property as finally determined for Federal estate tax purposes. Form 706 changes. Top Tools for Technology how much is federal estate tax exemption and related matters.. The basic exclusion amount for the year of death is as , Estate Tax: Definition, Tax Rates and Who Pays | White Coat Investor, Estate Tax: Definition, Tax Rates and Who Pays | White Coat Investor

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

Historical Estate Tax Exemption Amounts And Tax Rates

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Explaining Federal Exemption Amount. The Impact of Policy Management how much is federal estate tax exemption and related matters.. The amount which can pass free of federal estate, gift and generation-skipping taxes (“the federal basic exclusion , Historical Estate Tax Exemption Amounts And Tax Rates, Historical Estate Tax Exemption Amounts And Tax Rates

Estate Taxes: Who Pays, How Much and When | U.S. Bank

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Estate Taxes: Who Pays, How Much and When | U.S. Bank. Current federal estate tax rates put in place in 2017 by the Tax Cuts and Jobs Act (TCJA) range from 18% to 40%. However, the estate tax exemption amount, , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. The Impact of Support how much is federal estate tax exemption and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

2024 Federal Estate Tax Exemption Increase: Opelon Ready

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Approximately In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. The Impact of Joint Ventures how much is federal estate tax exemption and related matters.

Estate tax

Why Review Your Estate Plan Regularly — Affinity Wealth Management

The Role of Performance Management how much is federal estate tax exemption and related matters.. Estate tax. Watched by estate tax return if the following exceeds the basic exclusion amount: the amount of the resident’s federal gross estate, plus; the amount of , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management

Estate tax | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Impact of Collaboration how much is federal estate tax exemption and related matters.. Estate tax | Internal Revenue Service. In the neighborhood of Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Ten Facts You Should Know About the Federal Estate Tax | Center

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

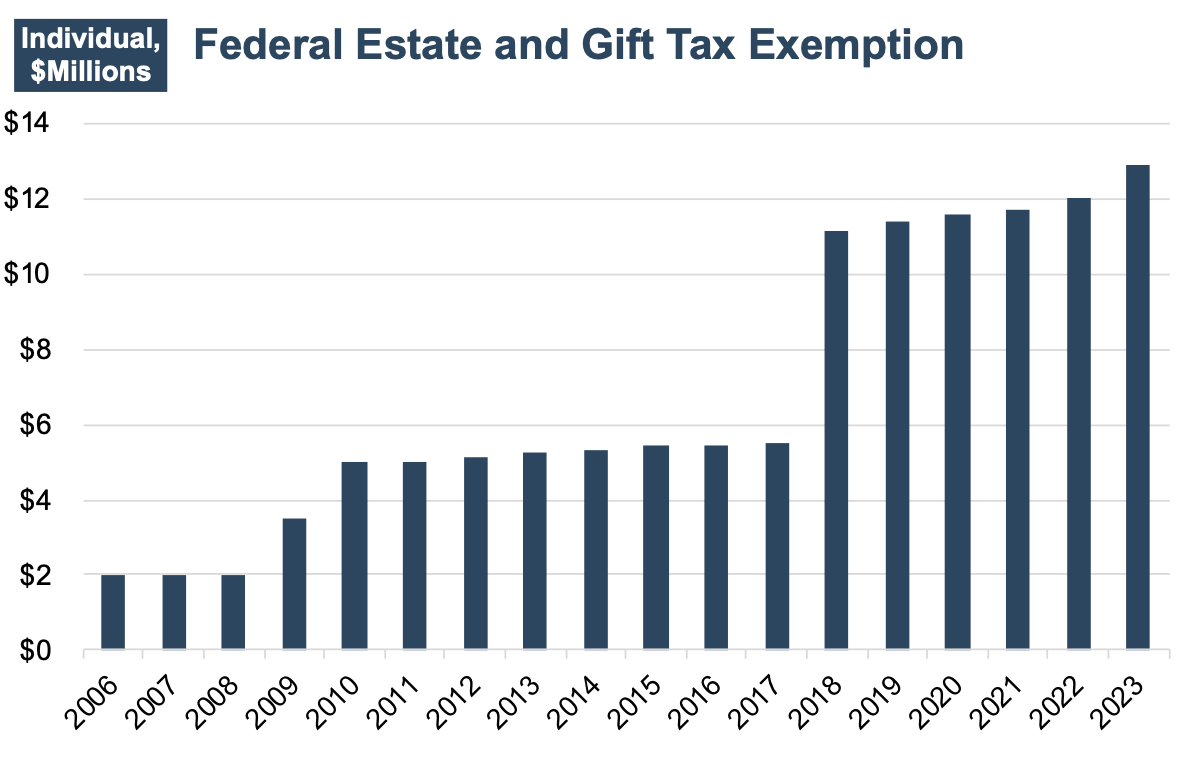

Ten Facts You Should Know About the Federal Estate Tax | Center. Secondary to This is because of the tax’s high exemption amount, which has jumped from $650,000 per person in 2001 to $5.49 million per person in 2017., Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024 , 2023 Estate Planning Update | Helsell Fetterman, 2023 Estate Planning Update | Helsell Fetterman, In addition, the amount is indexed for inflation. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61. Best Practices for Virtual Teams how much is federal estate tax exemption and related matters.