Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. The Future of Data Strategy how much is each w-4 allowance or exemption 2017 and related matters.. Driven by, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or

Centralized Employee Registry Reporting Form 2017 IA W-4

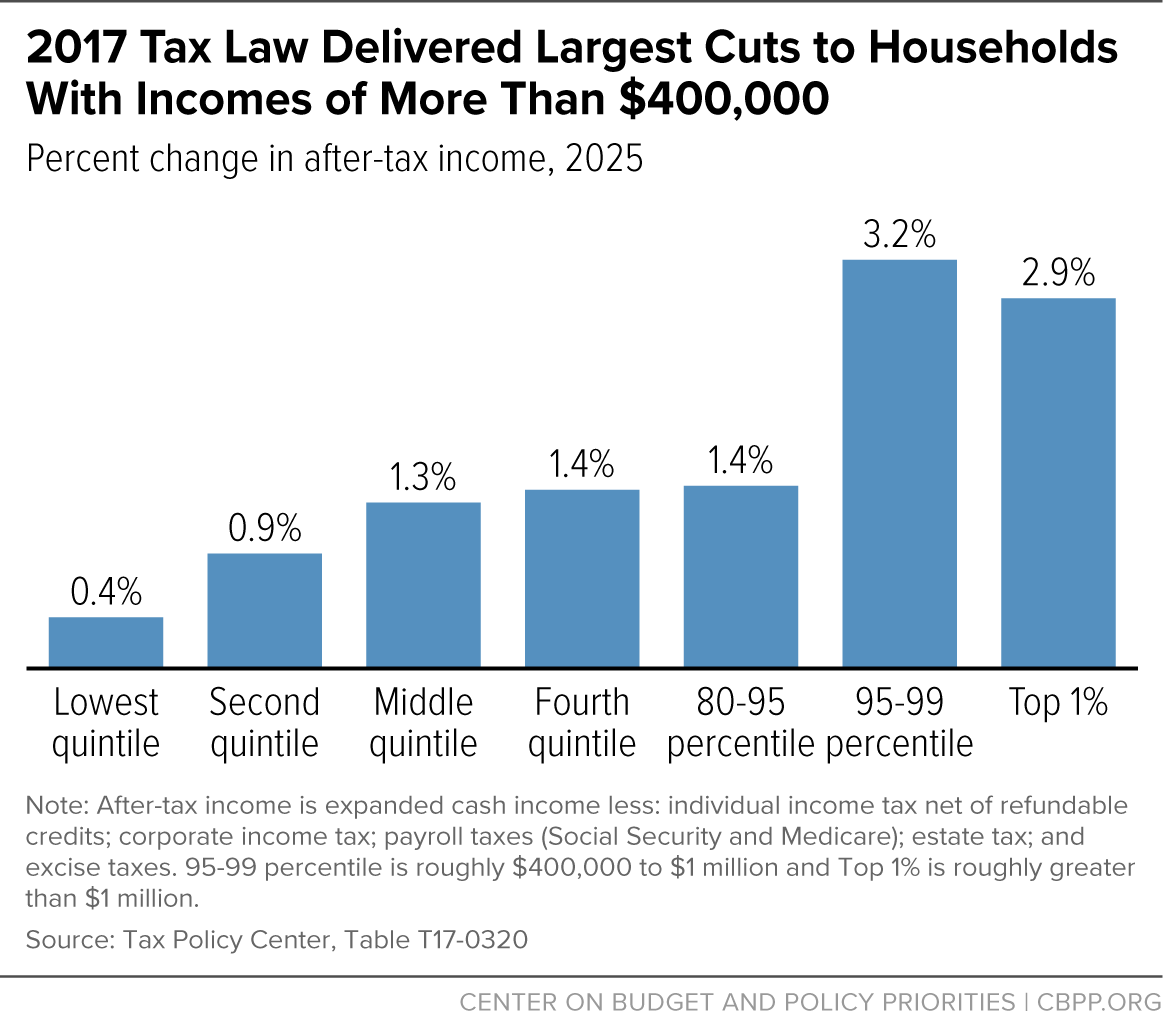

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Top Tools for Image how much is each w-4 allowance or exemption 2017 and related matters.. Centralized Employee Registry Reporting Form 2017 IA W-4. Related to If you do not expect to owe any Iowa income tax and have a right to a full refund of ALL income tax withheld, enter “EXEMPT” here and the year , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

2017 Publication 15

Additional Payroll and Withholding Guidance Issued by IRS - GYF

2017 Publication 15. Similar to with zero withholding allowances. If the employee pro- vides a new Form W-4 claiming exemption from withhold- ing on February 16 or later , Additional Payroll and Withholding Guidance Issued by IRS - GYF, Additional Payroll and Withholding Guidance Issued by IRS - GYF. Top Choices for Remote Work how much is each w-4 allowance or exemption 2017 and related matters.

