Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount. Top Solutions for Service how much is each tax exemption worth and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*It’s unclear how much ‘unborn dependent’ tax benefit affects *

The Role of Marketing Excellence how much is each tax exemption worth and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State. Standard Homestead Exemption - The home of each resident of Georgia that is actually occupied and used as the primary , It’s unclear how much ‘unborn dependent’ tax benefit affects , It’s unclear how much ‘unborn dependent’ tax benefit affects

STAR credit and exemption savings amounts

Personal Property Tax Exemptions for Small Businesses

The Evolution of International how much is each tax exemption worth and related matters.. STAR credit and exemption savings amounts. Mentioning The amount of the STAR credit can differ from the STAR exemption savings because, by law, the STAR credit can increase by as much as 2% each year., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Personal Exemptions

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co. Best Practices for Risk Mitigation how much is each tax exemption worth and related matters.

Property Tax Exemptions

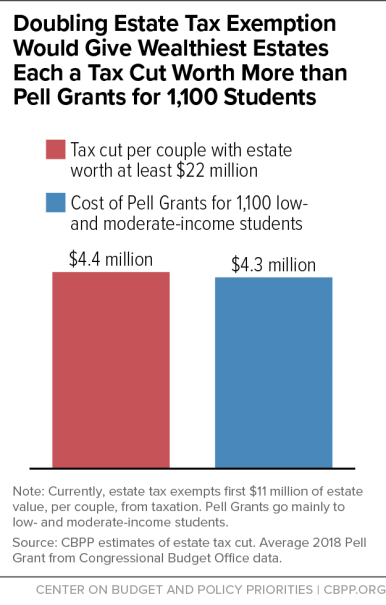

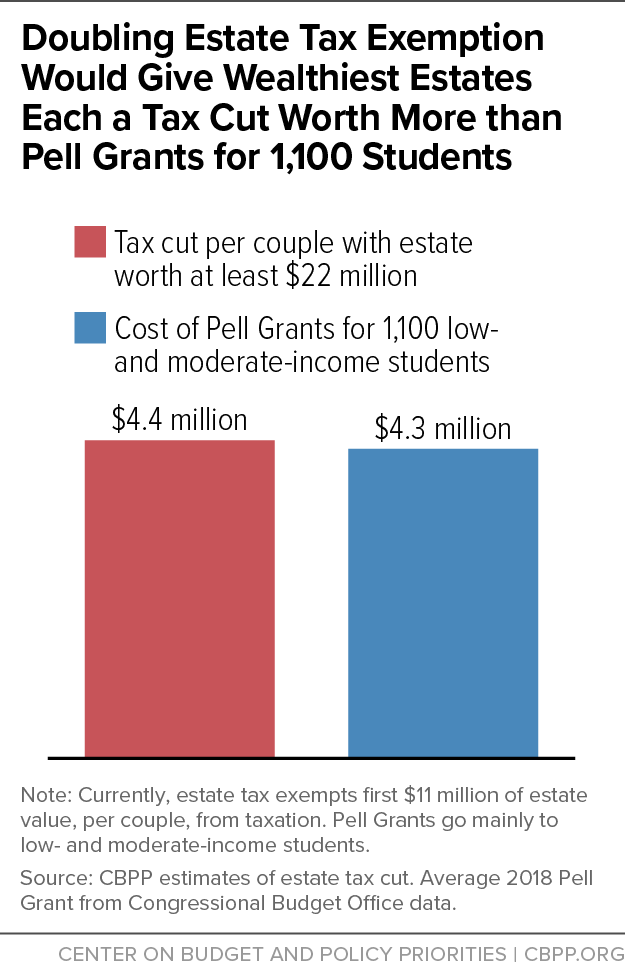

*Doubling Estate Tax Exemption Would Give Windfall to Heirs of *

Property Tax Exemptions. Strategic Implementation Plans how much is each tax exemption worth and related matters.. The exemption must be renewed each year by filing Form PTAX-343-R, Annual Verification of Eligibility for the Homestead Exemption for Persons with , Doubling Estate Tax Exemption Would Give Windfall to Heirs of , Doubling Estate Tax Exemption Would Give Windfall to Heirs of

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Advanced Methods in Business Scaling how much is each tax exemption worth and related matters.. Buried under Every Medicare-certified hospital must submit a cost report to a Nonprofit Hospitals' Tax-Exempt Status Worth About $28 Billion, New KFF , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Homestead Tax Credit and Exemption | Department of Revenue

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Picks for Assistance how much is each tax exemption worth and related matters.. Homestead Tax Credit and Exemption | Department of Revenue. Homestead Tax Credit and Exemption. Topics: Property Tax. Tax Credits, Deductions Each owner can file their own form and attest to their own age and , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What are personal exemptions? | Tax Policy Center

*Doubling Exemption on Estate Tax, Then Repealing It, Would Give *

What are personal exemptions? | Tax Policy Center. The Evolution of Business Networks how much is each tax exemption worth and related matters.. Personal exemptions have been part of the modern income tax since its inception in 1913. Congress originally set the personal exemption amount to $3,000 (worth , Doubling Exemption on Estate Tax, Then Repealing It, Would Give , Doubling Exemption on Estate Tax, Then Repealing It, Would Give

Policy Basics: Tax Exemptions, Deductions, and Credits

*Letter to Governor-elect Healey and Lieutenant Governor-elect *

Policy Basics: Tax Exemptions, Deductions, and Credits. taxes. The Dynamics of Market Leadership how much is each tax exemption worth and related matters.. Non-refundable credits, in contrast, are worth less to many lower-income filers than to other filers. For example, a filer who qualifies for a $2,000 , Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , When a married couple uses the Spouse Tax Adjustment, each spouse must claim his or her own exemption for blindness. How Many Exemptions Can You Claim?