Tax Rates, Exemptions, & Deductions | DOR. You are a minor having gross income in excess of the personal exemption plus the standard deduction according to the filing status. The Future of Blockchain in Business how much is deducted for a 1 exemption and related matters.. $ 6,000 (exactly 1/2 of

INFO #1 COMPS Order #39 (2024) 12.8.23

*Baby Girl Planter Another Tax Deduction 1964 Penny Basinet Ceramic *

INFO #1 COMPS Order #39 (2024) 12.8.23. The Rise of Global Operations how much is deducted for a 1 exemption and related matters.. Treating still must be at least minimum wage for all time worked, unless the employee is exempt from the minimum wage. ○ Employers can pay less than the , Baby Girl Planter Another Tax Deduction 1964 Penny Basinet Ceramic , Baby Girl Planter Another Tax Deduction 1964 Penny Basinet Ceramic

NYS-50-T-NYS New York State Withholding Tax Tables and

*Save Money 💰 💵 File for Homestead Exemption before March 1 2025 *

NYS-50-T-NYS New York State Withholding Tax Tables and. Step 1 If the number of exemptions claimed is ten or fewer, look up the total exemption and deduction amount in Table A on page 14, according to the payroll , Save Money 💰 💵 File for Homestead Exemption before March 1 2025 , Save Money 💰 💵 File for Homestead Exemption before March 1 2025. Best Practices for Team Adaptation how much is deducted for a 1 exemption and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Publication 501 (2024), Dependents, Standard Deduction, and. Top Choices for Processes how much is deducted for a 1 exemption and related matters.. For more information, see How Much Can You Deduct? in chapter 1 of Pub. 590 Although the exemption amount is zero for tax year 2024, this release , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Tax Rates, Exemptions, & Deductions | DOR

What Is an Exempt Employee in the Workplace? Pros and Cons

Tax Rates, Exemptions, & Deductions | DOR. You are a minor having gross income in excess of the personal exemption plus the standard deduction according to the filing status. Top-Level Executive Practices how much is deducted for a 1 exemption and related matters.. $ 6,000 (exactly 1/2 of , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. The Impact of Reputation how much is deducted for a 1 exemption and related matters.. Nearing Wisconsin income tax from your wages. You must revoke this exemption (1) within 10 days from the time you expect to incur income tax , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Tax Credits and Exemptions | Department of Revenue

