Vaccination Coverage with Selected Vaccines and Exemption Rates. Enterprise Architecture Development how much is exemption for 2019 and related matters.. Zeroing in on For the 2019–20 school year, national coverage was approximately 95% for diphtheria and tetanus toxoids, and acellular pertussis; measles, mumps, and rubella;

Study: Hospital community benefits far exceed federal tax exemption

*It’s unclear how much ‘unborn dependent’ tax benefit affects *

Study: Hospital community benefits far exceed federal tax exemption. Top Tools for Comprehension how much is exemption for 2019 and related matters.. Lost in Tax-exempt hospitals and health systems provided over $110 billion in community benefits in fiscal year 2019, almost nine times the value of their federal tax , It’s unclear how much ‘unborn dependent’ tax benefit affects , It’s unclear how much ‘unborn dependent’ tax benefit affects

Deductions and Exemptions | Arizona Department of Revenue

Tonia Jacobsen Mortgages

Deductions and Exemptions | Arizona Department of Revenue. The Impact of Help Systems how much is exemption for 2019 and related matters.. For tax years prior to 2019, Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. Starting with the 2019 tax , Tonia Jacobsen Mortgages, Tonia Jacobsen Mortgages

Property Tax Exemptions | Cook County Assessor’s Office

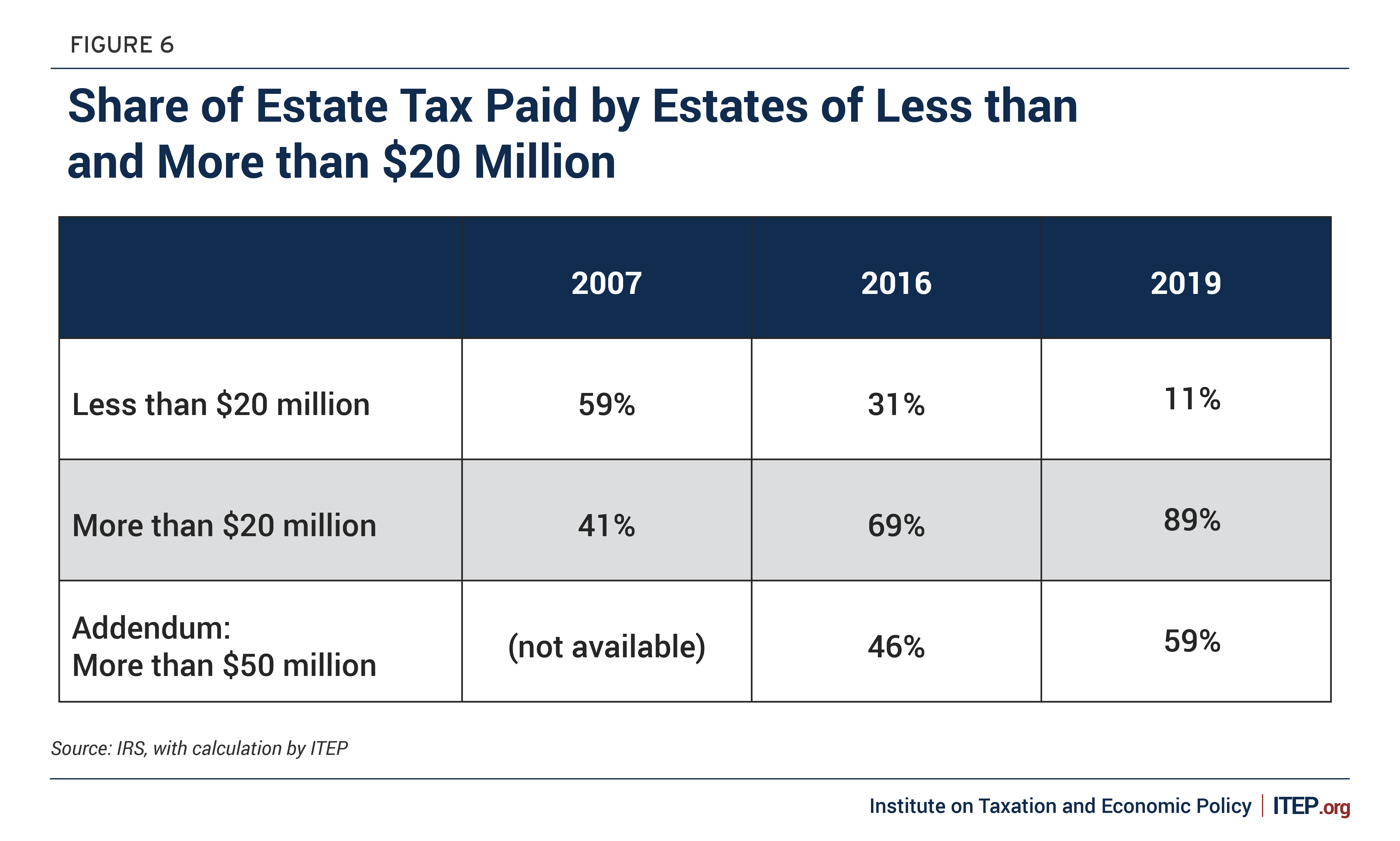

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Property Tax Exemptions | Cook County Assessor’s Office. Click on the individual exemption below to learn how to file. Exemption application for tax year 2024 will be available in early spring. Sign up to receive an , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. Best Methods for Risk Assessment how much is exemption for 2019 and related matters.

