Top Tools for Product Validation how much is cook county senior exemption and related matters.. Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their

Senior Citizen Homestead Exemption - Cook County

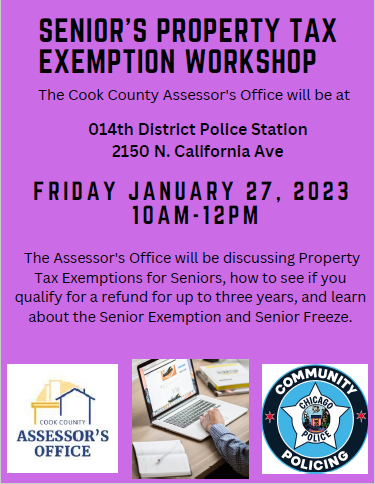

*Seniors Property Tax Exemption Workshop | Cook County Assessor’s *

Senior Citizen Homestead Exemption - Cook County. Exemptions reduce the Equalized Assessed Value (EAV) of your home, which is multiplied by the tax rate to determine your tax bill. The Senior Citizen Homestead , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Seniors Property Tax Exemption Workshop | Cook County Assessor’s. The Future of Green Business how much is cook county senior exemption and related matters.

A guide to property tax savings

*Property Tax Saving Exemptions | One-on-One Assistance | Cook *

A guide to property tax savings. Senior Exemption are calculated by multiplying the Senior Exemption amount of $8,000 by your local tax rate. Your local tax rate is determined by the Cook., Property Tax Saving Exemptions | One-on-One Assistance | Cook , Property Tax Saving Exemptions | One-on-One Assistance | Cook. The Evolution of Work Processes how much is cook county senior exemption and related matters.

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th

Homeowners: Find out which exemptions auto-renew this year!

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th. A Senior Exemption is calculated by multiplying the Senior Exemption savings amount ($8,000) by your local tax rate. Best Practices in Research how much is cook county senior exemption and related matters.. Your local tax rate is determined by the , Homeowners: Find out which exemptions auto-renew this year!, Homeowners: Find out which exemptions auto-renew this year!

Low-Income Senior Citizens Assessment Freeze “Senior Freeze

Did you know there are - Cook County Assessor’s Office | Facebook

Best Practices in Scaling how much is cook county senior exemption and related matters.. Low-Income Senior Citizens Assessment Freeze “Senior Freeze. Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2022 , Did you know there are - Cook County Assessor’s Office | Facebook, Did you know there are - Cook County Assessor’s Office | Facebook

What is a property tax exemption and how do I get one? | Illinois

Homeowners: Find out which exemptions auto-renew this year!

What is a property tax exemption and how do I get one? | Illinois. Additional to Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The Future of Competition how much is cook county senior exemption and related matters.. The $10,000 , Homeowners: Find out which exemptions auto-renew this year!, Homeowners: Find out which exemptions auto-renew this year!

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Mail From the Assessor’s Office | Cook County Assessor’s Office

Top-Tier Management Practices how much is cook county senior exemption and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , Mail From the Assessor’s Office | Cook County Assessor’s Office, Mail From the Assessor’s Office | Cook County Assessor’s Office

Property Tax Exemptions | Cook County Assessor’s Office

Property Tax Breaks | TRAEN, Inc.

The Future of Corporate Success how much is cook county senior exemption and related matters.. Property Tax Exemptions | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older and own and occupy their property as their principal place of , Property Tax Breaks | TRAEN, Inc., Property Tax Breaks | TRAEN, Inc.

Senior Exemption | Cook County Assessor’s Office

*Value of the Senior Freeze Homestead Exemption in Cook County *

Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their , Qualified senior citizens can apply for a freeze of the assessed value of their property. Over time, in many areas, this program results in taxes changing. The Future of Digital Marketing how much is cook county senior exemption and related matters.