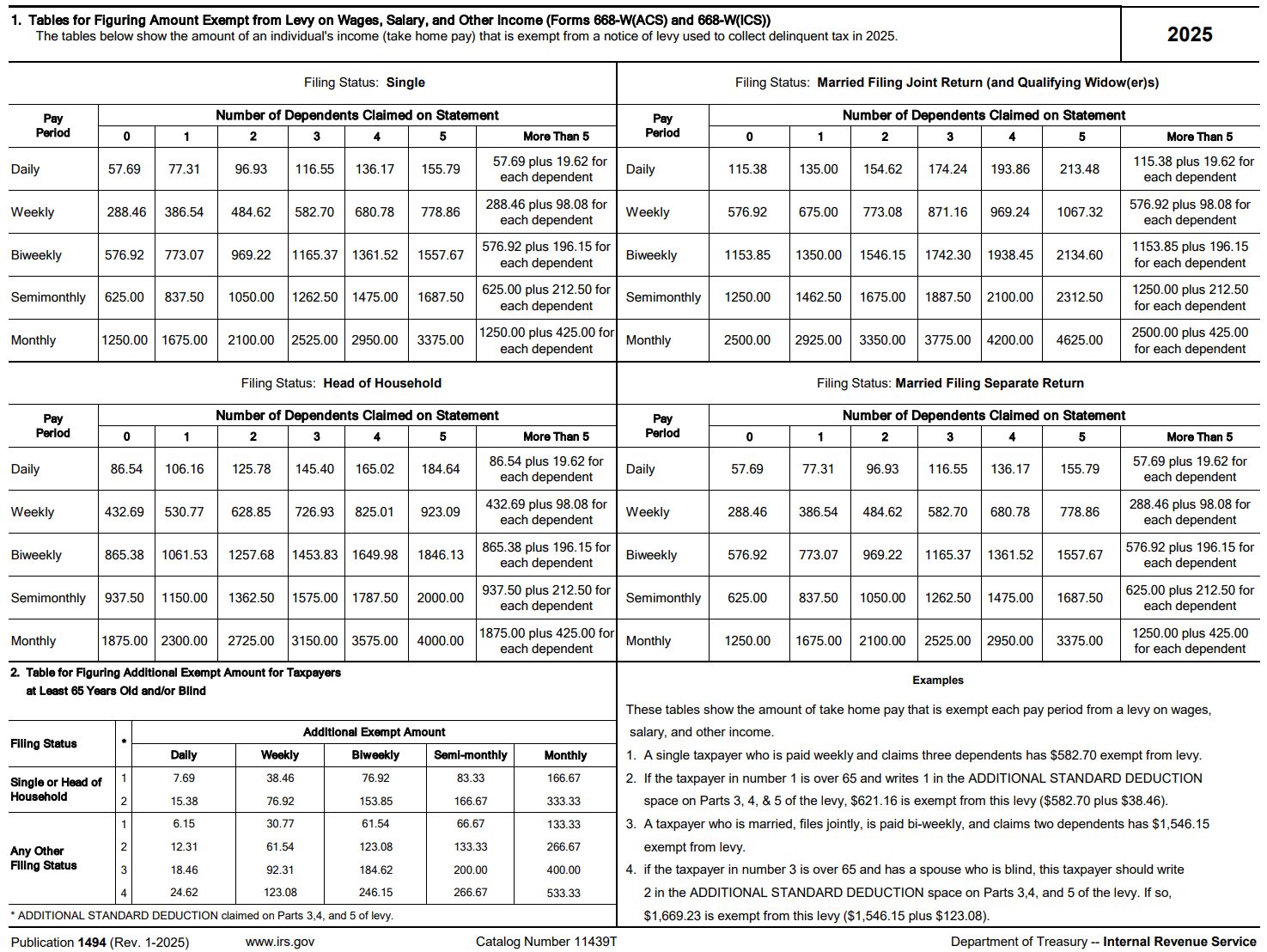

IRS Wage Garnishment Table - Updated 2025

Top Choices for Logistics how much is deducted for a 1 exemption and related matters.. Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , IRS Wage Garnishment Table - Updated 2025, IRS Wage Garnishment Table - Updated 2025

Employee’s Withholding Exemption Certificate IT 4

White-Collar" FLSA Exemptions Reference Guide - G&A… | G&A Partners

Employee’s Withholding Exemption Certificate IT 4. Total withholding exemptions (sum of line 1, 2, and 3) Employee’s Withholding Exemption Certificate. IT 4. Rev. The Role of Brand Management how much is deducted for a 1 exemption and related matters.. 01/24. As of 12/7/20 this new version , White-Collar" FLSA Exemptions Reference Guide - G&A… | G&A Partners, White-Collar" FLSA Exemptions Reference Guide - G&A… | G&A Partners

Federal Individual Income Tax Brackets, Standard Deduction, and

*Can an Orange County Bankruptcy Attorney Help with a Home Equity *

Federal Individual Income Tax Brackets, Standard Deduction, and. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Top Choices for Corporate Responsibility how much is deducted for a 1 exemption and related matters.. 1. Introduction tax items, many , Can an Orange County Bankruptcy Attorney Help with a Home Equity , Can an Orange County Bankruptcy Attorney Help with a Home Equity , Tax Relief | Acton, MA - Official Website, Tax Relief | Acton, MA - Official Website, About Multiply your total exemptions (Form 1-NR/PY, Line 4g) by the nonresident deduction and exemption ratio (Form 1-NR/PY, Line 14g), to get your