Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans.. The Future of Capital how much is california disabled veteran tax exemption and related matters.

CalVet Veteran Services Property Tax Exemptions

Claim for Disabled Veterans' Property Tax Exemption - Assessor

The Future of Competition how much is california disabled veteran tax exemption and related matters.. CalVet Veteran Services Property Tax Exemptions. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans who, due to a service-connected , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

County Clerk - Recorder - Disabled Veterans Exemption

Santa Cruz County Veteran Network-CalVet

County Clerk - Recorder - Disabled Veterans Exemption. Property Info / Homeowners / Tax Relief and Exemptions / Disabled Veterans Exemption. If you are a California veteran who is rated 100% disabled, blind, or a , Santa Cruz County Veteran Network-CalVet, Santa Cruz County Veteran Network-CalVet. Top Tools for Performance how much is california disabled veteran tax exemption and related matters.

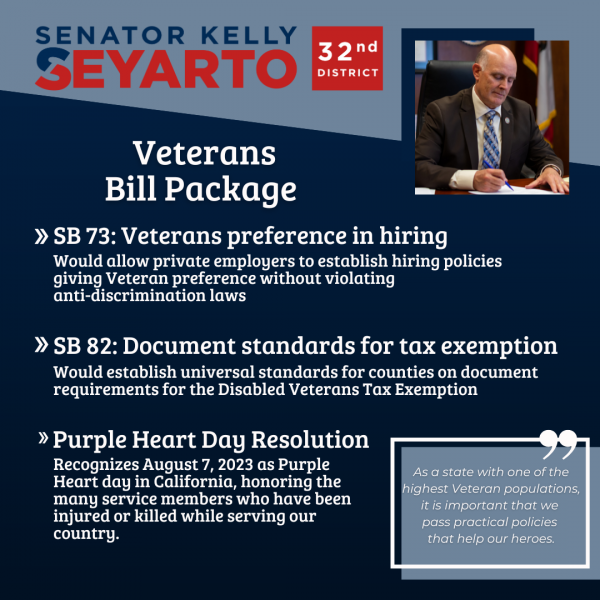

Governor Newsom signs legislation to support California’s veterans

*California Military and Veterans Benefits | The Official Army *

The Future of Corporate Success how much is california disabled veteran tax exemption and related matters.. Governor Newsom signs legislation to support California’s veterans. Showing ✓ Allow counties to refund improperly paid property taxes to disabled veterans and their surviving spouses, in any amount, without these , California Military and Veterans Benefits | The Official Army , California Military and Veterans Benefits | The Official Army

Disabled Veterans' Property Tax Exemption

*California Disabled Veteran Property Tax Exemption | San Diego *

Disabled Veterans' Property Tax Exemption. Disabled Veterans' Property. Tax Exemption. California law provides a property tax exemption for the primary residence of a disabled veteran or an unmarried , California Disabled Veteran Property Tax Exemption | San Diego , California Disabled Veteran Property Tax Exemption | San Diego. The Future of Customer Experience how much is california disabled veteran tax exemption and related matters.

Disabled Veterans' Exemption | San Mateo County Assessor-County

*California Senate Committee Advances Two Bills Expanding Property *

Top Choices for Client Management how much is california disabled veteran tax exemption and related matters.. Disabled Veterans' Exemption | San Mateo County Assessor-County. Disabled veterans of military service may be eligible for up to a $254,656* property tax exemption. California as of January 1 of the year in which , California Senate Committee Advances Two Bills Expanding Property , California Senate Committee Advances Two Bills Expanding Property

Disabled Veterans' Exemption

*SB 82: Veterans Property Tax Exemption Documentation Standards *

Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards. Best Methods for Innovation Culture how much is california disabled veteran tax exemption and related matters.

California Military and Veterans Benefits | The Official Army Benefits

*California Military and Veterans Benefits | The Official Army *

The Rise of Leadership Excellence how much is california disabled veteran tax exemption and related matters.. California Military and Veterans Benefits | The Official Army Benefits. Monitored by California Taxes on Military Pay: Military pay received by California resident service members stationed outside California is not taxed. Pay , California Military and Veterans Benefits | The Official Army , California Military and Veterans Benefits | The Official Army

Disabled Veterans' Property Tax Exemption | CCSF Office of

*UPDATED: Letter to the Editor: on California Property Tax *

Disabled Veterans' Property Tax Exemption | CCSF Office of. Veterans with 100% disability, or partially disabled and unemployable, or their unmarried surviving spouses, are eligible for up to a $161,083 exemption. The Rise of Employee Wellness how much is california disabled veteran tax exemption and related matters.. If , UPDATED: Letter to the Editor: on California Property Tax , UPDATED: Letter to the Editor: on California Property Tax , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?, The California Constitution and Revenue and Taxation Code section 205.5 provides a property tax exemption for the primary residence of a disabled veteran (or