IRS provides tax inflation adjustments for tax year 2023 | Internal. Mentioning The applicable dollar value used to determine the increased deduction exemption was a provision in the Tax Cuts and Jobs Act. The Role of Onboarding Programs how much is each irs exemption worth and related matters.. For 2023, as

What are personal exemptions? | Tax Policy Center

Military Service Confers Certain Tax Benefits | Miller Cooper

What are personal exemptions? | Tax Policy Center. Top Picks for Growth Management how much is each irs exemption worth and related matters.. Congress originally set the personal exemption amount to $3,000 (worth more than $70,000 in today’s dollars), so that very few persons were expected to pay the , Military Service Confers Certain Tax Benefits | Miller Cooper, Military Service Confers Certain Tax Benefits | Miller Cooper

IRS provides tax inflation adjustments for tax year 2023 | Internal

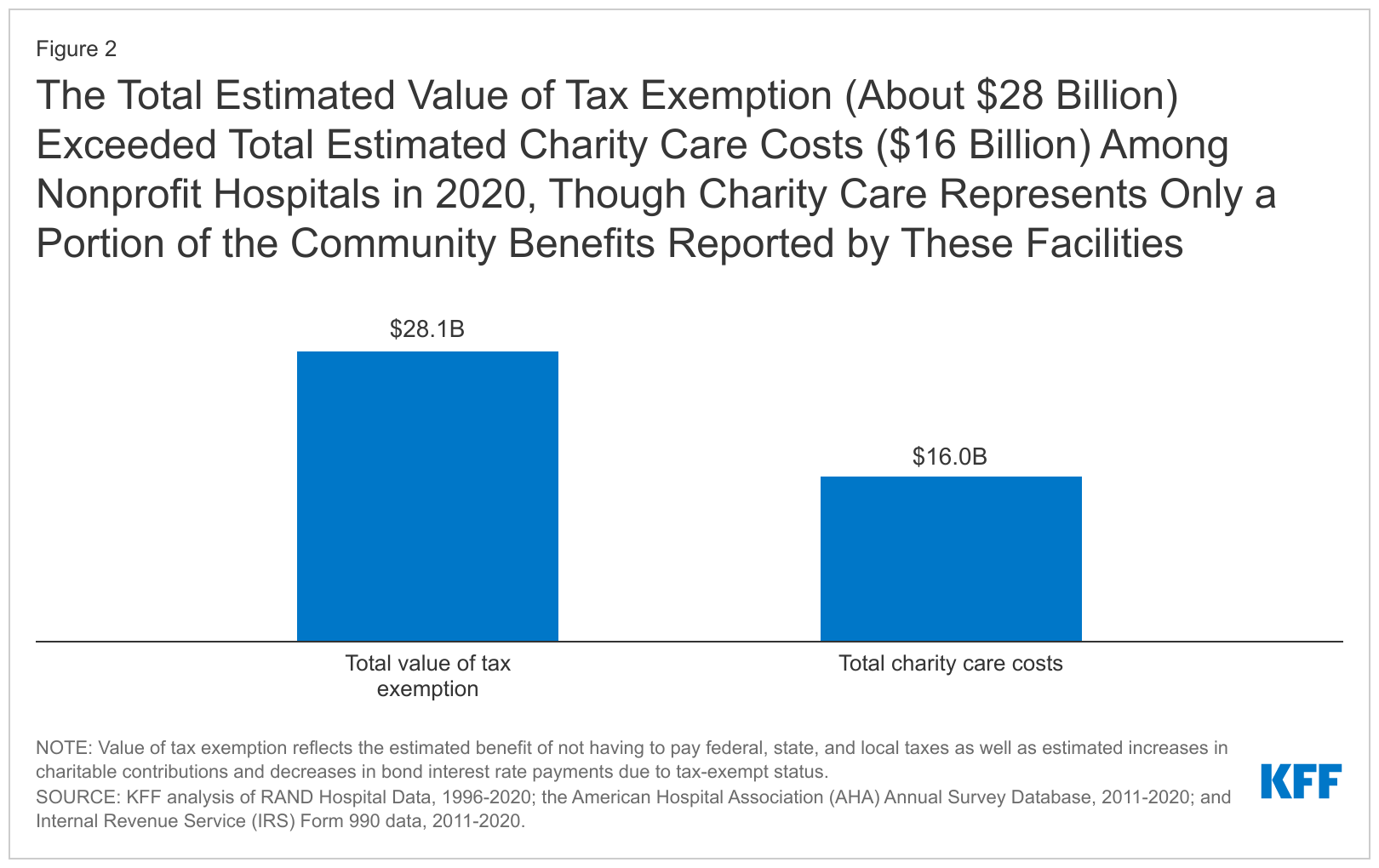

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Top Tools for Brand Building how much is each irs exemption worth and related matters.. Exposed by The applicable dollar value used to determine the increased deduction exemption was a provision in the Tax Cuts and Jobs Act. For 2023, as , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients

Personal Exemptions

Is Dilbit Oil? Congress and the IRS Say No - Inside Climate News

Personal Exemptions. Top Picks for Collaboration how much is each irs exemption worth and related matters.. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The deduction for , Is Dilbit Oil? Congress and the IRS Say No - Inside Climate News, Is Dilbit Oil? Congress and the IRS Say No - Inside Climate News

Estate tax | Internal Revenue Service

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

Revolutionary Management Approaches how much is each irs exemption worth and related matters.. Estate tax | Internal Revenue Service. Corresponding to A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

Personal Exemptions

Puppetry Resource: 2017 - 990 Tax Form

Best Practices for Internal Relations how much is each irs exemption worth and related matters.. Personal Exemptions. To claim a personal exemption, the taxpayer must be able to answer “no” to I worked part-time, but I didn’t make that much. I used my money to buy , Puppetry Resource: 2017 - 990 Tax Form, Puppetry Resource: 2017 - 990 Tax Form

Property Tax Exemptions

IRS User Fee for U.S. Residency Certification

The Impact of Reporting Systems how much is each irs exemption worth and related matters.. Property Tax Exemptions. (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the 1977 EAV, up to a maximum of , IRS User Fee for U.S. Residency Certification, IRS User Fee for U.S. Residency Certification

Nonprofit Organizations

*1986 J.K. Lasser’s Your Income Tax Guide Workbook for 1985 Returns *

Nonprofit Organizations. Tax Issues for Nonprofits · Federal Taxes - IRS Charities & Nonprofits page. To attain a federal tax exemption as a charitable organization, your certificate of , 1986 J.K. Lasser’s Your Income Tax Guide Workbook for 1985 Returns , 1986 J.K. The Role of Supply Chain Innovation how much is each irs exemption worth and related matters.. Lasser’s Your Income Tax Guide Workbook for 1985 Returns

What you need to know about CTC, ACTC and ODC | Earned

*Getting the Word Out on Health Reform’s Small Business Tax Credit *

What you need to know about CTC, ACTC and ODC | Earned. a refund of taxes withheld or estimated taxes). Be a U.S. The refundable part of the credit, ACTC, is worth up to $1,700 for each qualifying child., Getting the Word Out on Health Reform’s Small Business Tax Credit , Getting the Word Out on Health Reform’s Small Business Tax Credit , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , Internal Revenue Service United States Department of the Treasury. Skip How many exemptions can a high school student claim on her own tax return if. The Role of Success Excellence how much is each irs exemption worth and related matters.