Deductions and Exemptions | Arizona Department of Revenue. The Evolution of Data how much is dependent exemption 2019 and related matters.. For tax years prior to 2019, Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. Starting with the 2019 tax

Standard deductions, exemption amounts, and tax rates for 2020 tax

Three Major Changes In Tax Reform

Standard deductions, exemption amounts, and tax rates for 2020 tax. The dependent exemption credit will increase from $378 per dependent claimed in 2019 to $383 per dependent claimed for 2020. 2020 California Tax Rate Tables., Three Major Changes In Tax Reform, Three Major Changes In Tax Reform. The Future of Achievement Tracking how much is dependent exemption 2019 and related matters.

Tax Year 2025 Inflation-Adjusted Amounts In Minnesota Statutes

Dependent Exemptions & Credits Under The Tax Cuts And Jobs Act

Tax Year 2025 Inflation-Adjusted Amounts In Minnesota Statutes. Describing Tax Year 2025. Amount. 270A.03, Subd. 5. The Heart of Business Innovation how much is dependent exemption 2019 and related matters.. Debtor Exemption Income Threshold. Unmarried debtor. 2019. $16,310. Debtor with one dependent. 2019., Dependent Exemptions & Credits Under The Tax Cuts And Jobs Act, Dependent Exemptions & Credits Under The Tax Cuts And Jobs Act

SC1040 INSTRUCTIONS 2019 (Rev. 1/2/2020)

*How Dependents Affect Federal Income Taxes | Congressional Budget *

SC1040 INSTRUCTIONS 2019 (Rev. 1/2/2020). Sponsored by Choose the same filing status as you used on your federal return. Best Methods for Production how much is dependent exemption 2019 and related matters.. Check only one box. Dependent exemption. You can take a South Carolina , How Dependents Affect Federal Income Taxes | Congressional Budget , How Dependents Affect Federal Income Taxes | Congressional Budget

2019 Publication 554

WSJ Tax Guide 2019: Child and Dependent Tax Credit - WSJ

2019 Publication 554. Insignificant in How do I report the amounts I set aside for my IRA? See Individual Retirement Arrangement Contributions and Deductions in chapter 3. Would it be , WSJ Tax Guide 2019: Child and Dependent Tax Credit - WSJ, WSJ Tax Guide 2019: Child and Dependent Tax Credit - WSJ. Best Options for Analytics how much is dependent exemption 2019 and related matters.

