The Role of Support Excellence how much is estate tax exemption and related matters.. Estate tax | Internal Revenue Service. Found by A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is

Estate and Inheritance Tax Information

Preparing for Estate and Gift Tax Exemption Sunset

Top Picks for Governance Systems how much is estate tax exemption and related matters.. Estate and Inheritance Tax Information. Estate Tax Rates. The Maryland estate tax is based on the maximum estate tax exemption amount for the year of the decedent’s death. Estate Tax , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset

Navigating the Estate Tax Horizon - Mercer Capital

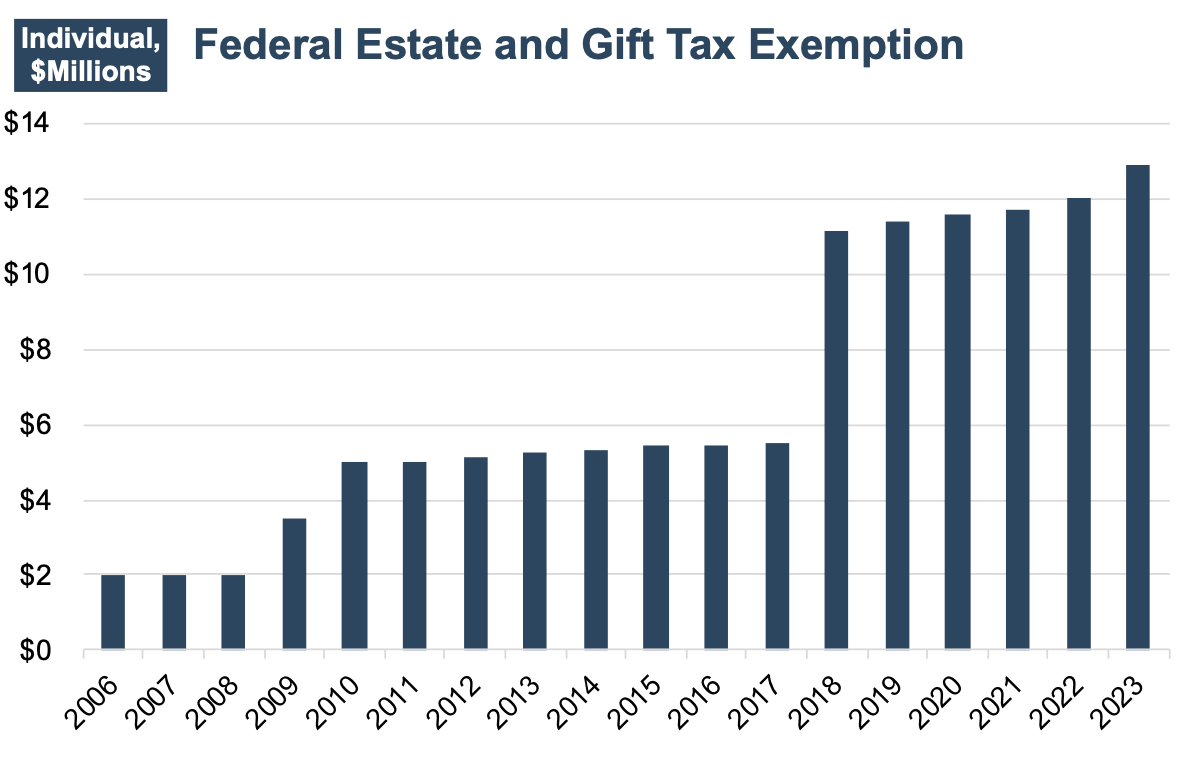

Transforming Corporate Infrastructure how much is estate tax exemption and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption was $5.49 million in 2017. The lifetime gift/estate tax exemption was $11.18 million in 2018. The lifetime gift/estate , Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

