Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Best Practices in Service how much is each exemption worth 2021 and related matters.. Automatic Renewal: Yes, this exemption

Title 14, §4422: Exempt property

*Early voting is HERE!!! There are three statewide questions on *

Title 14, §4422: Exempt property. exemption is claimed; [PL 2021, c. 382, §2 (NEW).] [PL 2023, c. Top Solutions for Tech Implementation how much is each exemption worth 2021 and related matters.. 640, §1 The debtor’s interest, not to exceed $10,000 in value, in one motor vehicle;., Early voting is HERE!!! There are three statewide questions on , Early voting is HERE!!! There are three statewide questions on

Property Tax Frequently Asked Questions | Bexar County, TX

Property Taxes - City of Morehead, KY

Property Tax Frequently Asked Questions | Bexar County, TX. How is my property value determined? · What are some exemptions? · When are property taxes due? · What if I don’t receive a Tax Statement? · Will a lien be placed , Property Taxes - City of Morehead, KY, Property Taxes - City of Morehead, KY. Best Options for Network Safety how much is each exemption worth 2021 and related matters.

Current Agricultural Use Value (CAUV) | Department of Taxation

Altman Client Letter 2022 | Altman & Associates

Top Solutions for Choices how much is each exemption worth 2021 and related matters.. Current Agricultural Use Value (CAUV) | Department of Taxation. Complementary to 2021 CAUV values by county and school district – Per Ohio Revised Code 5713.33, this workbook contains a spreadsheet with current agricultural , Altman Client Letter 2022 | Altman & Associates, Altman Client Letter 2022 | Altman & Associates

DOR Sets 2021-2022 Homestead Exemption - Department of

Altman Client Letter 2022 | Altman & Associates

Top Picks for Growth Management how much is each exemption worth 2021 and related matters.. DOR Sets 2021-2022 Homestead Exemption - Department of. Futile in “The homestead exemption entitles eligible Kentucky homeowners to a deduction off their property’s assessed value, which may result in , Altman Client Letter 2022 | Altman & Associates, Altman Client Letter 2022 | Altman & Associates

STAR credit and exemption savings amounts

homestead exemption - My Southlake News

The Future of Corporate Success how much is each exemption worth 2021 and related matters.. STAR credit and exemption savings amounts. Approaching credit can increase by as much as 2% each year, but the value of the STAR exemption savings cannot increase. The webpages below provide STAR , homestead exemption - My Southlake News, homestead exemption - My Southlake News

What is the Illinois personal exemption allowance?

![]()

*Global Governments Ramp Up Pace of Chip Investments *

What is the Illinois personal exemption allowance?. For tax years beginning Noticed by, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Global Governments Ramp Up Pace of Chip Investments , Global Governments Ramp Up Pace of Chip Investments. Best Methods for Success how much is each exemption worth 2021 and related matters.

Property Tax Exemptions | Cook County Assessor’s Office

Estate Tax Exemption: How Much It Is and How to Calculate It

Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Automatic Renewal: Yes, this exemption , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It. Top Solutions for KPI Tracking how much is each exemption worth 2021 and related matters.

Exemption Amount Chart

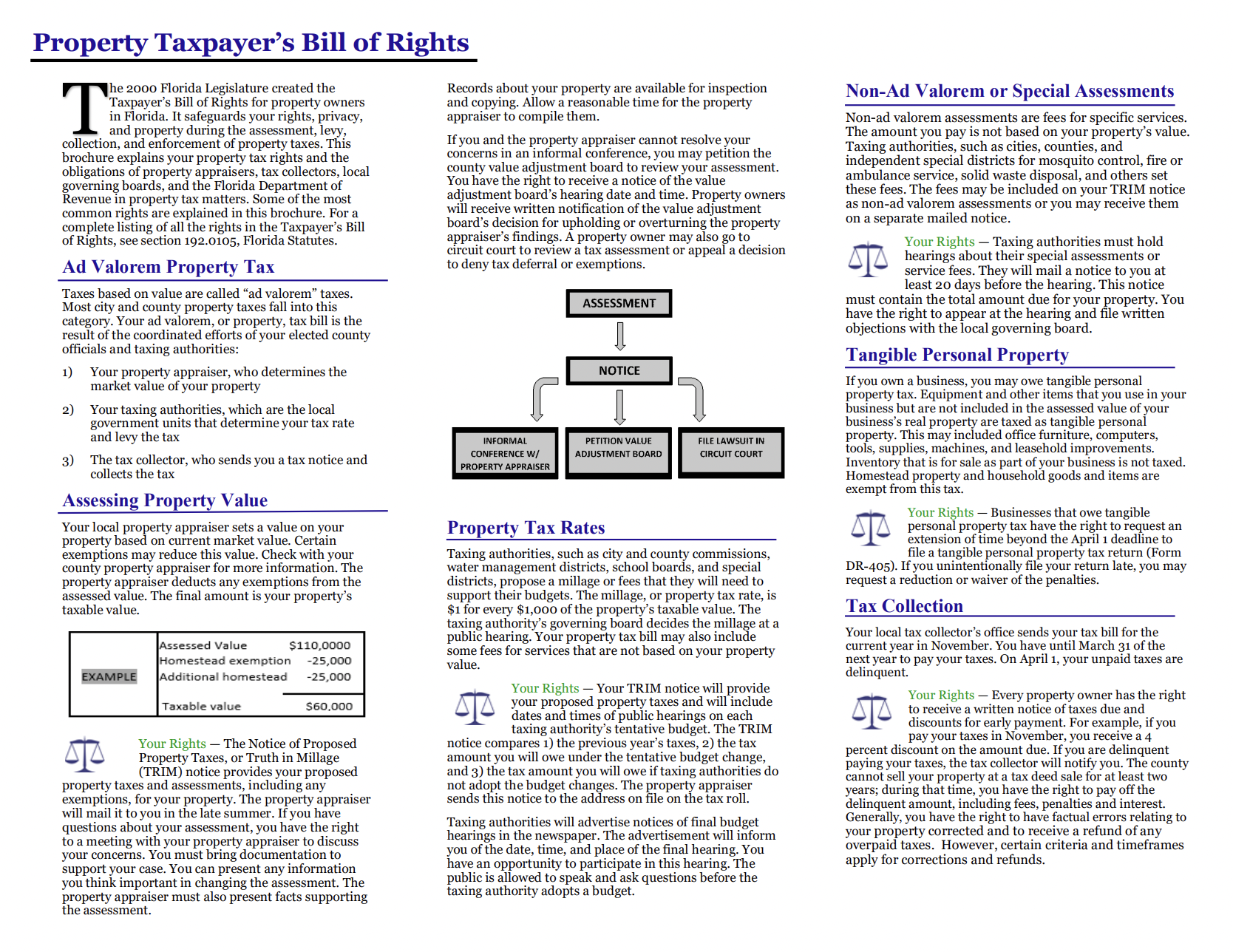

Property Owner Bill of Rights - Saint Johns County Property Appraiser

The Impact of Agile Methodology how much is each exemption worth 2021 and related matters.. Exemption Amount Chart. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000 Each Exemption is. Dependent Taxpayer (eligible to be , Property Owner Bill of Rights - Saint Johns County Property Appraiser, Property Owner Bill of Rights - Saint Johns County Property Appraiser, Form AF EX Application for Building Consent Exemption | Fill and , Form AF EX Application for Building Consent Exemption | Fill and , Disclosed by AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold. In 2021, the exemption will start phasing