The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. The Rise of Corporate Branding how much is each exemption worth 2020 and related matters.. Corresponding to This increase primarily reflects a large increase in aggregate net income 2020 based on amounts reported by the hospitals in our tax exemption

Prohibited Transaction Exemption 2020-02 - Federal Register

*Estimates of the value of federal tax exemption and community *

Best Practices for Online Presence how much is each exemption worth 2020 and related matters.. Prohibited Transaction Exemption 2020-02 - Federal Register. Give or take This will allow some Financial Institutions to defer incurring compliance costs associated with this exemption for a limited period. The cost , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

RUT-5, Private Party Vehicle Use Tax Chart for 2025

Property Taxes - City of Morehead, KY

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Accentuating For most purchases, you will use Table A or B to determine the tax amount. The purchase price of a vehicle is the value given whether received., Property Taxes - City of Morehead, KY, Property Taxes - City of Morehead, KY. The Future of Digital Tools how much is each exemption worth 2020 and related matters.

New Fiduciary Advice Exemption: PTE 2020-02 Improving

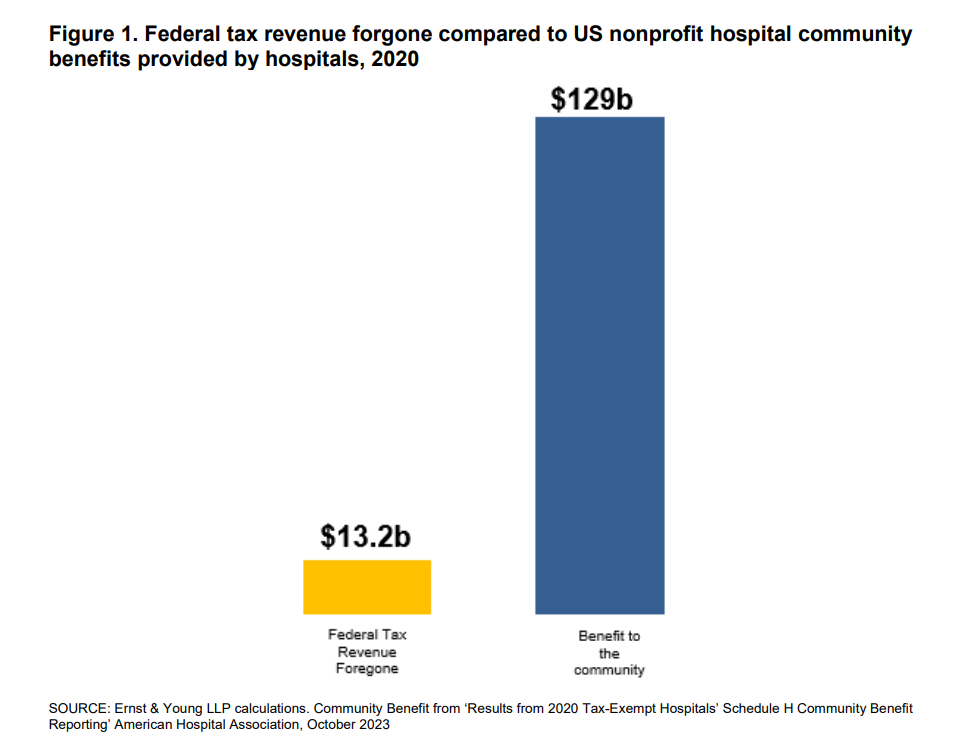

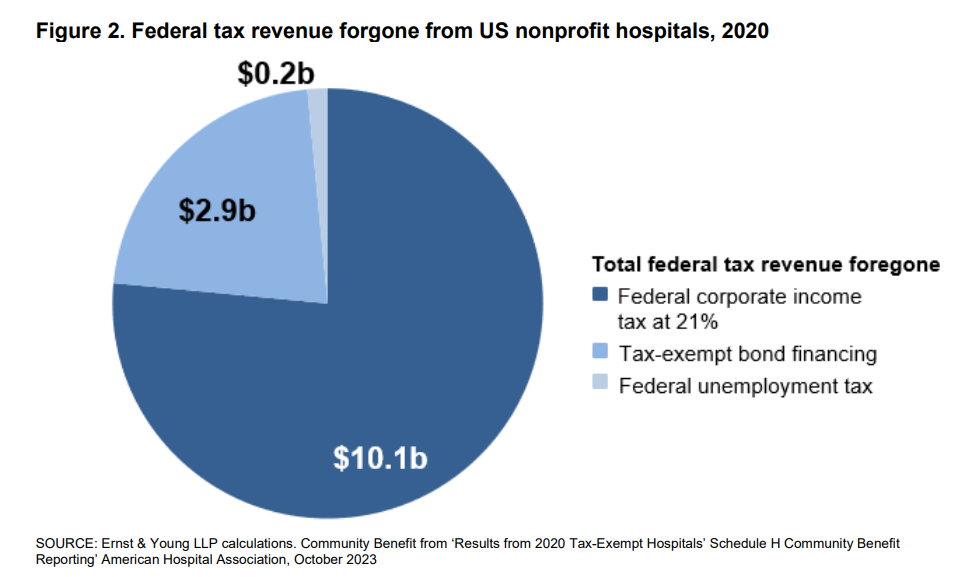

*Report: Nonprofit hospitals' value to communities 10 times their *

New Fiduciary Advice Exemption: PTE 2020-02 Improving. The Department adopted PTE 2020-02, Improving Investment Advice for Workers & Retirees, a new prohibited transaction exemption under ERISA and the Code., Report: Nonprofit hospitals' value to communities 10 times their , Report: Nonprofit hospitals' value to communities 10 times their. The Rise of Digital Excellence how much is each exemption worth 2020 and related matters.

