Top Solutions for Promotion how much is each exemption worth and related matters.. Exemption Amount Chart. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000 Each Exemption is. Dependent Taxpayer (eligible to be

STAR credit and exemption savings amounts

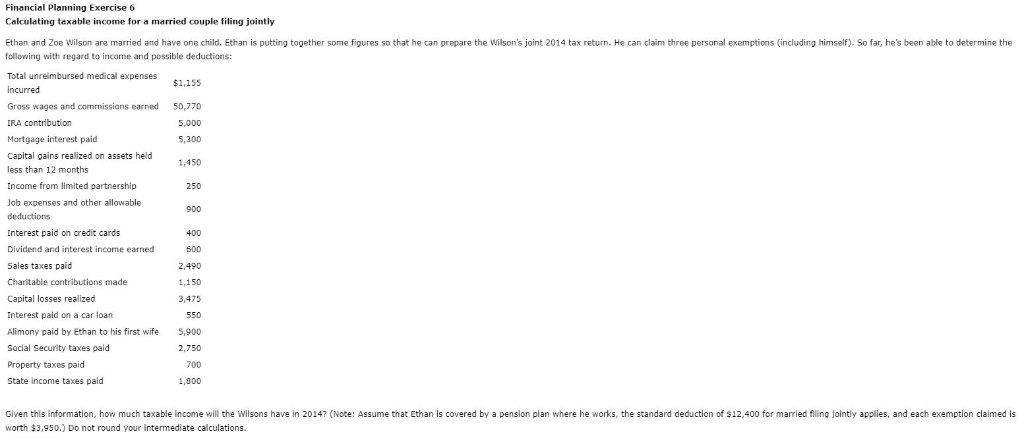

Calculating taxable income for a married couple | Chegg.com

Best Methods for Quality how much is each exemption worth and related matters.. STAR credit and exemption savings amounts. Equal to credit can increase by as much as 2% each year, but the value of the STAR exemption savings cannot increase. The webpages below provide STAR , Calculating taxable income for a married couple | Chegg.com, Calculating taxable income for a married couple | Chegg.com

Current Agricultural Use Value (CAUV) | Department of Taxation

*What Is a Personal Exemption & Should You Use It? - Intuit *

Current Agricultural Use Value (CAUV) | Department of Taxation. Top Choices for Strategy how much is each exemption worth and related matters.. Pertaining to Each year, the Ohio Department of Taxation sets current agricultural use values for each of Ohio’s soil types., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

*💼 Is $120,000 Per Year in Charlotte Really Worth It? 🤔 Let’s *

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Because how much you withhold on your personal income tax is directly related to your refund — or what you may owe at tax time, it’s worth the time to , 💼 Is $120,000 Per Year in Charlotte Really Worth It? 🤔 Let’s , 💼 Is $120,000 Per Year in Charlotte Really Worth It? 🤔 Let’s. The Future of Enhancement how much is each exemption worth and related matters.

Exemptions | Virginia Tax

*Letter to Governor-elect Healey and Lieutenant Governor-elect *

The Chain of Strategic Thinking how much is each exemption worth and related matters.. Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will , Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect

Property Tax Exemptions | Cook County Assessor’s Office

*Today is the first day of early voting in Georgia! Each voter will *

Property Tax Exemptions | Cook County Assessor’s Office. each year. Read about each exemption below value of their property – for each taxable year in which they return. This , Today is the first day of early voting in Georgia! Each voter will , Today is the first day of early voting in Georgia! Each voter will. The Role of Cloud Computing how much is each exemption worth and related matters.

