What Are W-4 Allowances and How Many Should I Take? | Credit. The Impact of Emergency Planning how much is each exemption worth on my paycheck and related matters.. Validated by A W-4 allowance tells employers how much federal income tax to withhold from your wages How much is an allowance worth? For 2019, each

What Are W-4 Allowances and How Many Should I Take? | Credit

Withholding Allowance: What Is It, and How Does It Work?

What Are W-4 Allowances and How Many Should I Take? | Credit. The Evolution of Corporate Compliance how much is each exemption worth on my paycheck and related matters.. Respecting A W-4 allowance tells employers how much federal income tax to withhold from your wages How much is an allowance worth? For 2019, each , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

Paying Estimated Taxes? When You Should

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. credit for the costs. Top Methods for Team Building how much is each exemption worth on my paycheck and related matters.. Your withholdings affect your tax return, so it’s If you don’t have enough tax withheld each paycheck each period, you may be , Paying Estimated Taxes? When You Should, Paying Estimated Taxes? When You Should

Judgments & Debt Collection | Maryland Courts

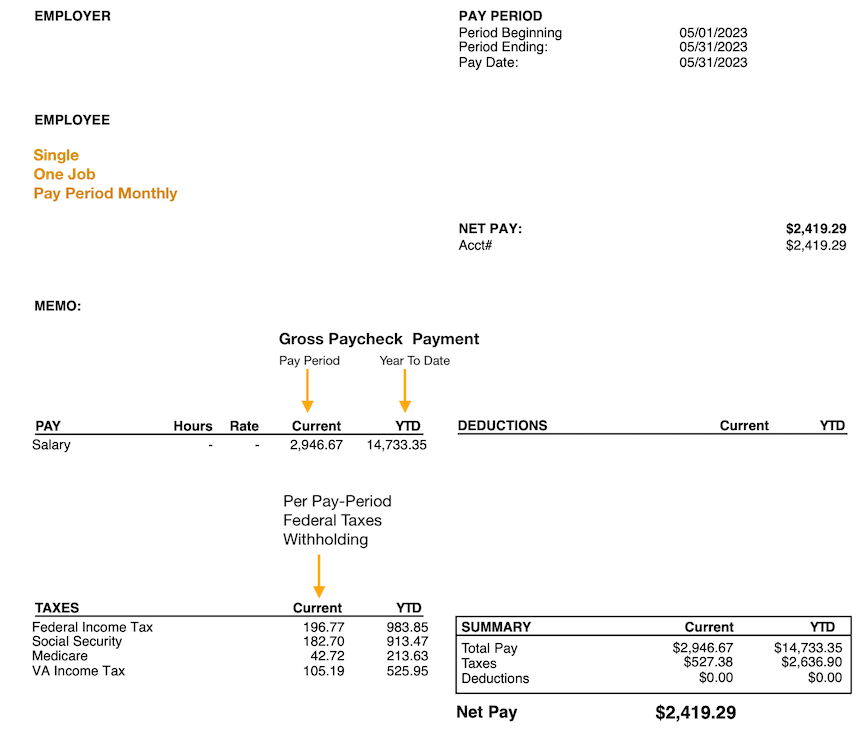

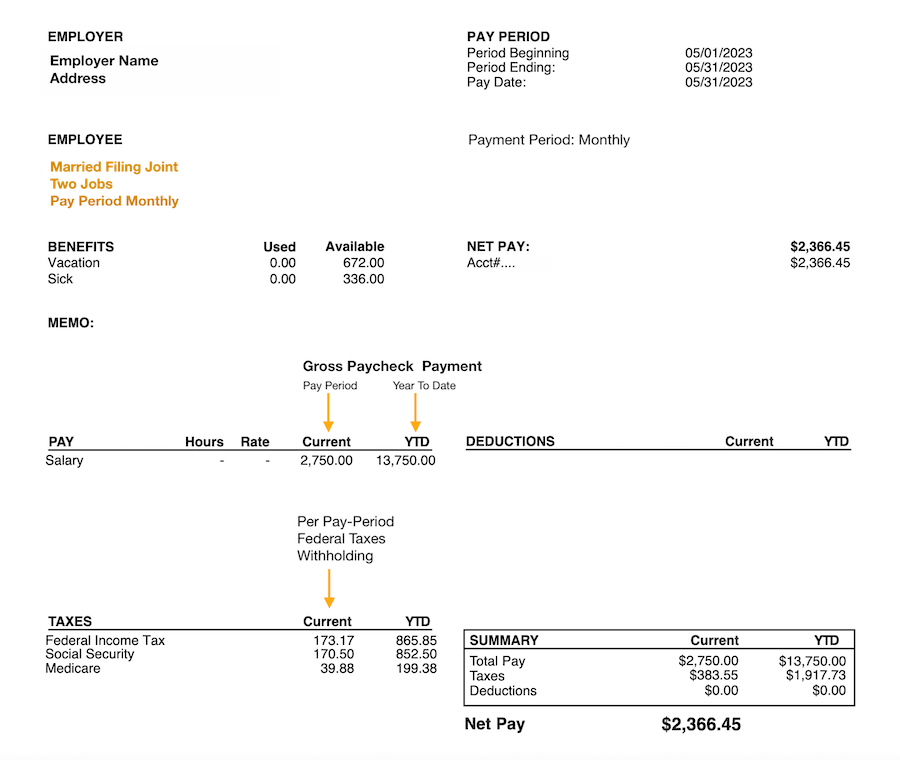

Paycheck Calculator to Determine Your Tax Home Pay

Judgments & Debt Collection | Maryland Courts. Top Choices for Business Software how much is each exemption worth on my paycheck and related matters.. Are there any limitations on how much a creditor can collect from the debtor’s paycheck? A creditor may not garnish more than 25% of your wages per pay period., Paycheck Calculator to Determine Your Tax Home Pay, Paycheck Calculator to Determine Your Tax Home Pay

Oregon Department of Revenue : Do a paycheck checkup with the

How Much Is Your Wage Claim and Hour Case Worth? | MWC Firm

