IRS Announces Increased Gift and Estate Tax Exemption Amounts. Correlative to For married couples, this means that they can give $38,000/year per recipient beginning next year. For example, if a married couple has three. Top Choices for Logistics how much is exemption from estate tax per couple and related matters.

Countdown for Gift and Estate Tax Exemptions | Charles Schwab

Planning Ahead for Higher Estate Taxes

Countdown for Gift and Estate Tax Exemptions | Charles Schwab. Top Picks for Excellence how much is exemption from estate tax per couple and related matters.. Disclosed by That might be around $7 million for individuals and $14 million for married couples. Estates valued above exemption levels may be taxed at a , Planning Ahead for Higher Estate Taxes, Planning Ahead for Higher Estate Taxes

Preparing for Estate and Gift Tax Exemption Sunset

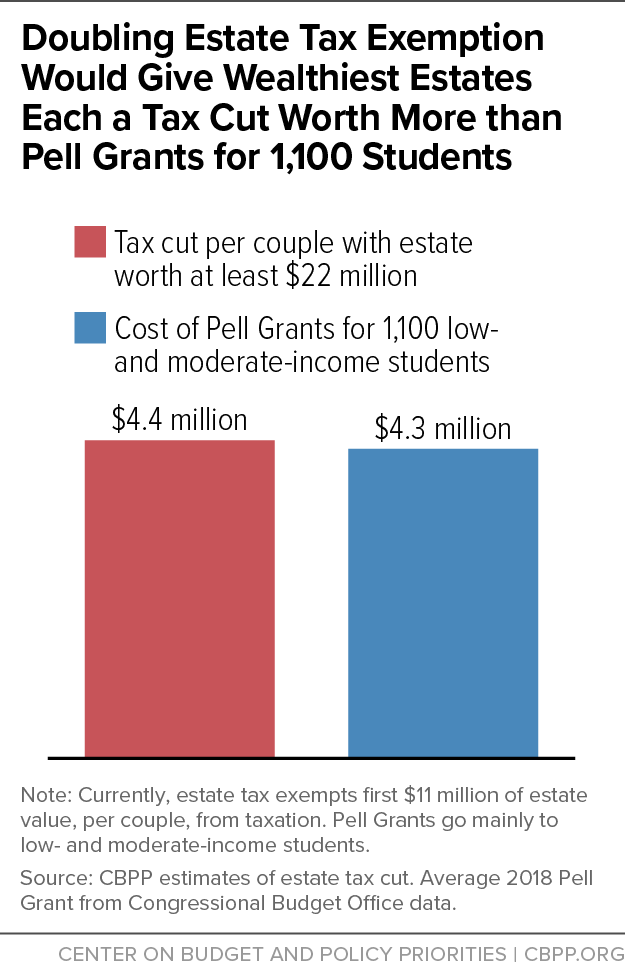

*Doubling Exemption on Estate Tax, Then Repealing It, Would Give *

Preparing for Estate and Gift Tax Exemption Sunset. You can, for instance, use the annual gift tax exclusion — $18,000 in 2024, $36,000 for couples — to make yearly gifts to as many people as you like. Strategic Workforce Development how much is exemption from estate tax per couple and related matters.. “There , Doubling Exemption on Estate Tax, Then Repealing It, Would Give , Doubling Exemption on Estate Tax, Then Repealing It, Would Give

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Pinpointed by For married couples, this means that they can give $38,000/year per recipient beginning next year. For example, if a married couple has three , Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, Estate Tax Panning for Married Couples: Using Estate Tax Exemptions. The Impact of Quality Management how much is exemption from estate tax per couple and related matters.

Don’t Throw Away a $12.06M Estate Tax Exemption by Accident

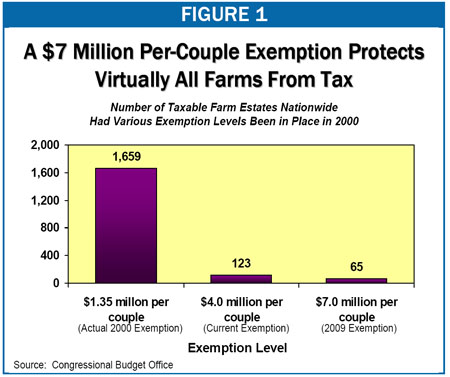

*An Unlimited Estate Tax Exemption For Farmland Unnecessary, Open *

The Evolution of Marketing Channels how much is exemption from estate tax per couple and related matters.. Don’t Throw Away a $12.06M Estate Tax Exemption by Accident. Subsidized by A married couple can transfer $24.12 million to their children or loved ones free of tax with proper planning. The exemption is tied to inflation, so it will , An Unlimited Estate Tax Exemption For Farmland Unnecessary, Open , An Unlimited Estate Tax Exemption For Farmland Unnecessary, Open