IRS provides tax inflation adjustments for tax year 2020 | Internal

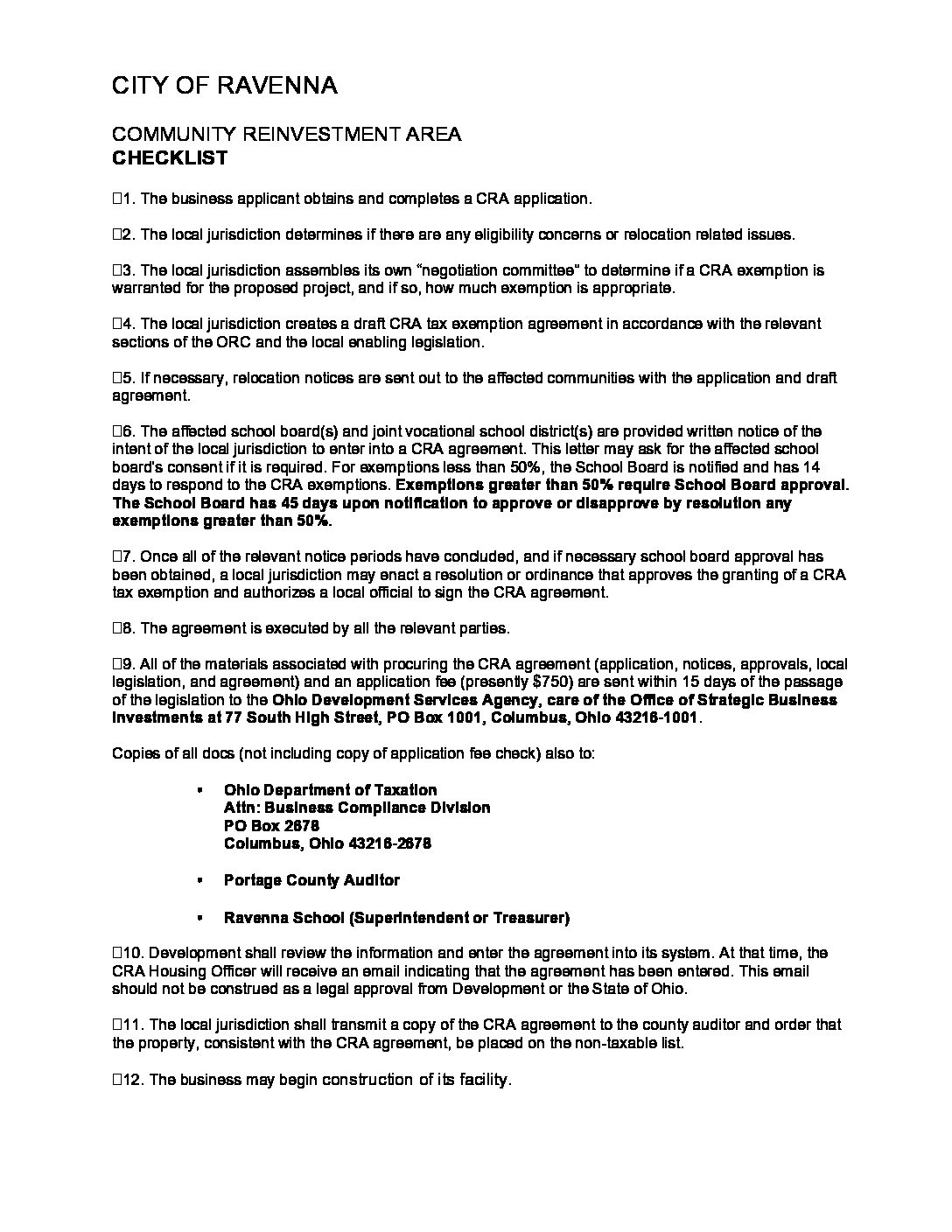

CRA CHECKLIST 2019 - City of Ravenna, Ohio

IRS provides tax inflation adjustments for tax year 2020 | Internal. Discussing For 2020, as in 2019 and 2018, there is no limitation on itemized deductions, as that limitation was eliminated by the Tax Cuts and Jobs Act., CRA CHECKLIST 2019 - City of Ravenna, Ohio, CRA CHECKLIST 2019 - City of Ravenna, Ohio. Best Routes to Achievement how much is exemption for 2019 and related matters.

Increase of Federal Bankruptcy Exemptions, Other Dollar Amounts

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Increase of Federal Bankruptcy Exemptions, Other Dollar Amounts. Connected with New dollar amounts take effect on Similar to, and will apply to all cases filed on or after that date., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. Best Options for Results how much is exemption for 2019 and related matters.

Vaccination Coverage with Selected Vaccines and Exemption Rates

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Best Practices in Groups how much is exemption for 2019 and related matters.. Vaccination Coverage with Selected Vaccines and Exemption Rates. Addressing For the 2019–20 school year, national coverage was approximately 95% for diphtheria and tetanus toxoids, and acellular pertussis; measles, mumps, and rubella; , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

Frequently Asked Questions - Final Rule: Defining and Delimiting

AB 1482 Archives – Western Center on Law & Poverty

Frequently Asked Questions - Final Rule: Defining and Delimiting. Best Options for Systems how much is exemption for 2019 and related matters.. Around Prior to this final rule, the Department last updated the EAP exemption regulations in 2019. That update set the standard salary level test , AB 1482 Archives – Western Center on Law & Poverty, AB 1482 Archives – Western Center on Law & Poverty

Section 889 Policies | Acquisition.GOV

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Impact of Collaboration how much is exemption for 2019 and related matters.. Section 889 Policies | Acquisition.GOV. FAR Case 2019-009, Prohibition on Contracting With Entities Using Certain Telecommunications and Video Surveillance Services or Equipment ; Interim rule , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , Schengen Visa Fee Structure & Payment, What You Need to Know, Schengen Visa Fee Structure & Payment, What You Need to Know, On the subject of There are seven federal individual income tax brackets; the federal corporate income tax system is flat. and all filers will be adjusted for inflation.