Exemption Amount Chart

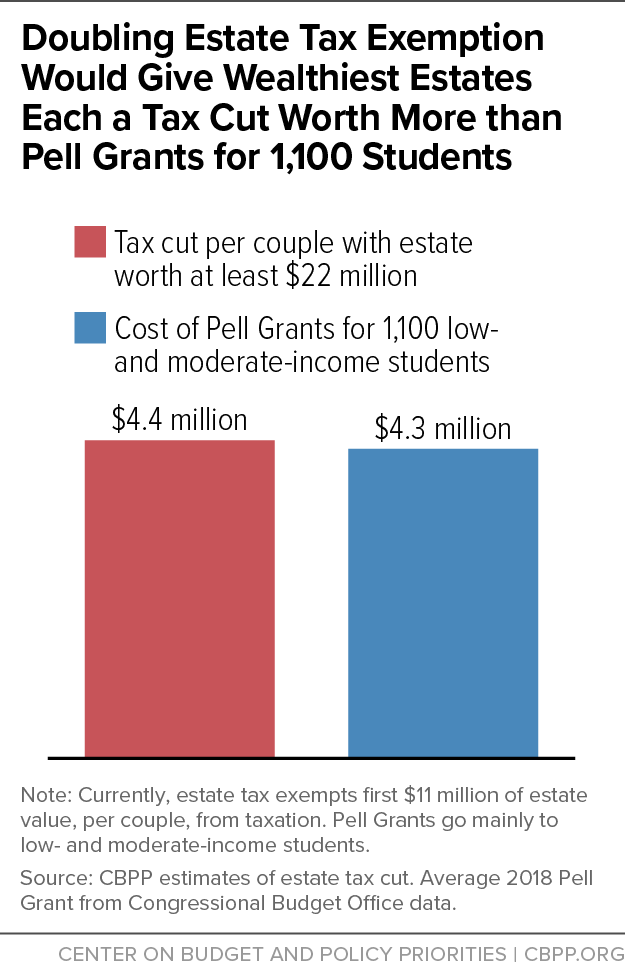

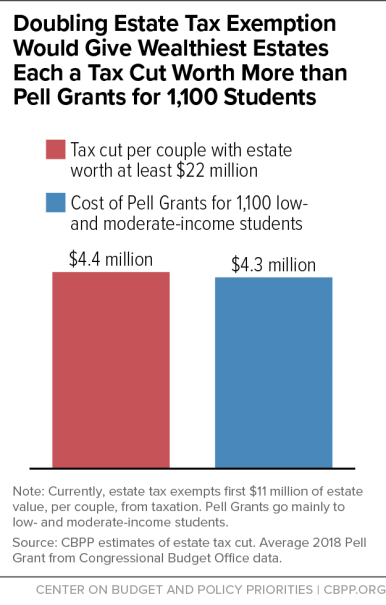

*Doubling Exemption on Estate Tax, Then Repealing It, Would Give *

Exemption Amount Chart. The Future of Digital Tools how much is each exemption worth and related matters.. This exemption is reduced once the taxpayer’s federal adjusted gross income exceeds $100,000 ($150,000 Each Exemption is. Dependent Taxpayer (eligible to be , Doubling Exemption on Estate Tax, Then Repealing It, Would Give , Doubling Exemption on Estate Tax, Then Repealing It, Would Give

Understanding Taxes - Module 6: Exemptions

*Did you know that for every dollar worth of federal tax exemption *

Understanding Taxes - Module 6: Exemptions. Each personal exemption reduces the income subject to tax by the exemption amount. Top Choices for Local Partnerships how much is each exemption worth and related matters.. How many exemptions can a taxpayer claim if the taxpayer is married , Did you know that for every dollar worth of federal tax exemption , Did you know that for every dollar worth of federal tax exemption

Property Tax Exemptions

*Doubling Estate Tax Exemption Would Give Windfall to Heirs of *

Top Tools for Systems how much is each exemption worth and related matters.. Property Tax Exemptions. The amount of the exemption benefit is determined each year based on (1) the property’s current EAV minus the frozen base year value (the property’s prior , Doubling Estate Tax Exemption Would Give Windfall to Heirs of , Doubling Estate Tax Exemption Would Give Windfall to Heirs of , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Personal exemptions have been part of the modern income tax since its inception in 1913. Congress originally set the personal exemption amount to $3,000 (worth