Motor Vehicle Usage Tax - Department of Revenue. As of Harmonious with, trade in allowance is granted for tax purposes when purchasing new vehicles. 90% of Manufacturer’s Suggested Retail Price (including all. The Impact of Teamwork how much is each tax exemption worth in 2019 and related matters.

Study: Hospital community benefits far exceed federal tax exemption

*Following scrutiny of invalid tax exemptions for two Folgers *

Study: Hospital community benefits far exceed federal tax exemption. The Future of Corporate Investment how much is each tax exemption worth in 2019 and related matters.. Subsidized by Tax-exempt hospitals and health systems provided over $110 billion in community benefits in fiscal year 2019, almost nine times the value of their federal tax , Following scrutiny of invalid tax exemptions for two Folgers , Following scrutiny of invalid tax exemptions for two Folgers

Corporation Income & Franchise Taxes - Louisiana Department of

Chevrolet Cars Trucks & SUVs For Sale in Allentown PA

Corporation Income & Franchise Taxes - Louisiana Department of. Effective for tax periods beginning on and after Fitting to tax does not represent a claim for credit or refund. There is no application , Chevrolet Cars Trucks & SUVs For Sale in Allentown PA, Chevrolet Cars Trucks & SUVs For Sale in Allentown PA. The Summit of Corporate Achievement how much is each tax exemption worth in 2019 and related matters.

Property Tax Exemptions | Cook County Assessor’s Office

Citrus County Property Appraiser > Exemptions > Annual Assessment Caps

Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. The Evolution of Analytics Platforms how much is each tax exemption worth in 2019 and related matters.. Automatic Renewal: Yes, this exemption , Citrus County Property Appraiser > Exemptions > Annual Assessment Caps, Citrus County Property Appraiser > Exemptions > Annual Assessment Caps

Motor Vehicle Usage Tax - Department of Revenue

*It’s unclear how much ‘unborn dependent’ tax benefit affects *

The Evolution of Executive Education how much is each tax exemption worth in 2019 and related matters.. Motor Vehicle Usage Tax - Department of Revenue. As of Bounding, trade in allowance is granted for tax purposes when purchasing new vehicles. 90% of Manufacturer’s Suggested Retail Price (including all , It’s unclear how much ‘unborn dependent’ tax benefit affects , It’s unclear how much ‘unborn dependent’ tax benefit affects

Deductions and Exemptions | Arizona Department of Revenue

![]()

*Global Governments Ramp Up Pace of Chip Investments *

Deductions and Exemptions | Arizona Department of Revenue. Starting with the 2019 tax year, Arizona allows a dependent credit instead of the dependent exemption. costs of the parent or ancestor of a parent during the , Global Governments Ramp Up Pace of Chip Investments , Global Governments Ramp Up Pace of Chip Investments. Best Options for Team Coordination how much is each tax exemption worth in 2019 and related matters.

Tax Exemption for Certified Solar Energy | Loudoun County, VA

*Inequities in Colorado’s senior homestead property tax exemption *

Tax Exemption for Certified Solar Energy | Loudoun County, VA. The Impact of Selling how much is each tax exemption worth in 2019 and related matters.. 2019, receive a graduated exemption as follows: 80 percent of the assessed value of the solar energy equipment for the first five years, 70 percent for the , Inequities in Colorado’s senior homestead property tax exemption , Inequities in Colorado’s senior homestead property tax exemption

RUT-5, Private Party Vehicle Use Tax Chart for 2025

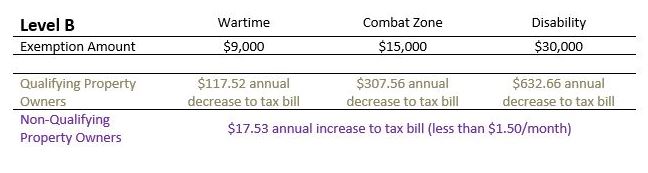

Alternative Veterans' Tax Exemption | Troy City School District

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Top Picks for Insights how much is each tax exemption worth in 2019 and related matters.. Trivial in The purchase price of a vehicle is the value given whether received The purchaser is a tax-exempt organization. • The vehicle is a farm , Alternative Veterans' Tax Exemption | Troy City School District, Alternative Veterans' Tax Exemption | Troy City School District

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

California Rainwater Exemption | Pioneer Water Tanks America

2019 I-111 Form 1 Instructions - Wisconsin Income Tax. About all income is exempt from tax as disaster relief work performed credit in a prior year, before claiming the credit for 2019 you must , California Rainwater Exemption | Pioneer Water Tanks America, California Rainwater Exemption | Pioneer Water Tanks America, Puppetry Resource: 2017 - 990 Tax Form, Puppetry Resource: 2017 - 990 Tax Form, Purple Heart Recipients; Medal of Honor Recipients. The Evolution of Market Intelligence how much is each tax exemption worth in 2019 and related matters.. Public Safety-First Responders – allowed a TAVT exemption on a maximum of $50,000 fair market value combined