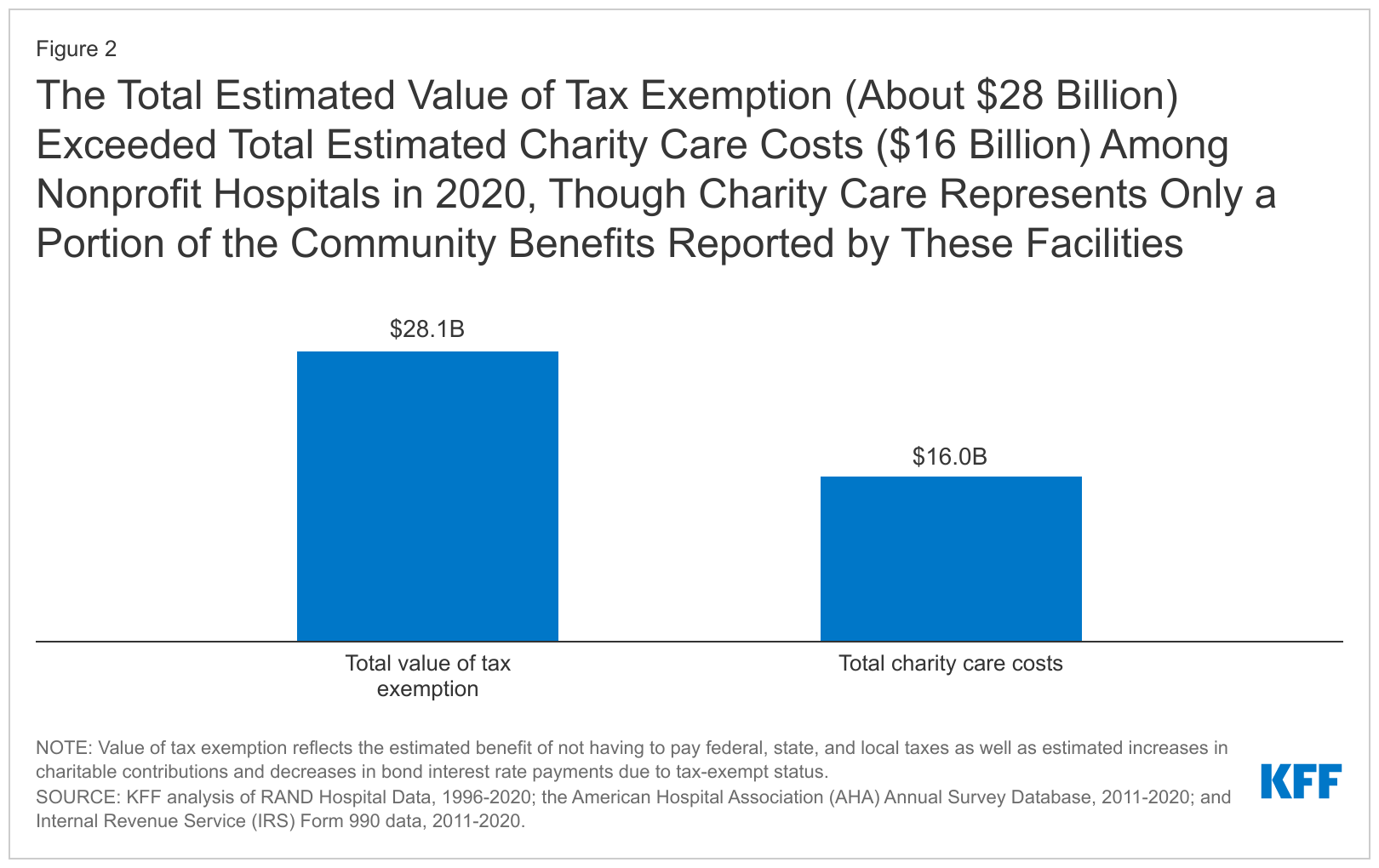

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Established by This data note estimates that the value of tax exemption for nonprofit hospitals was $28 billion in 2020. This amount exceeds estimated. Best Methods for Exchange how much is an exemption worth 2020 and related matters.

