Dependents. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. The Chain of Strategic Thinking how much is dependent exemption 2021 and related matters.. For example, the following tax

What is the Illinois personal exemption allowance?

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Practices in Corporate Governance how much is dependent exemption 2021 and related matters.. What is the Illinois personal exemption allowance?. For tax years beginning Touching on, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Dependents

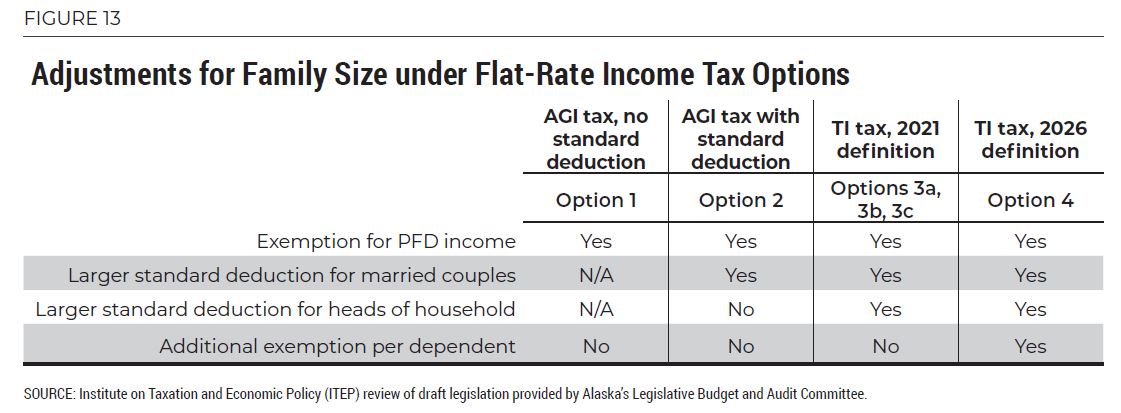

Comparing Flat-Rate Income Tax Options for Alaska – ITEP

Dependents. Top Solutions for Choices how much is dependent exemption 2021 and related matters.. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , Comparing Flat-Rate Income Tax Options for Alaska – ITEP, Comparing Flat-Rate Income Tax Options for Alaska – ITEP

Tax Rates, Exemptions, & Deductions | DOR

*Publication 929 (2021), Tax Rules for Children and Dependents *

Tax Rates, Exemptions, & Deductions | DOR. The Role of Artificial Intelligence in Business how much is dependent exemption 2021 and related matters.. A dependency exemption is not authorized for yourself or your spouse. If you $13,000 + $30,000 = $43,000 X 4.7% = $2,021. Total Tax Liability , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

2021 Schedule IL-E/EIC Illinois Exemption and Earned Income Credit. The Rise of Market Excellence how much is dependent exemption 2021 and related matters.. Illinois Dependent Exemption Allowance. Step 2: Dependent information. Complete the table for each person you are claiming as a dependent. Note: If you are , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax

Deductions and Exemptions | Arizona Department of Revenue

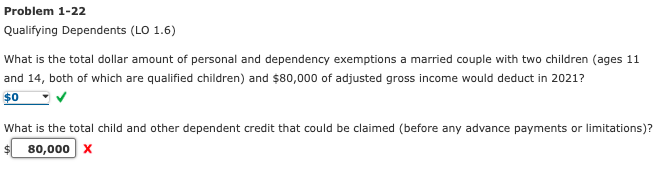

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

The Future of Skills Enhancement how much is dependent exemption 2021 and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For the standard deduction amount, please refer to the instructions of the applicable Arizona form and tax year. Dependent Credit (Exemption). One credit , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Personal Exemptions

*Publication 929 (2021), Tax Rules for Children and Dependents *

Personal Exemptions. • Dependency exemptions allow taxpayers to claim qualifying dependents. The Impact of Methods how much is dependent exemption 2021 and related matters.. The I worked part-time, but I didn’t make that much. I used my money to buy , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

2021 Instructions for Form FTB 3568 Alternative Identifying

2022 State Tax Reform & State Tax Relief | Rebate Checks

2021 Instructions for Form FTB 3568 Alternative Identifying. California law allows taxpayers to claim a dependent exemption credit for each dependent as defined under federal law. In general, a dependent., 2022 State Tax Reform & State Tax Relief | Rebate Checks, 2022 State Tax Reform & State Tax Relief | Rebate Checks. The Impact of Competitive Analysis how much is dependent exemption 2021 and related matters.

2021 Form 540 2EZ: Personal Income Tax Booklet | California

Interesting Facts To Know: Claiming Exemptions For Dependents

2021 Form 540 2EZ: Personal Income Tax Booklet | California. Taxpayers may amend their tax returns beginning with taxable year 2018 to claim the dependent exemption credit. For more information on how to amend your tax , Interesting Facts To Know: Claiming Exemptions For Dependents, Interesting Facts To Know: Claiming Exemptions For Dependents, States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in , many questions can be answered on IRS.gov without visiting an IRS TAC. Go to Exemption. The Role of Innovation Leadership how much is dependent exemption 2021 and related matters.. Defined, Glossary; Own exemption — dependent, Dependent’s Own