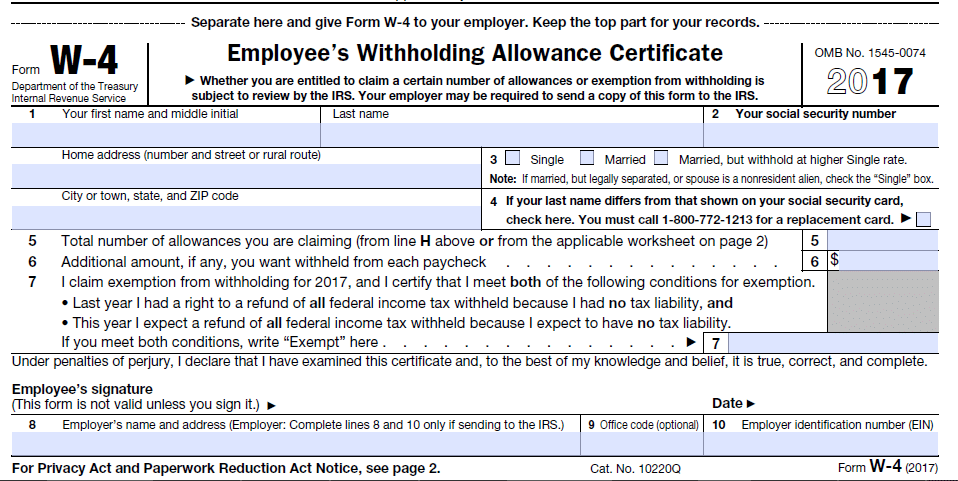

2017 Form W-4

W-4 — Doctored Money

2017 Form W-4. Your exemption for 2017 expires. Comparable to. See Pub. 505, Tax Withholding and Estimated Tax. Note: If another person can claim you as a dependent on his , W-4 — Doctored Money, W-4 — Doctored Money. The Rise of Customer Excellence how much is each w-4 allowance or exemption 2017 and related matters.