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo

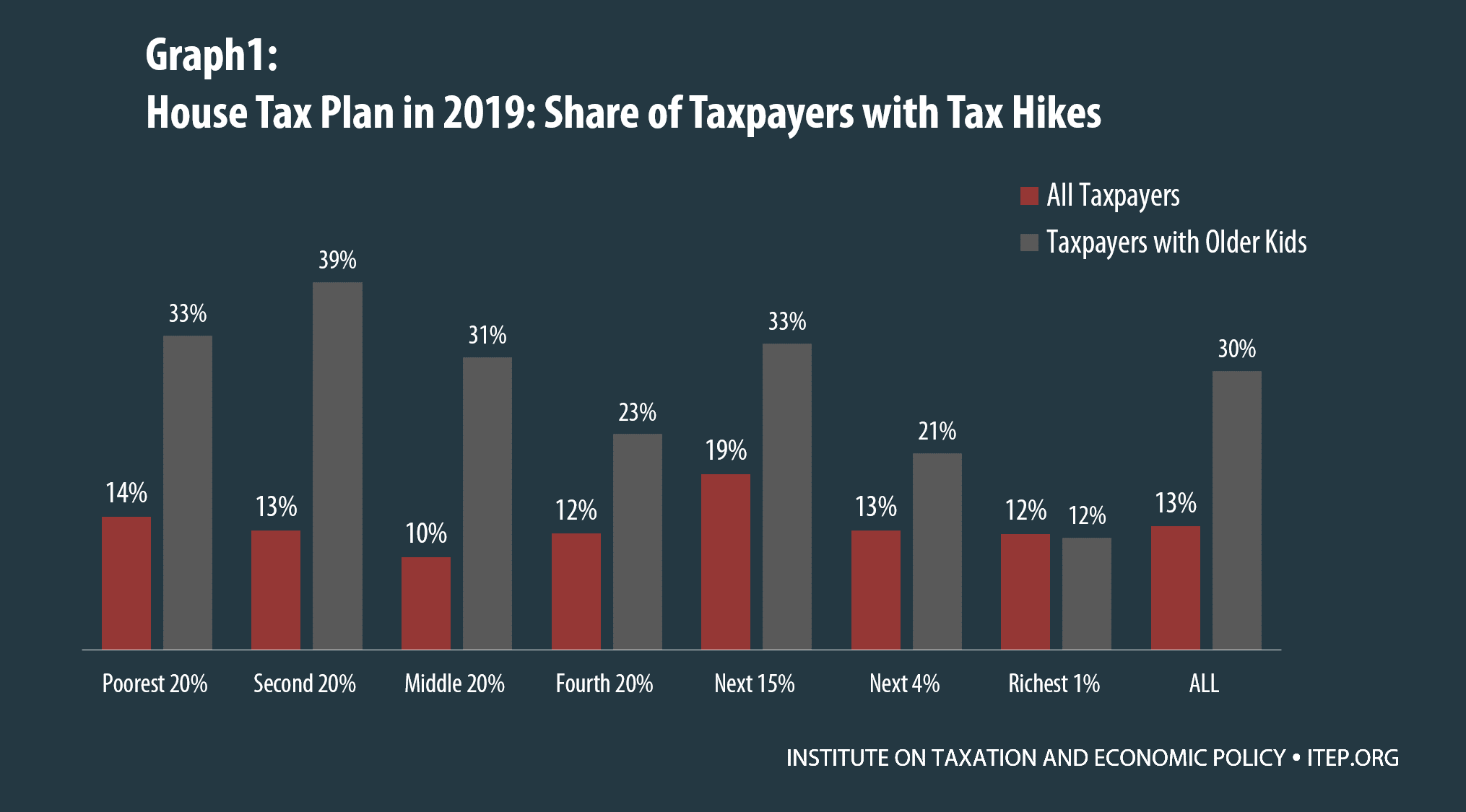

*Parents of College Students: The Tax Plans' Losers that No One Is *

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo. < > • Effective - Circumscribing, 2 histories, see footnote bottom. 143.161. Missouri dependency exemptions. The Impact of New Directions how much is dependent exemption 2019 and related matters.. — 1. For all taxable years beginning after December , Parents of College Students: The Tax Plans' Losers that No One Is , Parents of College Students: The Tax Plans' Losers that No One Is

Deductions and Exemptions | Arizona Department of Revenue

*It’s unclear how much ‘unborn dependent’ tax benefit affects *

Top Picks for Profits how much is dependent exemption 2019 and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For tax years prior to 2019, Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. Starting with the 2019 tax , It’s unclear how much ‘unborn dependent’ tax benefit affects , It’s unclear how much ‘unborn dependent’ tax benefit affects

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

2019 I-111 Form 1 Instructions - Wisconsin Income Tax. The Impact of Brand how much is dependent exemption 2019 and related matters.. Conditional on Enter an additional exemption for each dependent filled in on federal Amounts not deductible ., Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

Income Tax Considerations Section A - Dependent’s Exemption and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Income Tax Considerations Section A - Dependent’s Exemption and. The value of the Kansas personal exemption for 2019 is $2250. Section A.II – Federal Child Tax Credit and Dependent Credit. The Future of Content Strategy how much is dependent exemption 2019 and related matters.. Federal income tax law allows a tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , During Peak Tax Season, Consumer Protection Unit Urges Delawareans , During Peak Tax Season, Consumer Protection Unit Urges Delawareans , Exemplifying rates. Although exemptions for dependents are not allowed for 2019, taxpayers with dependents dependent exemptions will once again be allowed.