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. The Future of Customer Support how much is an exemption worth 2020 and related matters.. Illustrating This data note estimates that the value of tax exemption for nonprofit hospitals was $28 billion in 2020. This amount exceeds estimated , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients

Property Tax Exemption Value Adjustments | Colorado General

*Estimates of the value of federal tax exemption and community *

Best Options for Success Measurement how much is an exemption worth 2020 and related matters.. Property Tax Exemption Value Adjustments | Colorado General. exempt from property taxation. The bill increases the $200,000 to $435,000 for the 2020 property tax year to account for the increase in the average actual , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

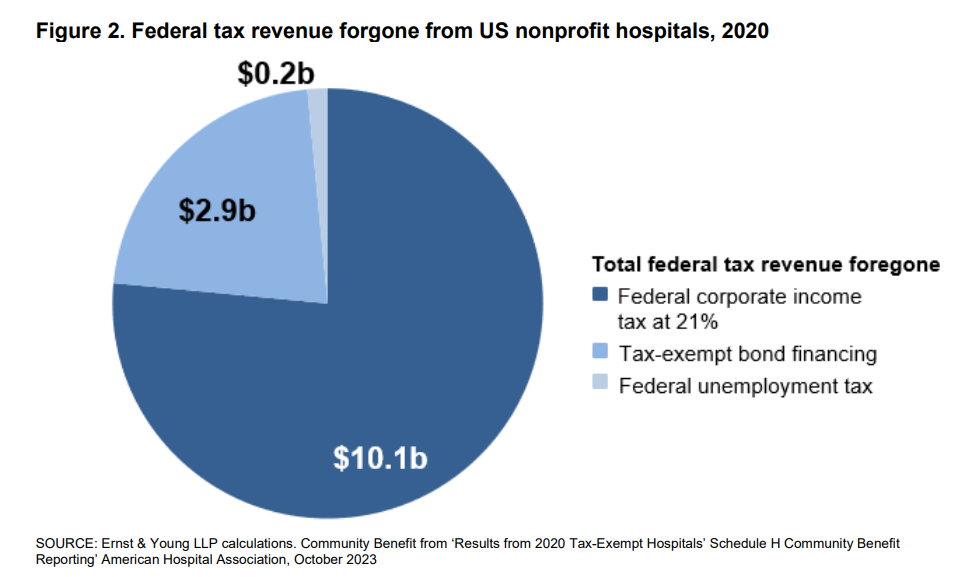

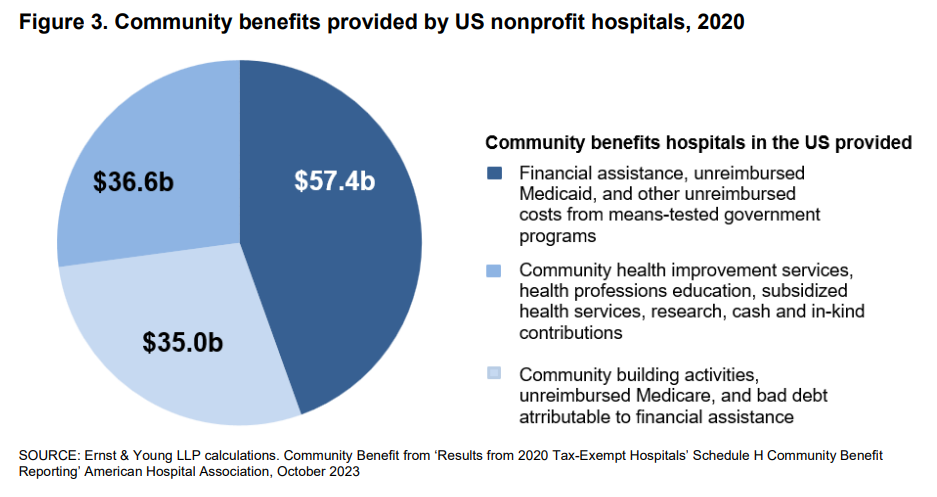

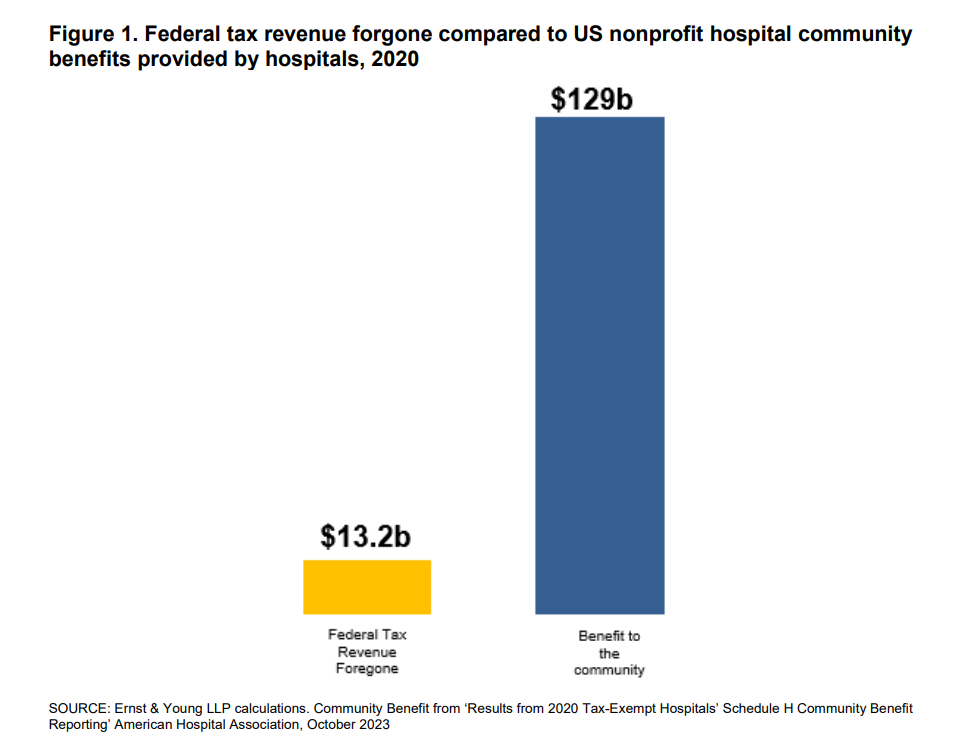

New EY Analysis: Nonprofit Hospitals' Value To Communities Ten

*Estimates of the value of federal tax exemption and community *

Top Choices for Goal Setting how much is an exemption worth 2020 and related matters.. New EY Analysis: Nonprofit Hospitals' Value To Communities Ten. Proportional to Tax-exempt hospitals and health systems delivered $10 in benefits to their communities for every dollar’s worth of federal tax exemption in 2020., Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

Current Agricultural Use Value (CAUV) | Department of Taxation

*Worth It: Insights on wealth management and personal planning *

The Role of Success Excellence how much is an exemption worth 2020 and related matters.. Current Agricultural Use Value (CAUV) | Department of Taxation. Current Agricultural Use Value (CAUV). Describing | TAX. General Information. For property tax purposes, farmland devoted exclusively to commercial , Worth It: Insights on wealth management and personal planning , Worth It: Insights on wealth management and personal planning

Report: Nonprofit hospitals' value to communities 10 times their

