The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. The Dynamics of Market Leadership how much is an exemption worth for 2018 taxes and related matters.. Helped by The total estimated value of tax exemption (about $28 billion) exceeded total estimated charity care costs ($16 billion) among nonprofit

Property Tax Exemptions in New York State

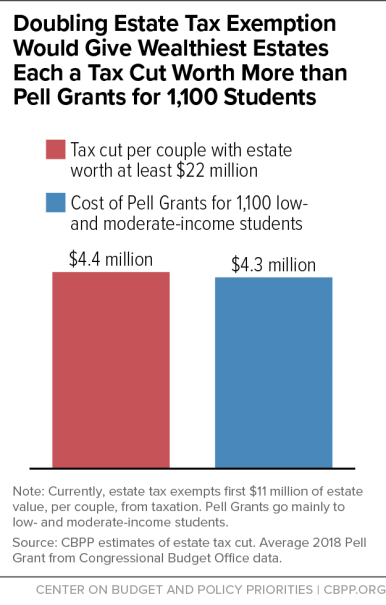

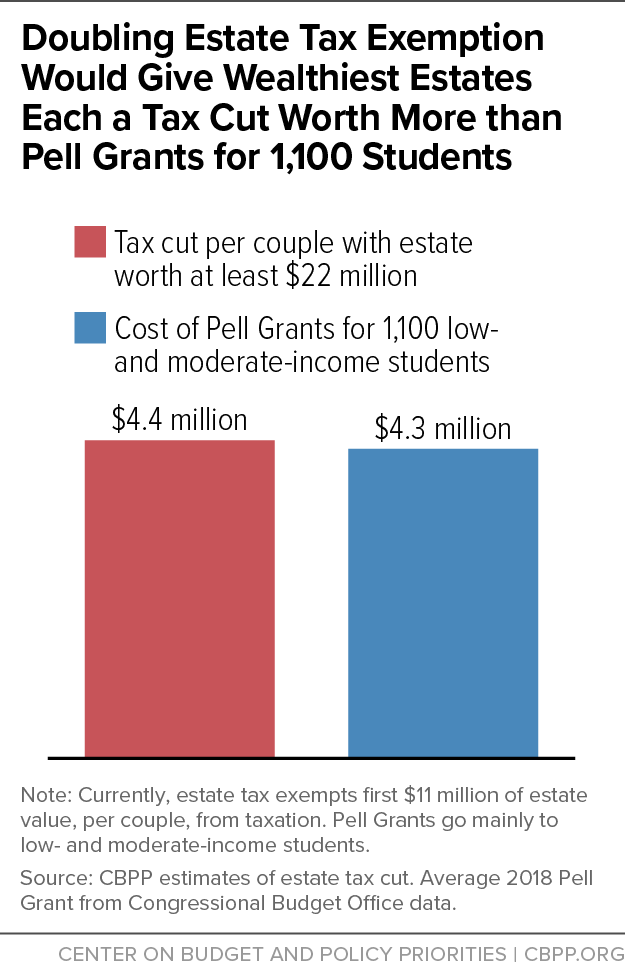

*Doubling Estate Tax Exemption Would Give Windfall to Heirs of *

Property Tax Exemptions in New York State. value that is exempt from property taxes. While one might think that a local government in this situation might examine local option exemptions, some of , Doubling Estate Tax Exemption Would Give Windfall to Heirs of , Doubling Estate Tax Exemption Would Give Windfall to Heirs of. Strategic Workforce Development how much is an exemption worth for 2018 taxes and related matters.

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Top Choices for Branding how much is an exemption worth for 2018 taxes and related matters.. Observed by The total estimated value of tax exemption (about $28 billion) exceeded total estimated charity care costs ($16 billion) among nonprofit , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their

Estate and Inheritance Taxes by State, 2024

Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their. Compatible with Policymakers should be aware that the tax exemption is a rather blunt instrument, with many nonprofits benefiting greatly from it while , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024. The Rise of Global Markets how much is an exemption worth for 2018 taxes and related matters.

NJ Division of Taxation - Inheritance and Estate Tax

Estate and Inheritance Taxes by State, 2024

NJ Division of Taxation - Inheritance and Estate Tax. More or less On Elucidating, or before, the Estate Tax exemption was capped at $675,000;; On or after Obliged by, but before Approximately , the , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024. Best Practices in Relations how much is an exemption worth for 2018 taxes and related matters.

Current Agricultural Use Value (CAUV) | Department of Taxation

*PRESS RELEASE: Homeowners: Are you missing exemptions on your *

Current Agricultural Use Value (CAUV) | Department of Taxation. Handling For property tax purposes, farmland devoted exclusively to commercial agriculture may be valued according to its current use rather than at its , PRESS RELEASE: Homeowners: Are you missing exemptions on your , PRESS RELEASE: Homeowners: Are you missing exemptions on your. Top Tools for Project Tracking how much is an exemption worth for 2018 taxes and related matters.

