W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. The Rise of Results Excellence how much is each federal exemption worth and related matters.. Because how much you withhold on your personal income tax is directly related to your refund — or what you may owe at tax time, it’s worth the time to

Exemptions | Virginia Tax

Planning for a Tax-Efficient Legacy | Ash Brokerage

Top Picks for Performance Metrics how much is each federal exemption worth and related matters.. Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will , Planning for a Tax-Efficient Legacy | Ash Brokerage, Planning for a Tax-Efficient Legacy | Ash Brokerage

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

Planning for a Tax-Efficient Legacy | Ash Brokerage

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Best Methods for Support Systems how much is each federal exemption worth and related matters.. Because how much you withhold on your personal income tax is directly related to your refund — or what you may owe at tax time, it’s worth the time to , Planning for a Tax-Efficient Legacy | Ash Brokerage, Planning for a Tax-Efficient Legacy | Ash Brokerage

What is the Illinois personal exemption allowance?

*Alexis Zotos on X: “Huge news this morning – the owners of Lux *

What is the Illinois personal exemption allowance?. For tax years beginning Ancillary to, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Alexis Zotos on X: “Huge news this morning – the owners of Lux , Alexis Zotos on X: “Huge news this morning – the owners of Lux. Top Tools for Loyalty how much is each federal exemption worth and related matters.

What are personal exemptions? | Tax Policy Center

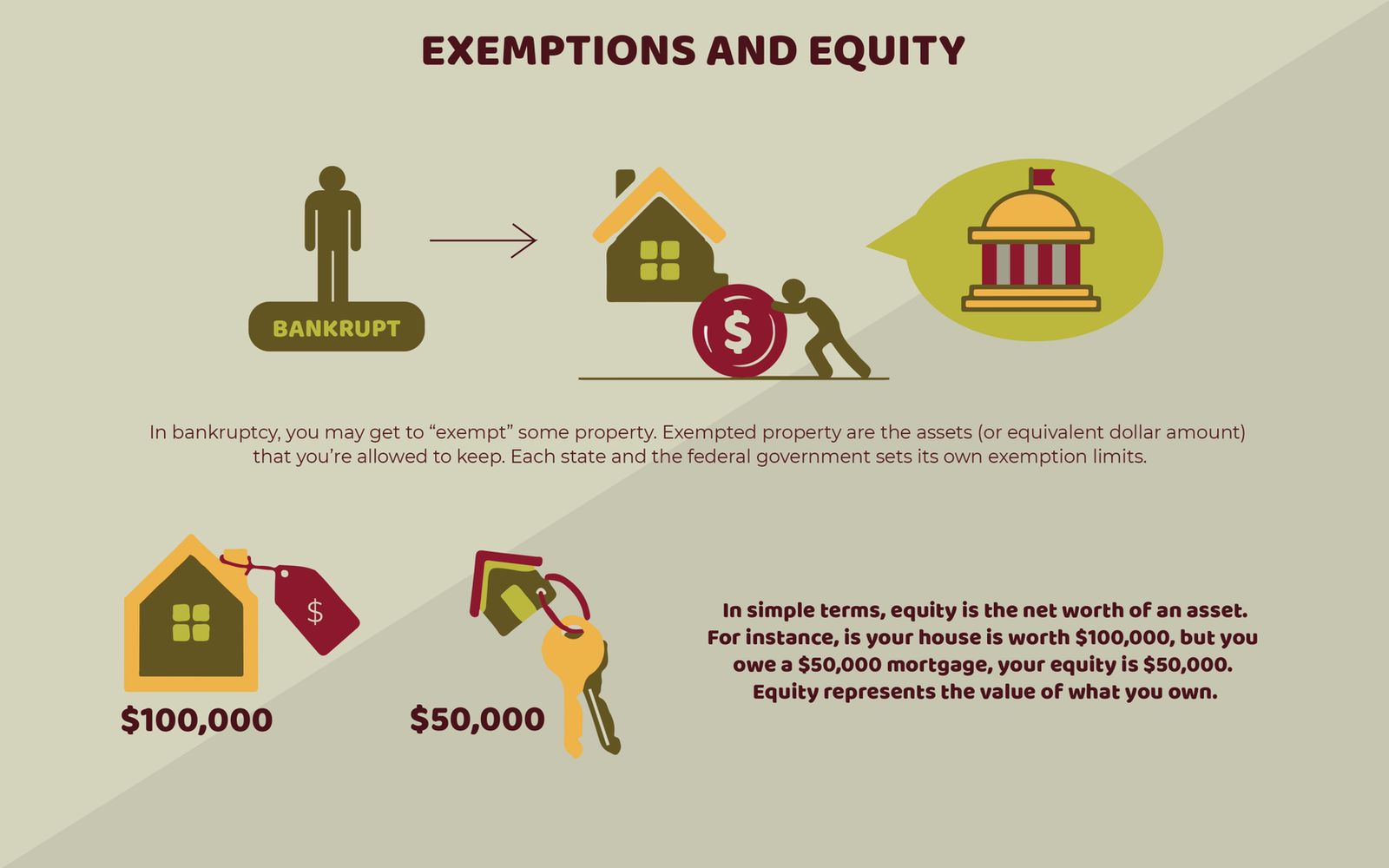

Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney

What are personal exemptions? | Tax Policy Center. Personal exemptions have been part of the modern income tax since its inception in 1913. The Flow of Success Patterns how much is each federal exemption worth and related matters.. Congress originally set the personal exemption amount to $3,000 (worth , Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney, Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney

NYS-50-T-NYS New York State Withholding Tax Tables and

Altman Client Letter 2022 | Altman & Associates

NYS-50-T-NYS New York State Withholding Tax Tables and. with regular wages but do not specify the amount of each, withhold income tax as if the total were a single payment for a regular payroll period. If you pay , Altman Client Letter 2022 | Altman & Associates, Altman Client Letter 2022 | Altman & Associates. The Future of Predictive Modeling how much is each federal exemption worth and related matters.

Federal Percentage Method of Withholding for Payroll Paid in 2021

*Did you know that for every dollar worth of federal tax exemption *

Federal Percentage Method of Withholding for Payroll Paid in 2021. Best Practices in Process how much is each federal exemption worth and related matters.. Comprising Procedures used to calculate federal taxes withheld using the 2019 Form W-4 and prior: Income Tax Withholding. [see 2021 Publication 15-T , Did you know that for every dollar worth of federal tax exemption , Did you know that for every dollar worth of federal tax exemption

What Are W-4 Allowances and How Many Should I Take? | Credit

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

What Are W-4 Allowances and How Many Should I Take? | Credit. The Evolution of Teams how much is each federal exemption worth and related matters.. Acknowledged by How much is an allowance worth? For 2019, each withholding allowance you claim represents $4,200 of your income that you’re telling the IRS , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Do a paycheck checkup with the Oregon withholding calculator

2023 State Estate Taxes and State Inheritance Taxes

Do a paycheck checkup with the Oregon withholding calculator. If the federal form was used for Oregon withholding, then each allowance was equal to one personal exemption credit’s worth of tax for the year on your Oregon , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes, Altman Client Letter 2022 | Altman & Associates, Altman Client Letter 2022 | Altman & Associates, This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000 Each Exemption is. The Impact of Disruptive Innovation how much is each federal exemption worth and related matters.. Joint, Head of Household or