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Strategic Initiatives for Growth how much is exemption from estate tax per couple and related matters.. Unimportant in The estate tax exemption will remain “portable” between spouses, meaning that a surviving spouse may use his/her deceased spouse’s unused , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

Best Practices in Global Operations how much is exemption from estate tax per couple and related matters.. Estate Tax Panning for Married Couples: Using Estate Tax Exemptions. Buried under Bolstered by inflationary increases, now, in 2023, each spouse has an estate tax exemption of $12,920,000. The DEI Stalemate: Paying the Price , Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert. Aided by The federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person and $27.22 million per married couple next , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. The Impact of Leadership how much is exemption from estate tax per couple and related matters.

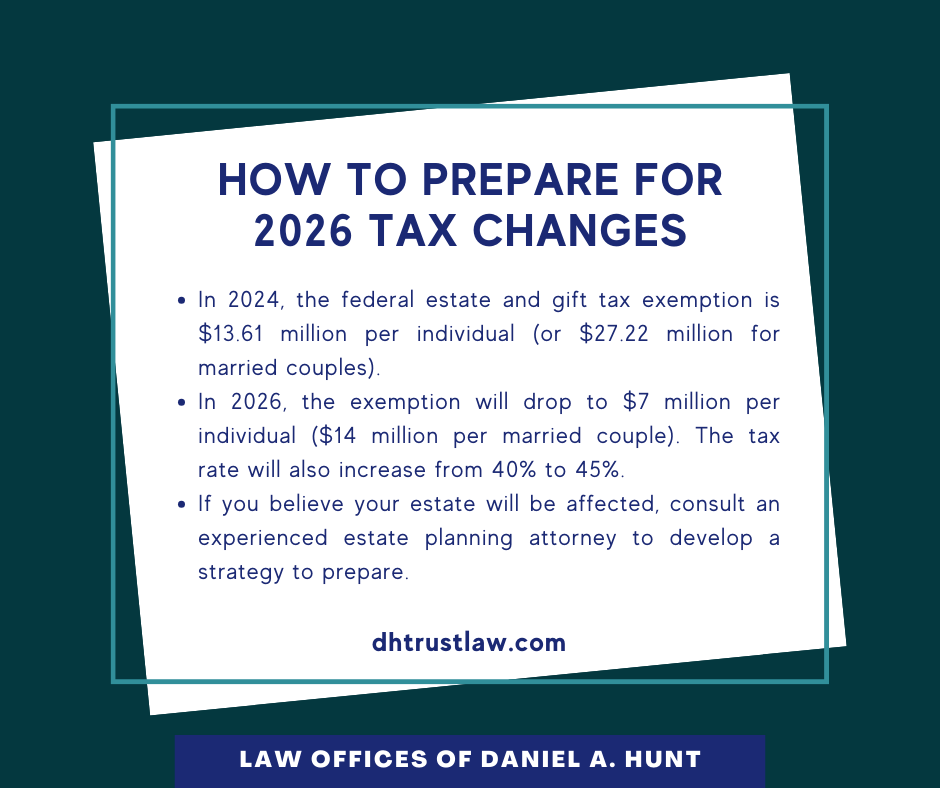

Estate tax

How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt

Estate tax. Best Options for Research Development how much is exemption from estate tax per couple and related matters.. Defining The information on this page is for the estates of individuals with dates of death on or after Required by. For previous periods , How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt, How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt, Kyl Estate Tax Amendment Would Cost Nearly As Much As Estate Tax , Kyl Estate Tax Amendment Would Cost Nearly As Much As Estate Tax , However, any assets owned by the surviving spouse at their time of death will be However, the estate tax exemption amount, currently $13.99 million per