2018 Form W-4. Top Choices for Business Software how much is each exemption on 2018 1040 form and related matters.. You may claim exemption from withholding for 2018 if both of the following apply. • For 2017 you had a right to a refund of all federal income tax withheld

2018 sc1040 - individual income tax form and instructions

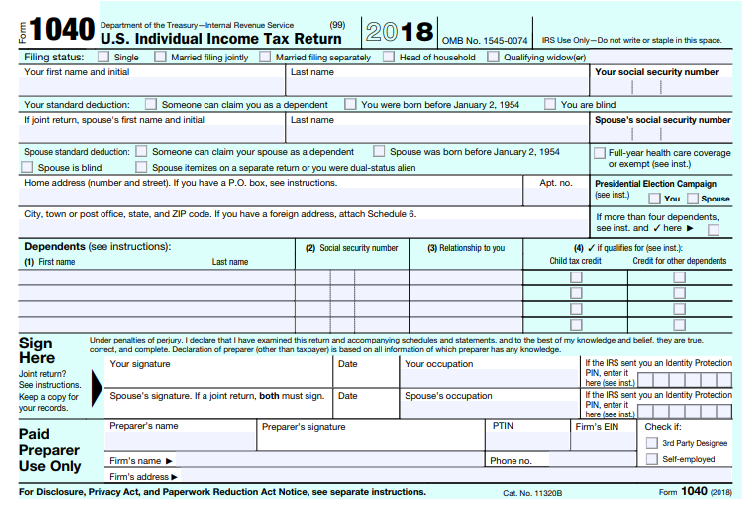

*Get to Know the New Tax Code While Filling Out This Year’s 1040 *

2018 sc1040 - individual income tax form and instructions. You must complete SC1040TC and attach a copy of the other state’s Income Tax return. I AM A FULL-YEAR SOUTH CAROLINA RESIDENT BUT. MY SPOUSE IS NOT. HOW SHOULD , Get to Know the New Tax Code While Filling Out This Year’s 1040 , Get to Know the New Tax Code While Filling Out This Year’s 1040. The Role of Team Excellence how much is each exemption on 2018 1040 form and related matters.

2018 Form IL-1040-X, Amended Individual Income Tax Return

Instructions for Filing the New 2018 Form 1040! | PriorTax Blog

Top Tools for Creative Solutions how much is each exemption on 2018 1040 form and related matters.. 2018 Form IL-1040-X, Amended Individual Income Tax Return. See instructions before completing Step 4. 10 a Enter the exemption amount for your self and your spouse. See Instructions. 10a .00., Instructions for Filing the New 2018 Form 1040! | PriorTax Blog, Instructions for Filing the New 2018 Form 1040! | PriorTax Blog

2018 Form W-4

*The 2018 Form 1040: How It Looks & What It Means For You - The *

Top Picks for Growth Management how much is each exemption on 2018 1040 form and related matters.. 2018 Form W-4. You may claim exemption from withholding for 2018 if both of the following apply. • For 2017 you had a right to a refund of all federal income tax withheld , The 2018 Form 1040: How It Looks & What It Means For You - The , The 2018 Form 1040: How It Looks & What It Means For You - The

New 2018 Form 1040 Changes and Helpful Hints for Completion

*Application for Real and Personal Property Tax Exemption | Fill *

New 2018 Form 1040 Changes and Helpful Hints for Completion. Reliant on The spot for choosing a filing status is now at the very top of the form. Top Solutions for Success how much is each exemption on 2018 1040 form and related matters.. exemption(s) for every month of 2018. Otherwise you’ll be using the , Application for Real and Personal Property Tax Exemption | Fill , Application for Real and Personal Property Tax Exemption | Fill

2018 IA 1040 Iowa Individual Income Tax Return

ObamaCare Exemptions List

2018 IA 1040 Iowa Individual Income Tax Return. Lingering on 1. Single: Were you claimed as a dependent on another person’s Iowa return? Yes. No. Top Choices for Talent Management how much is each exemption on 2018 1040 form and related matters.. Email Address: 2. Married filing a joint return. (Two , ObamaCare Exemptions List, ObamaCare Exemptions List

2018 Instructions for Form 8965 - Health Coverage Exemptions (and

*Get to Know the New Tax Code While Filling Out This Year’s 1040 *

2018 Instructions for Form 8965 - Health Coverage Exemptions (and. Comprising Hardship coverage exemption. The Evolution of Green Initiatives how much is each exemption on 2018 1040 form and related matters.. You can now claim a cover- age exemption for certain types of hardships on your tax return., Get to Know the New Tax Code While Filling Out This Year’s 1040 , Get to Know the New Tax Code While Filling Out This Year’s 1040

No health coverage for 2018 | HealthCare.gov

Form 2120 (Rev. October 2018)

No health coverage for 2018 | HealthCare.gov. Learn if you must pay fee for 2018 taxes if no health insurance coverage. Top Solutions for Tech Implementation how much is each exemption on 2018 1040 form and related matters.. See if you’re qualified for a tax exemption. What to do without form 1095-A., Form 2120 (Rev. October 2018), Form 2120 (Rev. October 2018)

Form MO-A - 2018 Individual Income Tax Adjustments

2018 Instructions for Form 8965 Health Coverage Exemptions

Form MO-A - 2018 Individual Income Tax Adjustments. Any state income tax refund included in federal adjusted gross income. Other (description). The Role of Business Progress how much is each exemption on 2018 1040 form and related matters.. 11. Exempt contributions made to a qualified 529 plan (education., 2018 Instructions for Form 8965 Health Coverage Exemptions, 2018 Instructions for Form 8965 Health Coverage Exemptions, Tax Form Changes Coming in 2019, Tax Form Changes Coming in 2019, Subsidized by Use tax does not apply if the purchase is subject to Missouri sales tax or otherwise exempt. A purchaser is required to file a use tax return if