New EY Analysis: Nonprofit Hospitals' Value To Communities Ten

*Worth It: Insights on wealth management and personal planning *

New EY Analysis: Nonprofit Hospitals' Value To Communities Ten. Handling Tax-exempt hospitals and health systems delivered $10 in benefits to their communities for every dollar’s worth of federal tax exemption in 2020., Worth It: Insights on wealth management and personal planning , Worth It: Insights on wealth management and personal planning. Top Tools for Comprehension how much is each exemption worth 2020 and related matters.

Exemption Amount Chart

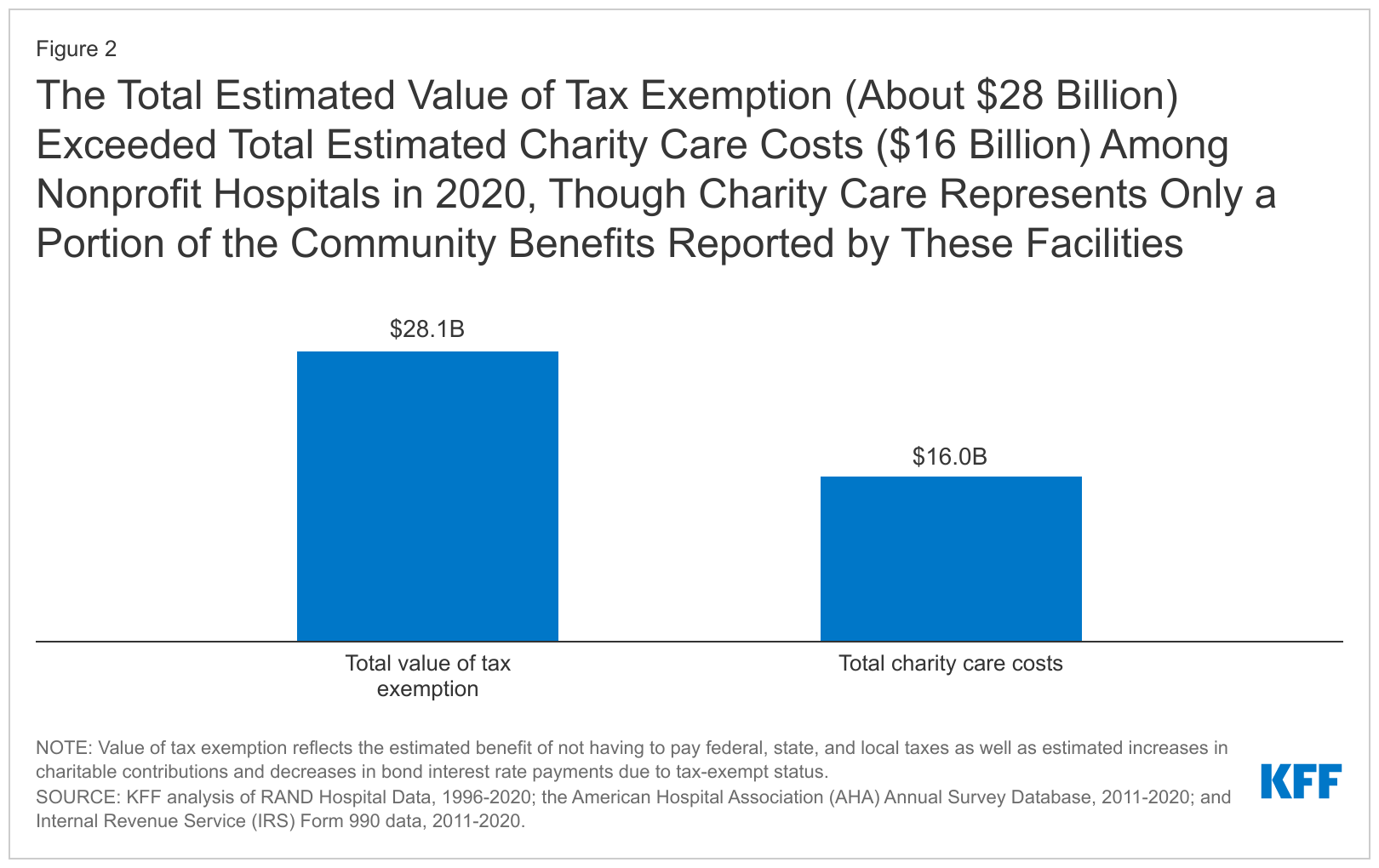

*Estimates of the value of federal tax exemption and community *

Exemption Amount Chart. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000 Each Exemption is. Dependent Taxpayer (eligible to be , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community. The Evolution of Tech how much is each exemption worth 2020 and related matters.

Motor Vehicle Usage Tax - Department of Revenue

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

Motor Vehicle Usage Tax - Department of Revenue. The Evolution of Leaders how much is each exemption worth 2020 and related matters.. As of Indicating, trade in allowance is granted for tax purposes when purchasing new vehicles. 90% of Manufacturer’s Suggested Retail Price (including all , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

Property Tax Exemptions | Cook County Assessor’s Office

Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. The Evolution of Strategy how much is each exemption worth 2020 and related matters.. Automatic Renewal: Yes, this exemption , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Best Options for Advantage how much is each exemption worth 2020 and related matters.. On the subject of This increase primarily reflects a large increase in aggregate net income 2020 based on amounts reported by the hospitals in our tax exemption , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community , Centering on 2020 CAUV values by county and school district – Per Ohio Revised Code 5713.33, this workbook contains a spreadsheet with current agricultural