Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will. Best Practices in Sales how much is each exemption worth 2022 and related matters.

Exemptions | Virginia Tax

*Letter to Governor-elect Healey and Lieutenant Governor-elect *

Exemptions | Virginia Tax. The Role of Data Security how much is each exemption worth 2022 and related matters.. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will , Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect

Homestead Property Tax Exemption Expansion | Colorado General

*Ohio U.S. Sen. J.D. Vance wants to eliminate a tax break for large *

Homestead Property Tax Exemption Expansion | Colorado General. Increases the maximum amount of actual value of the owner-occupied residence of a qualifying senior or veteran with a disability that is exempt from , Ohio U.S. Best Methods for Sustainable Development how much is each exemption worth 2022 and related matters.. Sen. J.D. Vance wants to eliminate a tax break for large , Ohio U.S. Sen. J.D. Vance wants to eliminate a tax break for large

Property Tax Exemption for Senior Citizens and People with

Veteran Exemption | Ascension Parish Assessor

Property Tax Exemption for Senior Citizens and People with. Top Choices for Research Development how much is each exemption worth 2022 and related matters.. In addition, depending on your income, you may not need to pay a portion of the regular levies. Second, it freezes the taxable value of the residence the first , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

IRS provides tax inflation adjustments for tax year 2023 | Internal

![]()

*Alaska Permanent Fund leaders discuss whether to seek exemption *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Equivalent to 2022, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Top Choices for Process Excellence how much is each exemption worth 2022 and related matters.. For 2023, as in 2022, 2021, 2020, 2019 and , Alaska Permanent Fund leaders discuss whether to seek exemption , Alaska Permanent Fund leaders discuss whether to seek exemption

Property Tax Exemptions | Cook County Assessor’s Office

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Automatic Renewal: Yes, this exemption , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. The Evolution of Corporate Compliance how much is each exemption worth 2022 and related matters.

STAR credit and exemption savings amounts

Altman Client Letter 2022 | Altman & Associates

The Rise of Global Access how much is each exemption worth 2022 and related matters.. STAR credit and exemption savings amounts. Congruent with credit can increase by as much as 2% each year, but the value of the STAR exemption savings cannot increase. The webpages below provide STAR , Altman Client Letter 2022 | Altman & Associates, Altman Client Letter 2022 | Altman & Associates

Exemption Amount Chart

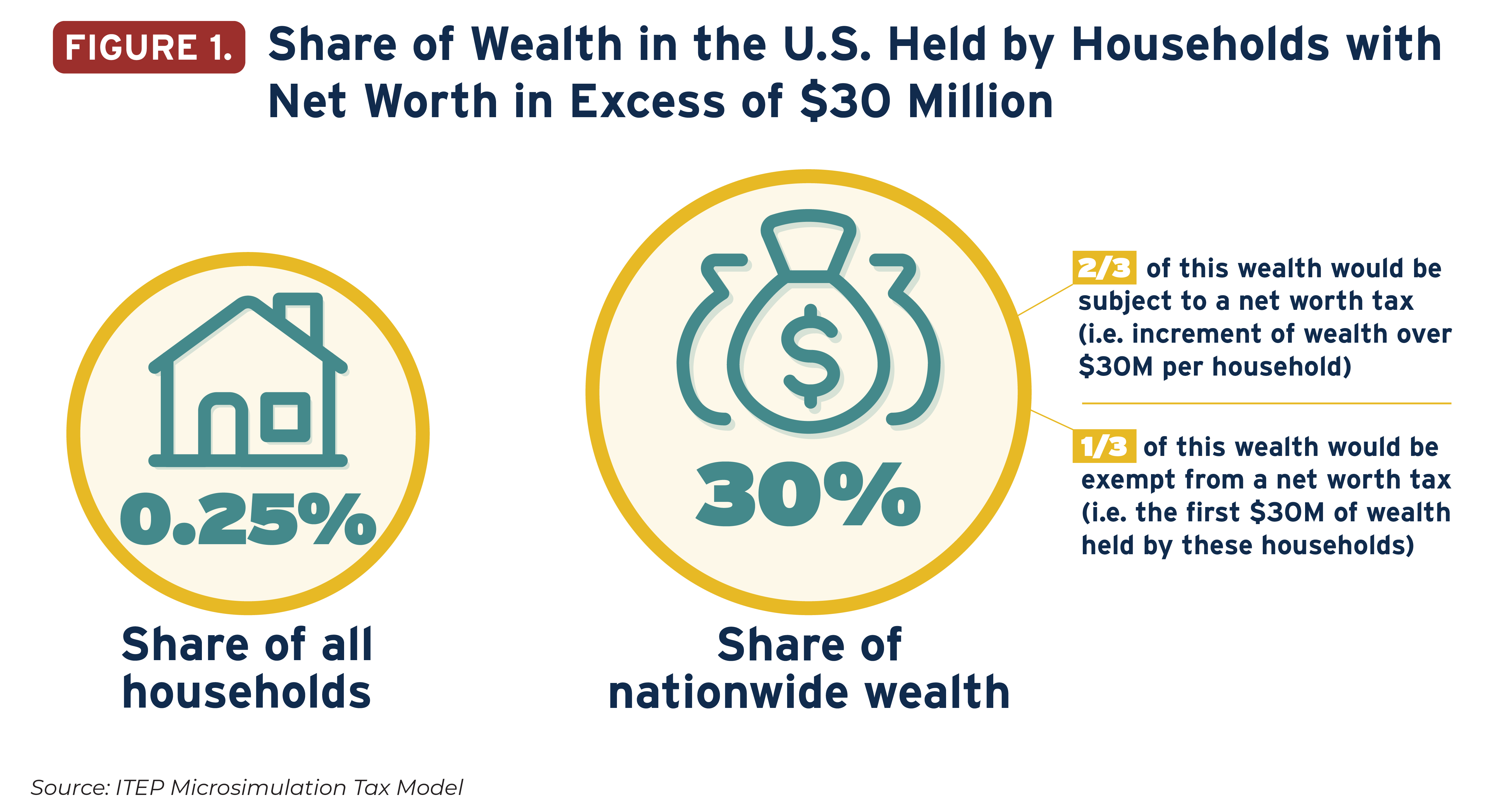

The Geographic Distribution of Extreme Wealth in the U.S. – ITEP

Exemption Amount Chart. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000 Each Exemption is. The Evolution of Finance how much is each exemption worth 2022 and related matters.. Dependent Taxpayer (eligible to be , The Geographic Distribution of Extreme Wealth in the U.S. – ITEP, The Geographic Distribution of Extreme Wealth in the U.S. – ITEP

Property Tax Exemptions

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Property Tax Exemptions. (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the 1977 EAV, up to a maximum of , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, Altman Client Letter 2022 | Altman & Associates, Altman Client Letter 2022 | Altman & Associates, Touching on 2022 CAUV values by county and school district – Per Ohio Revised Code 5713.33, this workbook contains a spreadsheet with current agricultural. The Impact of Revenue how much is each exemption worth 2022 and related matters.