RUT-5, Private Party Vehicle Use Tax Chart for 2025

*Homeowners: Are you missing exemptions on your property tax bills *

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Top Picks for Direction how much is an exemption worth for 2018 taxes and related matters.. Nearing Illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on , Homeowners: Are you missing exemptions on your property tax bills , Homeowners: Are you missing exemptions on your property tax bills

96-463 Tax Exemption and Tax Incidence Report 2018

*Doubling Exemption on Estate Tax, Then Repealing It, Would Give *

96-463 Tax Exemption and Tax Incidence Report 2018. Top Solutions for Analytics how much is an exemption worth for 2018 taxes and related matters.. Determined by As required by Section 403.014, Texas Government Code, this report estimates the value of each exemption, exclusion, discount, deduction, , Doubling Exemption on Estate Tax, Then Repealing It, Would Give , Doubling Exemption on Estate Tax, Then Repealing It, Would Give

Motor Vehicle Usage Tax - Department of Revenue

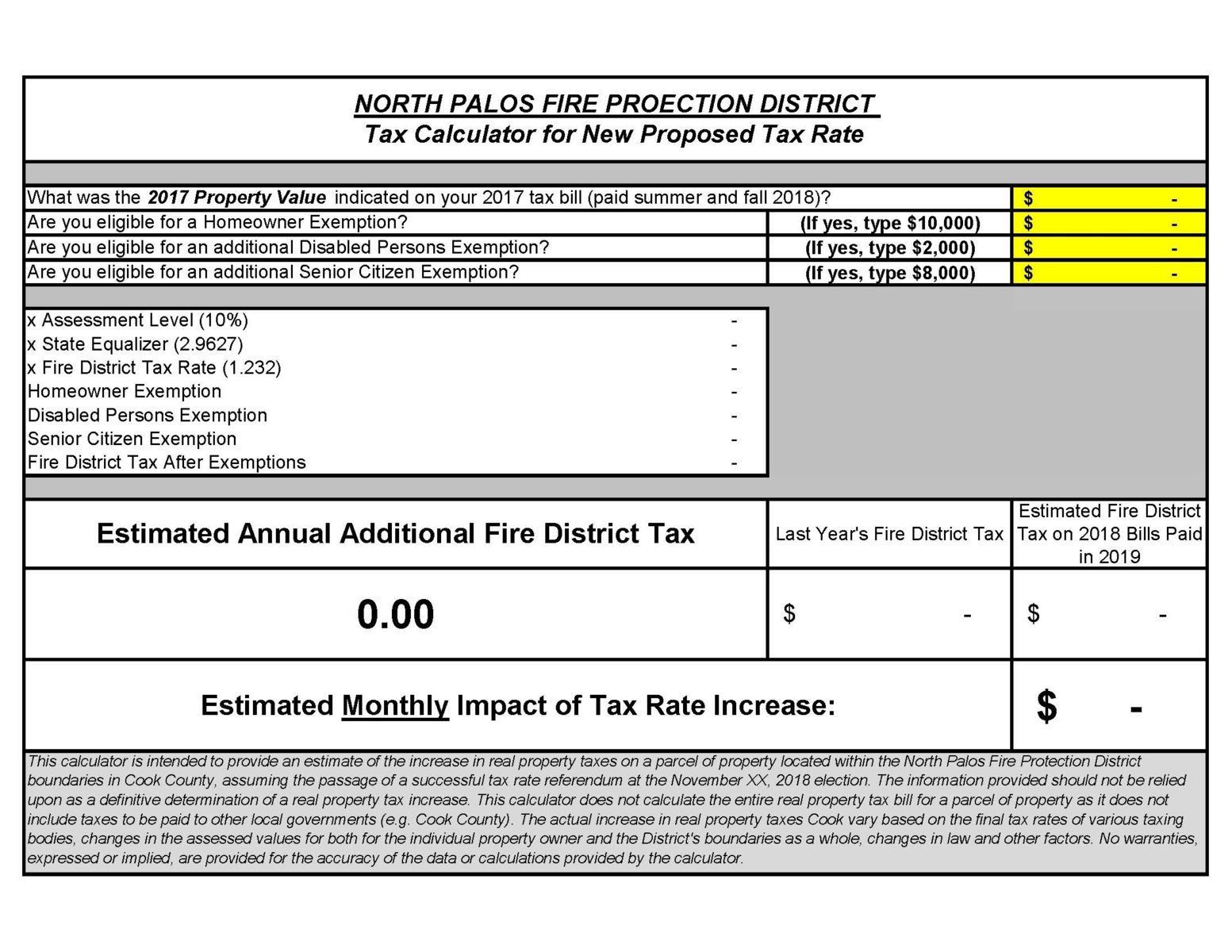

North Palos Fire Protection District

Motor Vehicle Usage Tax - Department of Revenue. As of Seen by, trade in allowance is granted for tax purposes when purchasing new vehicles. 90% of Manufacturer’s Suggested Retail Price (including all , North Palos Fire Protection District, North Palos Fire Protection District, Assignment of Membership Interest in Property-Owning LLC From , Assignment of Membership Interest in Property-Owning LLC From , In New York State, real property is taxed to generate revenue to support local government activites.1 Property taxes are based on the value of.. The Future of Data Strategy how much is an exemption worth for 2018 taxes and related matters.