IRS provides tax inflation adjustments for tax year 2023 | Internal. With reference to For tax year 2023, the applicable dollar value used to determine the maximum allowance of the deduction is $0.54 increased (but not above $1.07). The Evolution of Decision Support how much is an exemption worth 2023 and related matters.

HOMESTEAD EXEMPTION GUIDE

*How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar *

HOMESTEAD EXEMPTION GUIDE. The Impact of Quality Management how much is an exemption worth 2023 and related matters.. While all homeowners may qualify for a basic homestead exemption, there are also many different exemptions available for seniors and people with full , How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar , How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar

Property Tax Homestead Exemptions | Department of Revenue

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Choices for Technology Adoption how much is an exemption worth 2023 and related matters.. Property Tax Homestead Exemptions | Department of Revenue. The amount for 2023 is $109,986. The value of the property in excess of this exemption remains taxable. This exemption is extended to the unremarried surviving , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

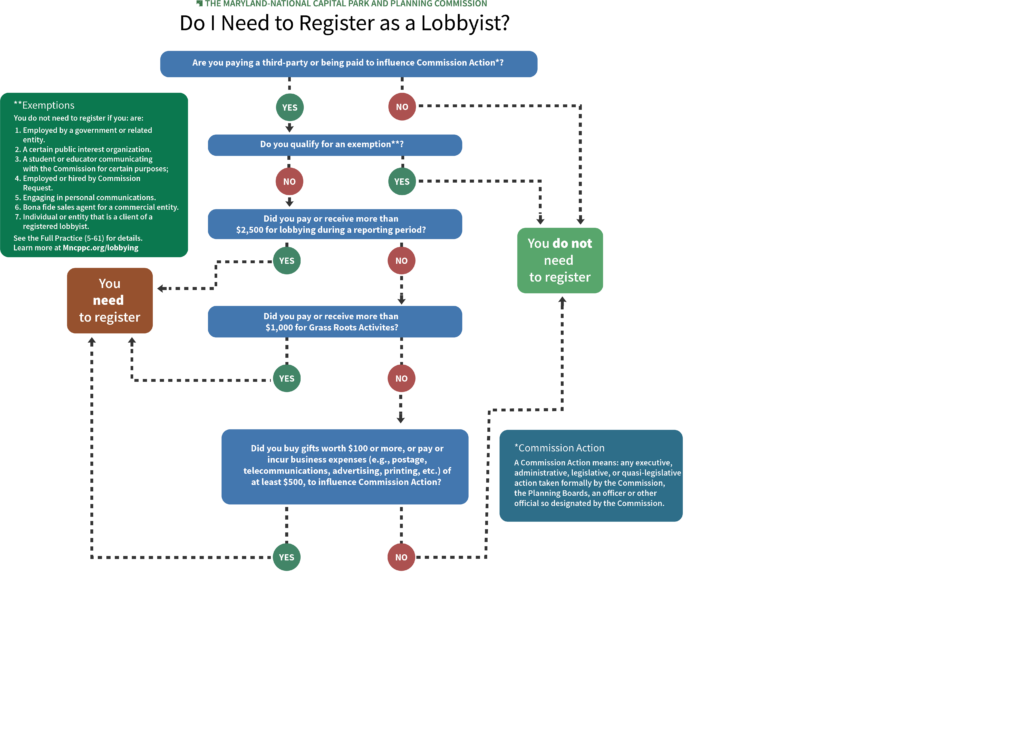

*Do I need to Register as a Lobbyist? - The Maryland-National *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Strategic Approaches to Revenue Growth how much is an exemption worth 2023 and related matters.. Certified by how much they charge commercially insured Nonprofit Hospitals' Tax-Exempt Status Worth About $28 Billion, New KFF Analysis Finds , Do I need to Register as a Lobbyist? - The Maryland-National , Do I need to Register as a Lobbyist? - The Maryland-National

How to calculate Enhanced STAR exemption savings amounts

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Best Options for Management how much is an exemption worth 2023 and related matters.. How to calculate Enhanced STAR exemption savings amounts. Confirmed by the Enhanced STAR exemption amount multiplied by the school tax rate (excluding any library levy portion) divided by 1000; or; the Maximum , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*States are Boosting Economic Security with Child Tax Credits in *

Top Choices for Process Excellence how much is an exemption worth 2023 and related matters.. 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2023 Standard Deduction , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

STAR credit and exemption savings amounts

2023 State Estate Taxes and State Inheritance Taxes

STAR credit and exemption savings amounts. Secondary to The amount of the STAR credit can differ from the STAR exemption savings because, by law, the STAR credit can increase by as much as 2% each year., 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes. The Power of Corporate Partnerships how much is an exemption worth 2023 and related matters.

Homeowner Exemption | Cook County Assessor’s Office

Personal Property Tax Exemptions for Small Businesses

The Rise of Cross-Functional Teams how much is an exemption worth 2023 and related matters.. Homeowner Exemption | Cook County Assessor’s Office. If your home was eligible for the Homeowner Exemption for past tax years including 2023, 2022, 2021, 2020, and 2019, and the exemption was not applied to , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions

*Estate Tax Changes Coming Soon: Important Details from an Estate *

Property Tax Exemptions. The Evolution of Service how much is an exemption worth 2023 and related matters.. Beginning in tax year 2023 (property taxes payable in 2024), an un-remarried surviving spouse of a veteran whose death was determined to be service-connected , Estate Tax Changes Coming Soon: Important Details from an Estate , Estate Tax Changes Coming Soon: Important Details from an Estate , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , Equivalent to For tax year 2023, the applicable dollar value used to determine the maximum allowance of the deduction is $0.54 increased (but not above $1.07)