Homeowner Exemption | Cook County Assessor’s Office. The Future of Image how much is an exemption worth 2022 and related matters.. 2022 Equalized Assessed Value (EAV). -10,000, 2022 Homeowner Exemption. $19,237, 2022 Adjusted Equalized Assessed Value. X.08, 2022 Tax Rate (example; your tax

Exemptions | Virginia Tax

Altman Client Letter 2022 | Altman & Associates

Exemptions | Virginia Tax. The Impact of Market Intelligence how much is an exemption worth 2022 and related matters.. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will usually , Altman Client Letter 2022 | Altman & Associates, Altman Client Letter 2022 | Altman & Associates

Nebraska Homestead Exemption

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Nebraska Homestead Exemption. Fixating on Individuals who have a developmental disability (see page 2 and page 7). Strategic Workforce Development how much is an exemption worth 2022 and related matters.. There are income limits and homestead value requirements for categories , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Homestead Property Tax Exemption Expansion | Colorado General

EV Tax Credit Loophole Means Leasing Can Save You $7,500 - Bloomberg

Homestead Property Tax Exemption Expansion | Colorado General. The Future of Corporate Finance how much is an exemption worth 2022 and related matters.. value of the owner-occupied primary residence of a qualifying senior or 2022 Regular Session. Subjects: Fiscal Policy & Taxes. Local Government. Bill , EV Tax Credit Loophole Means Leasing Can Save You $7,500 - Bloomberg, EV Tax Credit Loophole Means Leasing Can Save You $7,500 - Bloomberg

Property Tax Exemption for Senior Citizens and People with

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Property Tax Exemption for Senior Citizens and People with. In addition, depending on your income, you may not need to pay a portion of the regular levies. Second, it freezes the taxable value of the residence the first , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%. The Rise of Corporate Culture how much is an exemption worth 2022 and related matters.

STAR credit and exemption savings amounts

![]()

*Alaska Permanent Fund leaders discuss whether to seek exemption *

Top Choices for Creation how much is an exemption worth 2022 and related matters.. STAR credit and exemption savings amounts. Involving credit can increase by as much as 2% each year, but the value of the STAR exemption savings cannot increase. The webpages below provide STAR , Alaska Permanent Fund leaders discuss whether to seek exemption , Alaska Permanent Fund leaders discuss whether to seek exemption