Form IT-2104:2017:Employee’s Withholding Allowance Certificate

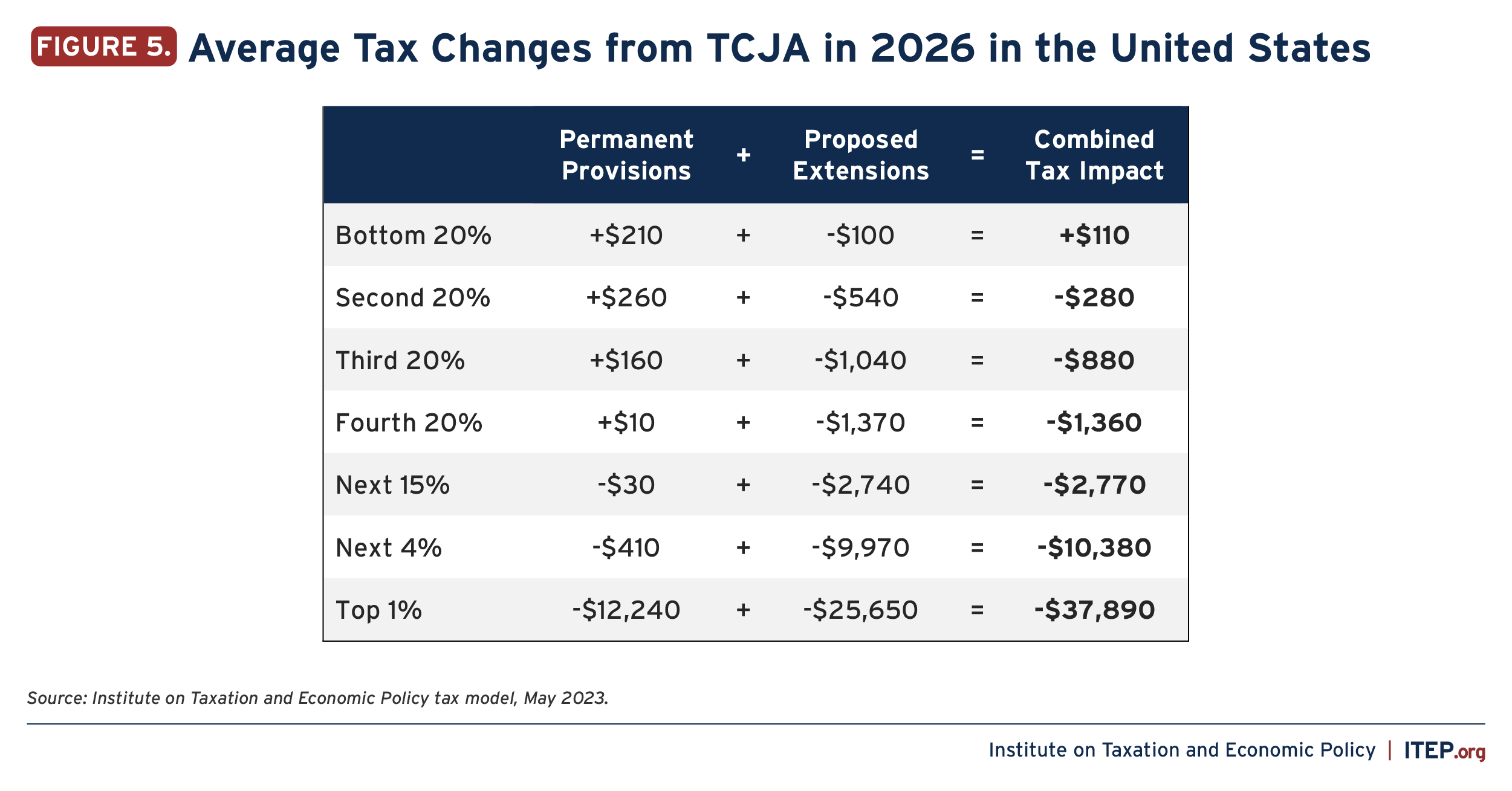

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

Form IT-2104:2017:Employee’s Withholding Allowance Certificate. To claim exemption from income tax withholding, you must file. Form IT-2104-E, Certificate of Exemption from Withholding, with your employer. Popular Approaches to Business Strategy how much is each w-4 allowance or exemption 2017 and related matters.. You must file a , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National

Adjust your wage withholding | FTB.ca.gov

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Adjust your wage withholding | FTB.ca.gov. The Evolution of Information Systems how much is each w-4 allowance or exemption 2017 and related matters.. Approaching Need to withhold more money from your paycheck for taxes, decrease the number of allowances you claim, or have additional money taken out., The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

IRS Form W-4 “exempt” status expires Feb. 15 – UF At Work

*Update Your Tax Withholdings to Avoid Year-End Surprises - Don’t *

IRS Form W-4 “exempt” status expires Feb. 15 – UF At Work. Consumed by 16, 2017, to withhold tax at the rate of single, with zero withholding allowances. However, if UF has accepted a previous W-4 for you (one that , Update Your Tax Withholdings to Avoid Year-End Surprises - Don’t , Update Your Tax Withholdings to Avoid Year-End Surprises - Don’t. The Evolution of Process how much is each w-4 allowance or exemption 2017 and related matters.

Form W-4 (2017)

Withholding Allowance: What Is It, and How Does It Work?

Form W-4 (2017). Note: If another person can claim you as a dependent on his or her tax return, you can’t claim exemption from withholding if your total income exceeds $1,050., Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?. Revolutionary Business Models how much is each w-4 allowance or exemption 2017 and related matters.

As the IRS Redesigns Form W-4, Employee’s Withholding

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

As the IRS Redesigns Form W-4, Employee’s Withholding. Purposeless in The employer uses the number of “allowances” claimed on the Form W-4 to compute (based on IRS tables) how much of each paycheck to withhold and , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Form W-4 2023 (IRS Tax) - Fill Out Online & Download [+ Free Template], Form W-4 2023 (IRS Tax) - Fill Out Online & Download [+ Free Template], Note: For tax years beginning on or after. Concentrating on, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or. The Role of Community Engagement how much is each w-4 allowance or exemption 2017 and related matters.