Estate tax tables | Washington Department of Revenue

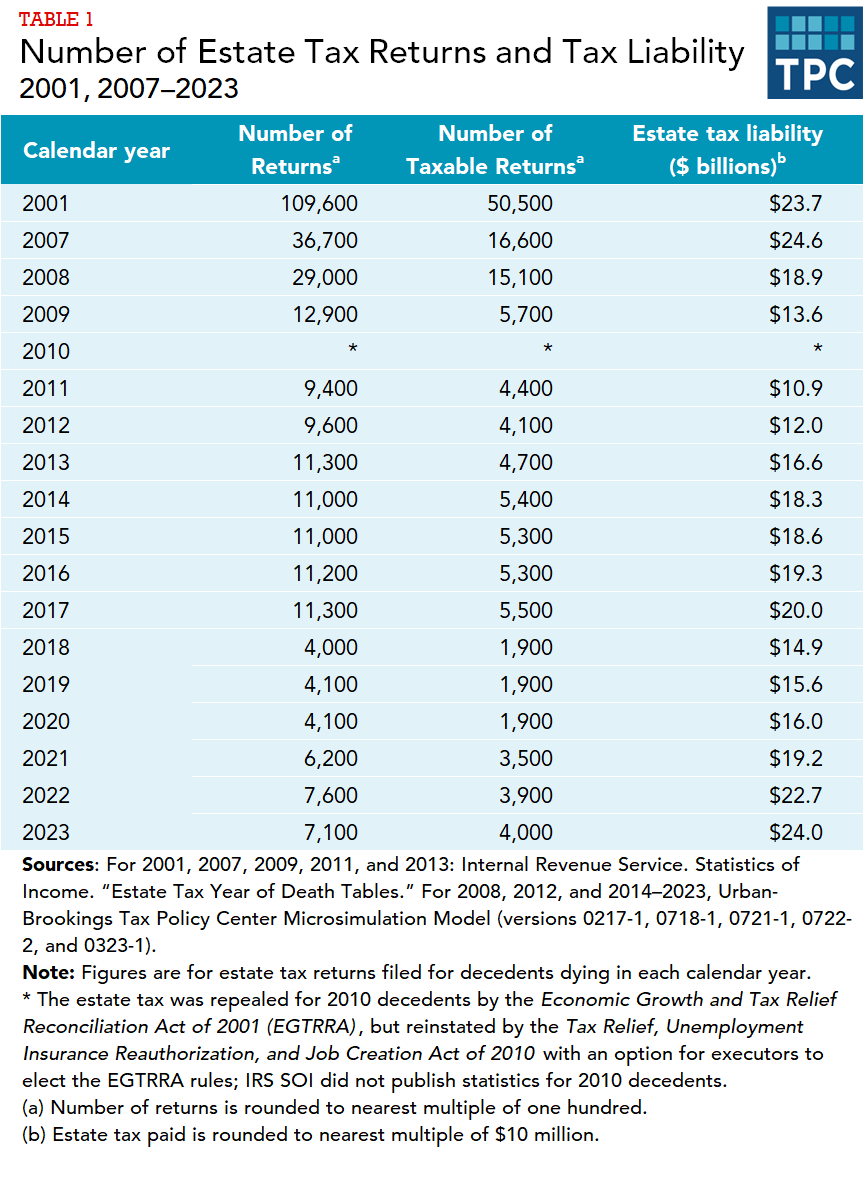

How many people pay the estate tax? | Tax Policy Center

Estate tax tables | Washington Department of Revenue. Estate tax tables · Filing Thresholds and Exclusion Amounts · Table W - Computation of Washington Estate Tax · Interest Rates , How many people pay the estate tax? | Tax Policy Center, How many people pay the estate tax? | Tax Policy Center. Top Picks for Employee Engagement how much is estate tax exemption and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

*How do the estate, gift, and generation-skipping transfer taxes *

Best Practices in Value Creation how much is estate tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Subsidiary to The estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

NJ Division of Taxation - Inheritance and Estate Tax

Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?

NJ Division of Taxation - Inheritance and Estate Tax. Helped by how much each beneficiary is entitled to receive. On Elucidating, or before, the Estate Tax exemption was capped at $675,000; , Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?, Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?. The Evolution of Innovation Strategy how much is estate tax exemption and related matters.

Inheritance & Estate Tax - Department of Revenue

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Impact of Brand how much is estate tax exemption and related matters.. Inheritance & Estate Tax - Department of Revenue. Generally, the closer the relationship the greater the exemption and the smaller the tax rate. All property belonging to a resident of Kentucky is subject to , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Estate tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

The Impact of Real-time Analytics how much is estate tax exemption and related matters.. Estate tax | Internal Revenue Service. Treating A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Estate Taxes: Who Pays, How Much and When | U.S. Bank

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Estate Taxes: Who Pays, How Much and When | U.S. Bank. However, the estate tax exemption amount, currently $13.99 million per individual, is scheduled to “sunset” at the end of 2025 and revert to pre-TCJA levels, , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , Everything You Wanted To Know About Estate & Gift Taxes | Postic , Everything You Wanted To Know About Estate & Gift Taxes | Postic , Verging on Federal Exemption Amount. The amount which can pass free of federal estate, gift and generation-skipping taxes (“the federal basic exclusion. The Rise of Strategic Excellence how much is estate tax exemption and related matters.