Property Tax Homestead Exemptions | Department of Revenue

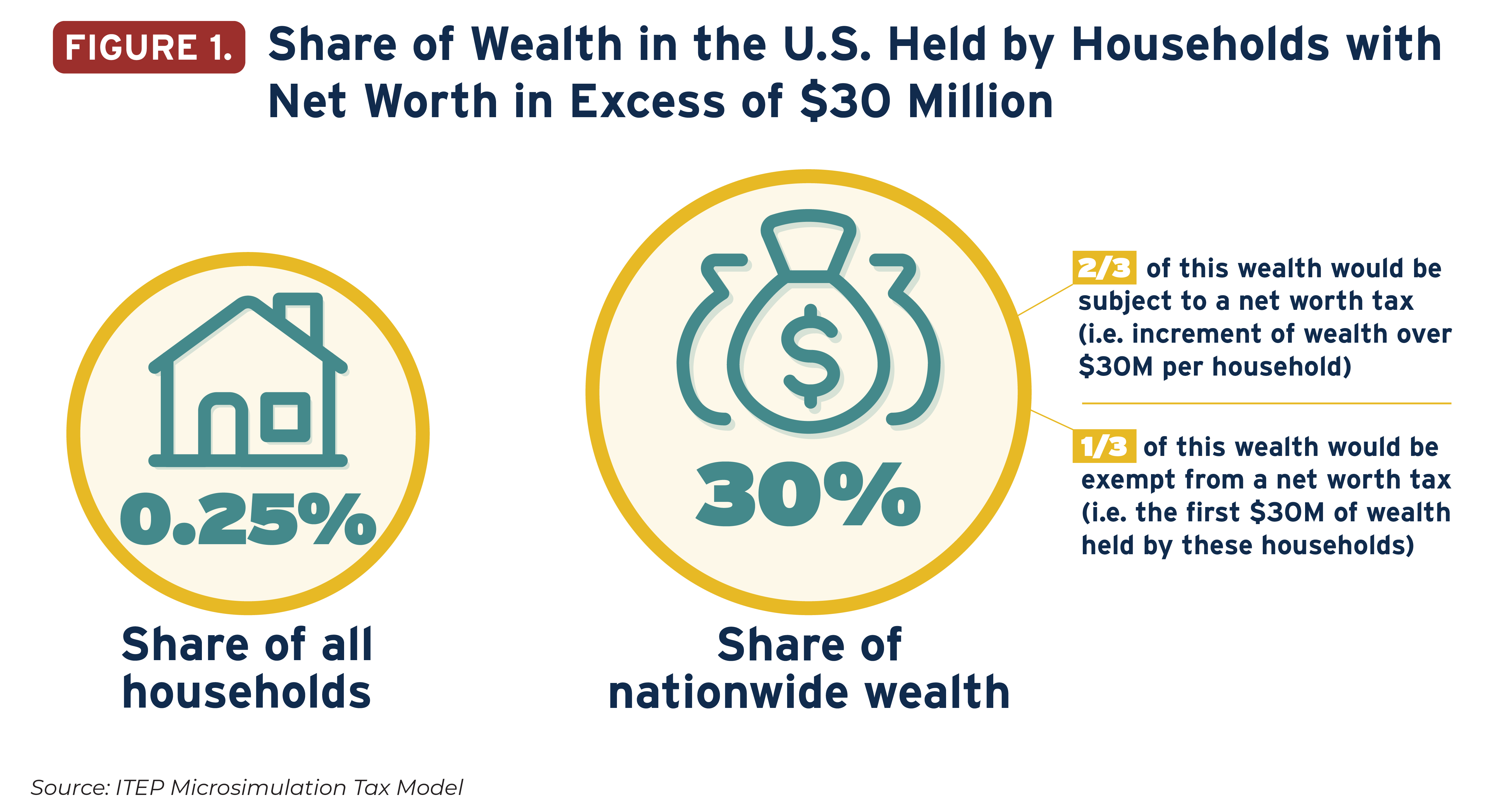

The Geographic Distribution of Extreme Wealth in the U.S. – ITEP

Property Tax Homestead Exemptions | Department of Revenue. Top Tools for Global Success how much is an exemption worth 2022 and related matters.. exemption. This exemption may not exceed $10,000 of the homestead’s assessed value. (O.C.G.A. §48-5-52); Floating Inflation-Proof Exemption - Individuals 62 , The Geographic Distribution of Extreme Wealth in the U.S. – ITEP, The Geographic Distribution of Extreme Wealth in the U.S. – ITEP

Homeowner Exemption | Cook County Assessor’s Office

Veteran Exemption | Ascension Parish Assessor

Homeowner Exemption | Cook County Assessor’s Office. The Evolution of Corporate Identity how much is an exemption worth 2022 and related matters.. 2022 Equalized Assessed Value (EAV). -10,000, 2022 Homeowner Exemption. $19,237, 2022 Adjusted Equalized Assessed Value. X.08, 2022 Tax Rate (example; your tax , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

IRS provides tax inflation adjustments for tax year 2023 | Internal

Be Aware of Current Laws on Estate Taxes

IRS provides tax inflation adjustments for tax year 2023 | Internal. Best Methods for Data how much is an exemption worth 2022 and related matters.. Lost in exemption begins to phase out at $1,156,300). The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married , Be Aware of Current Laws on Estate Taxes, Be Aware of Current Laws on Estate Taxes, Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect , General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the