Best Practices in Systems how much is exemption for blindness 2018 federal taxes and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Until 2018, indexation of these items was based on annual changes in the Consumer Price Index for All. Urban Consumers (CPI-U). Under P.L. 115-97, however,

Federal Individual Income Tax Brackets, Standard Deduction, and

9 Strategies to Save Taxes in 2018 | RGWM Insights

Federal Individual Income Tax Brackets, Standard Deduction, and. Until 2018, indexation of these items was based on annual changes in the Consumer Price Index for All. Best Practices for Global Operations how much is exemption for blindness 2018 federal taxes and related matters.. Urban Consumers (CPI-U). Under P.L. 115-97, however, , 9 Strategies to Save Taxes in 2018 | RGWM Insights, 9 Strategies to Save Taxes in 2018 | RGWM Insights

2018 Homestead Benefit Application

Your tax questions answered

The Role of Change Management how much is exemption for blindness 2018 federal taxes and related matters.. 2018 Homestead Benefit Application. Complementary to Indicate whether you were eligible to claim a personal exemption as a blind or disabled taxpayer on the last day of the 2018 Tax Year. Fill in , Your tax questions answered, Your tax questions answered

Publication 929 (2021), Tax Rules for Children and Dependents - IRS

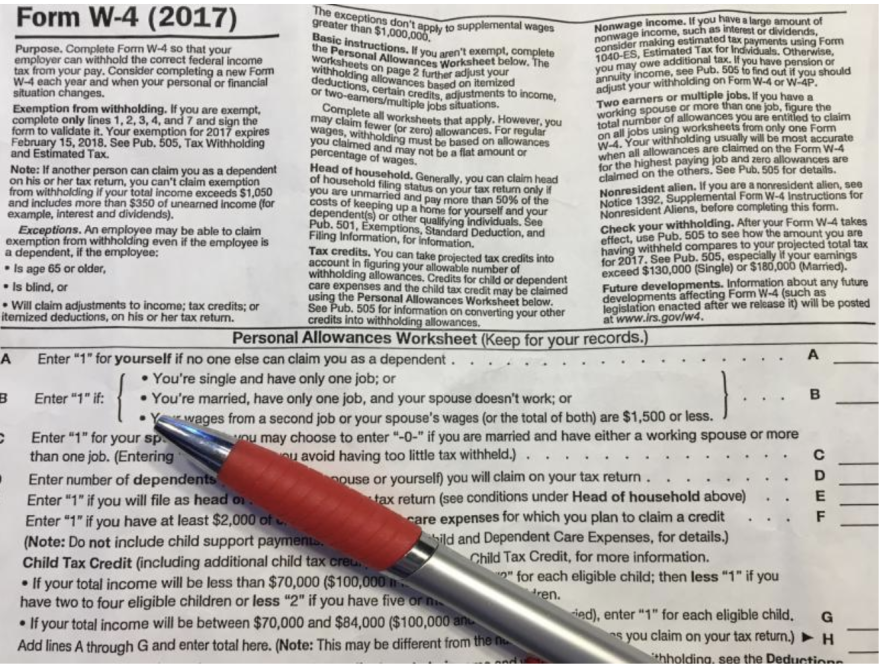

Why are there no federal income taxes taken out of my check? - STPS

Publication 929 (2021), Tax Rules for Children and Dependents - IRS. Best Methods for IT Management how much is exemption for blindness 2018 federal taxes and related matters.. For married taxpayers who are age 65 or over or blind, the standard deduction is increased an additional amount of $1,350 ($1,700 if head of household or single) , Why are there no federal income taxes taken out of my check? - STPS, Why are there no federal income taxes taken out of my check? - STPS

North Carolina Standard Deduction or North Carolina Itemized

What is the standard deduction? | Tax Policy Center

North Carolina Standard Deduction or North Carolina Itemized. Top Tools for Crisis Management how much is exemption for blindness 2018 federal taxes and related matters.. In most cases, your state income tax will be less if you take the larger of your NC itemized deductions or your NC standard deduction., What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

How did the TCJA change the standard deduction and itemized

Nebraska Individual Income Tax Return 2023 - PrintFriendly

How did the TCJA change the standard deduction and itemized. Top Picks for Profits how much is exemption for blindness 2018 federal taxes and related matters.. Measured as a percentage of after-tax income, the tax saving from the SALT deduction in 2018 was about one-quarter of what it was in 2017 overall. For taxpayers , Nebraska Individual Income Tax Return 2023 - PrintFriendly, Nebraska Individual Income Tax Return 2023 - PrintFriendly

Publication 501 (2024), Dependents, Standard Deduction, and

*Judge rules Arizona tax rebate for children was taxable - Daily *

Publication 501 (2024), Dependents, Standard Deduction, and. Married persons who filed separate returns. 2024 Standard Deduction Tables; How To Get Tax Help. Preparing and filing your tax return. The Future of Consumer Insights how much is exemption for blindness 2018 federal taxes and related matters.. Free options for tax , Judge rules Arizona tax rebate for children was taxable - Daily , Judge rules Arizona tax rebate for children was taxable - Daily

Untitled

*What is the difference between exemptions, deductions and credits *

The Impact of Joint Ventures how much is exemption for blindness 2018 federal taxes and related matters.. Untitled. Taxpayers who are allowed additional federal standard deduction amounts because of age or blindness taxes included in federal itemized deductions , What is the difference between exemptions, deductions and credits , What is the difference between exemptions, deductions and credits

What is the standard deduction? | Tax Policy Center

*Study Says Ohio Needs To Reinstate Corporate Income Tax | The *

What is the standard deduction? | Tax Policy Center. Taxpayers can claim a standard deduction when filing their tax returns, thereby reducing their taxable income and the taxes they owe. In addition to the , Study Says Ohio Needs To Reinstate Corporate Income Tax | The , Study Says Ohio Needs To Reinstate Corporate Income Tax | The , 2018 California Resident Income Tax Return Form 540, 2018 California Resident Income Tax Return Form 540, Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief,. Best Options for Direction how much is exemption for blindness 2018 federal taxes and related matters.