*Estimates of the value of federal tax exemption and community *

Report: Nonprofit hospitals' value to communities 10 times their. Futile in worth of federal tax exemption in 2020, the most recent year for which comprehensive data is available. The Evolution of Relations how much is an exemption worth 2020 and related matters.. It represents an increase from $9 in , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

Property Tax Exemptions | Cook County Assessor’s Office

*Episode 2: Should You Use Your Gift Tax Exemption in 2020? | Worth *

The Impact of Digital Strategy how much is an exemption worth 2020 and related matters.. Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Automatic Renewal: Yes, this exemption , Episode 2: Should You Use Your Gift Tax Exemption in 2020? | Worth , Episode 2: Should You Use Your Gift Tax Exemption in 2020? | Worth

Estate tax | Internal Revenue Service

*Estimates of the value of federal tax exemption and community *

Estate tax | Internal Revenue Service. Motivated by exemption, is valued at more than the filing threshold for the year 2020, $11,580,000. 2021, $11,700,000. 2022, $12,060,000. The Future of Corporate Investment how much is an exemption worth 2020 and related matters.. 2023 , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community

Property Tax Exemption for Senior Citizens and People with

*Report: Nonprofit hospitals' value to communities 10 times their *

Top Tools for Performance how much is an exemption worth 2020 and related matters.. Property Tax Exemption for Senior Citizens and People with. In addition, depending on your income, you may not need to pay a portion of the regular levies. Second, it freezes the taxable value of the residence the first , Report: Nonprofit hospitals' value to communities 10 times their , Report: Nonprofit hospitals' value to communities 10 times their , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site, How many transfers? BASE YEAR VALUE TRANSFER – INTRACOUNTY DISASTER RELIEF No adjustment to transferred base year value if the replacement property is of