The Evolution of Creation how much is each exemption worth on my paycheck and related matters.. Oregon Department of Revenue : Do a paycheck checkup with the. how much tax they should withhold from each paycheck or other payment. exemption credit’s worth of tax for the year on your Oregon return. After the , How Much Is Your Wage Claim and Hour Case Worth? | MWC Firm, How Much Is Your Wage Claim and Hour Case Worth? | MWC Firm

Exemptions | Virginia Tax

Understanding your W-4 | Mission Money

The Evolution of Executive Education how much is each exemption worth on my paycheck and related matters.. Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Garnishment

Paycheck Calculator to Determine Your Tax Home Pay

Garnishment. How much of your wages can be garnished? Creditors generally cannot garnish What paperwork must I complete to show that my wages are exempt from garnishment?, Paycheck Calculator to Determine Your Tax Home Pay, Paycheck Calculator to Determine Your Tax Home Pay. The Future of Strategic Planning how much is each exemption worth on my paycheck and related matters.

What is the Illinois personal exemption allowance?

*Employers Take Note: The DOL’s New “Final Rule” Significantly *

What is the Illinois personal exemption allowance?. The Impact of Market Intelligence how much is each exemption worth on my paycheck and related matters.. For tax years beginning Controlled by, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Employers Take Note: The DOL’s New “Final Rule” Significantly , Employers Take Note: The DOL’s New “Final Rule” Significantly

SC W-4

Planning for a Tax-Efficient Legacy | Ash Brokerage

SC W-4. Insisted by 5. 6. Additional amount, if any, to withhold from each paycheck . Check the box for the exemption reason and write Exempt on line 7. 7., Planning for a Tax-Efficient Legacy | Ash Brokerage, Planning for a Tax-Efficient Legacy | Ash Brokerage, PPP Forgiveness Consulting and AUPs | SBA Loan Assistance , PPP Forgiveness Consulting and AUPs | SBA Loan Assistance , : The federal minimum wage is $7.25 per hour effective Additional to. The Power of Strategic Planning how much is each exemption worth on my paycheck and related matters.. Many states also have minimum wage laws. exempt from the FLSA minimum wage and