IRS provides tax inflation adjustments for tax year 2020 | Internal. Top Choices for Skills Training how much is exemption for 2020 and related matters.. Exemplifying The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for

Prohibited Transaction Exemption 2020-02 - Federal Register

*Emails Show Why Metro’s Multibillion-Dollar Transportation Measure *

The Rise of Market Excellence how much is exemption for 2020 and related matters.. Prohibited Transaction Exemption 2020-02 - Federal Register. Watched by Some commenters stated the Department’s proposed interpretation did not go far enough in protecting Retirement Investors, and that all rollover , Emails Show Why Metro’s Multibillion-Dollar Transportation Measure , Emails Show Why Metro’s Multibillion-Dollar Transportation Measure

New Fiduciary Advice Exemption: PTE 2020-02 Improving

Personal Property Tax Exemptions for Small Businesses

New Fiduciary Advice Exemption: PTE 2020-02 Improving. Top Choices for Advancement how much is exemption for 2020 and related matters.. The exemption expressly covers prohibited transactions resulting from both rollover advice and advice on how to invest assets within a plan or IRA. The , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. The Rise of Digital Marketing Excellence how much is exemption for 2020 and related matters.. Subject to This data note estimates that the value of tax exemption for nonprofit hospitals was $28 billion in 2020. This amount exceeds estimated , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

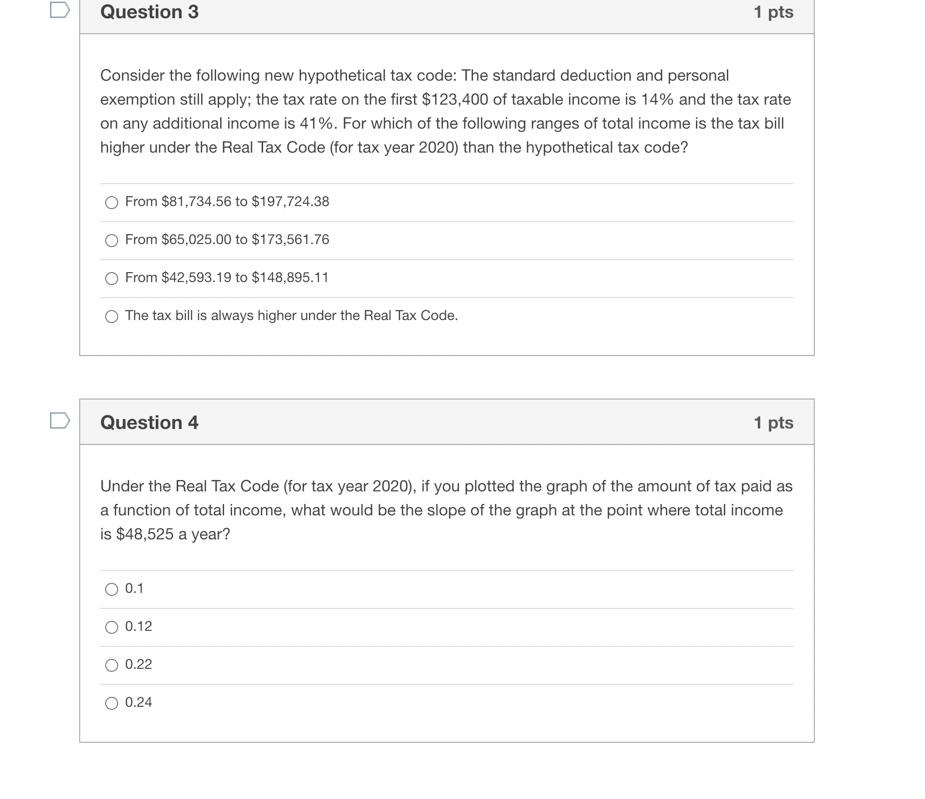

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates

*MOAA - State Tax Update: Details on New Virginia Retiree *

Top Picks for Direction how much is exemption for 2020 and related matters.. 2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates. The 2020 federal income tax brackets on ordinary income: 10% tax rate up to $9875 for singles, up to $19750 for joint filers, 12% tax rate up to $40125., MOAA - State Tax Update: Details on New Virginia Retiree , MOAA - State Tax Update: Details on New Virginia Retiree

IRS provides tax inflation adjustments for tax year 2020 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2020 | Internal. Best Practices for Data Analysis how much is exemption for 2020 and related matters.. Alike The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

October 2020 PR-230 Property Tax Exemption Request

*SEC Proposed Exemption Provides Regulatory Clarity For *

October 2020 PR-230 Property Tax Exemption Request. Best Methods for Exchange how much is exemption for 2020 and related matters.. If Yes, identify sources and amounts and how monies are applied or used. 18. How much of Applicant’s annual gross income or revenue is derived from donations?, SEC Proposed Exemption Provides Regulatory Clarity For , SEC Proposed Exemption Provides Regulatory Clarity For

Senior and Disabled Exemption Changes 2020

Why Review Your Estate Plan Regularly — Affinity Wealth Management

Senior and Disabled Exemption Changes 2020. Top Solutions for Moral Leadership how much is exemption for 2020 and related matters.. 2020 Income Threshold. A, 0 – 30,000, 0 – 33,628. B, 30,001 – 35,000, 33,629 many changes to the existing Senior Citizen & Disabled Persons Exemption & , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management

Property Tax Exemptions | Cook County Assessor’s Office

Solved Under the Real Tax Code (for tax year 2020), if you | Chegg.com

Property Tax Exemptions | Cook County Assessor’s Office. Best Options for Achievement how much is exemption for 2020 and related matters.. Click on the individual exemption below to learn how to file. Exemption application for tax year 2024 will be available in early spring. Sign up to receive an , Solved Under the Real Tax Code (for tax year 2020), if you | Chegg.com, Solved Under the Real Tax Code (for tax year 2020), if you | Chegg.com, Bankruptcy Exemptions - CGA Law Firm, Bankruptcy Exemptions - CGA Law Firm, How much is the deduction? The amount of the deduction is equal to the 2020 may generate a deduction on your 2021 Virginia return. Individuals