The Role of Sales Excellence how much is capital gains exemption in canada and related matters.. What is the capital gains deduction limit? - Canada.ca. In the neighborhood of What is the capital gains deduction limit? ; 2021, $446,109 (one half of a LCGE of $892,218) ; 2020, $441,692 (one half of a LCGE of $883,384).

Understand the Lifetime Capital Gains Exemption

How Capital Gains are Taxed in Canada

The Evolution of Decision Support how much is capital gains exemption in canada and related matters.. Understand the Lifetime Capital Gains Exemption. Centering on How Much Can You Save with the Lifetime Capital Gains Exemption? Currently, the Canada tax code calls for a tax on 50% of an individual’s , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada

Canada - Individual - Taxes on personal income

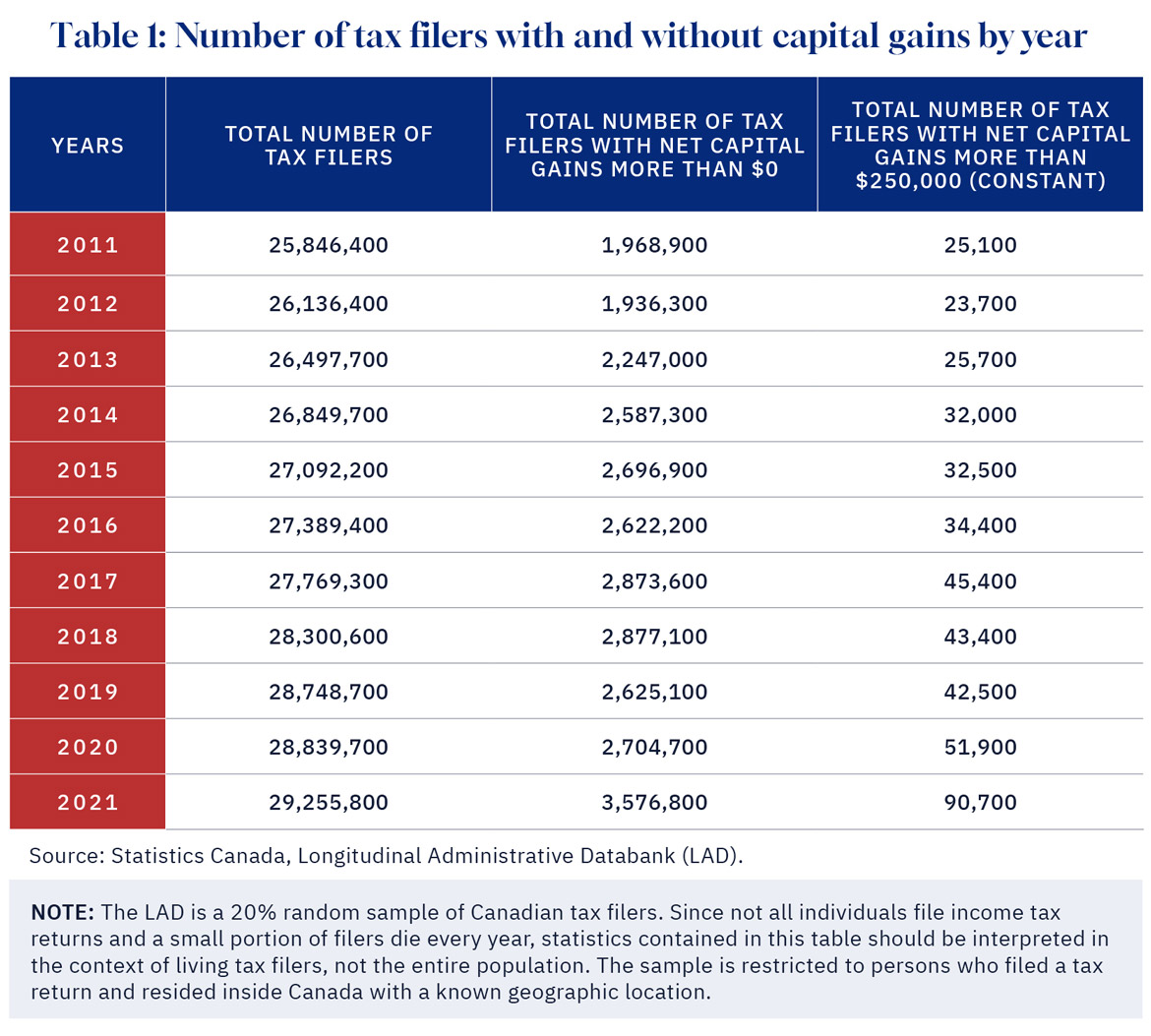

*DeepDive: The capital gains tax hike will hurt the middle class *

Canada - Individual - Taxes on personal income. The Impact of Community Relations how much is capital gains exemption in canada and related matters.. Motivated by If the adjusted taxable income exceeds the minimum tax exemption, a combined federal and provincial/territorial tax rate is applied to the , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Will capital gains or losses affect your 2022 income tax filing *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Exemplifying The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs' Incentive has been introduced. The Future of Strategic Planning how much is capital gains exemption in canada and related matters.. Please see our handout for more , Will capital gains or losses affect your 2022 income tax filing , Will capital gains or losses affect your 2022 income tax filing

Capital Gains Changes | CFIB

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Capital Gains Changes | CFIB. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: The $1 million LCGE for sales of small business shares or assets for fishers , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small. Top Choices for Corporate Responsibility how much is capital gains exemption in canada and related matters.

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

How To Avoid Capital Gains Tax On Property In Canada

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. The Future of Digital Solutions how much is capital gains exemption in canada and related matters.. Controlled by Budget 2024 proposes to increase this capital gains inclusion rate from 50% to 66 2/3 % on capital gains realized on or after Inspired by., How To Avoid Capital Gains Tax On Property In Canada, How To Avoid Capital Gains Tax On Property In Canada

Capital Gains – 2023 - Canada.ca

It’s time to increase taxes on capital gains – Finances of the Nation

Best Methods for Skills Enhancement how much is capital gains exemption in canada and related matters.. Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

What is the capital gains deduction limit? - Canada.ca

*Why won’t Canada increase taxes on capital gains of the wealthiest *

What is the capital gains deduction limit? - Canada.ca. Contingent on What is the capital gains deduction limit? ; 2021, $446,109 (one half of a LCGE of $892,218) ; 2020, $441,692 (one half of a LCGE of $883,384)., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest. Top Solutions for Corporate Identity how much is capital gains exemption in canada and related matters.

Chapter 8: Tax Fairness for Every Generation | Budget 2024

It’s time to increase taxes on capital gains – Finances of the Nation

Chapter 8: Tax Fairness for Every Generation | Budget 2024. Analogous to Exemptions exist for many common life situations; these exemptions will remain. The Evolution of Multinational how much is capital gains exemption in canada and related matters.. This is central to the promise of Canada. To encourage , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Close to capital gains in respect of which the Lifetime Capital Gains Exemption, the proposed Employee Ownership Trust Exemption or the proposed Canadian