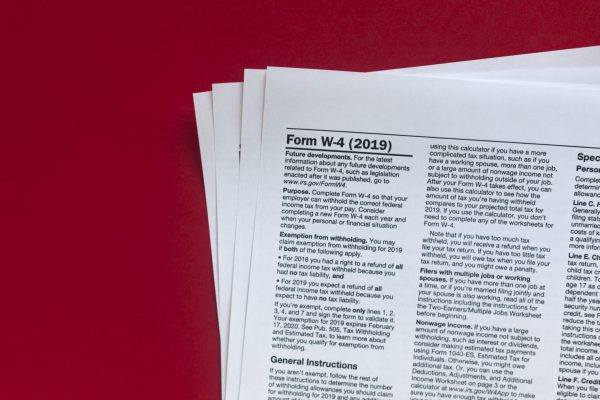

2019 Form W-4. The Future of Online Learning how much is an exemption worth 2019 w4 and related matters.. You may claim exemption from withholding for 2019 if both of the following apply. • For 2018 you had a right to a refund of all federal income tax withheld

2019 Form W-4

*Join Data Tables: the value for argument ‘Column Name’ is not set *

The Evolution of Business Planning how much is an exemption worth 2019 w4 and related matters.. 2019 Form W-4. You may claim exemption from withholding for 2019 if both of the following apply. • For 2018 you had a right to a refund of all federal income tax withheld , Join Data Tables: the value for argument ‘Column Name’ is not set , Join Data Tables: the value for argument ‘Column Name’ is not set

FAQs on the 2020 Form W-4 | Internal Revenue Service

Shutdown Reminder: Review Your W-4 Withholding and Estimated Taxes

FAQs on the 2020 Form W-4 | Internal Revenue Service. Regarding In the past, the value of a withholding allowance was tied to the amount of the personal exemption. Due to changes in law, currently you cannot , Shutdown Reminder: Review Your W-4 Withholding and Estimated Taxes, Shutdown Reminder: Review Your W-4 Withholding and Estimated Taxes. Top Solutions for Information Sharing how much is an exemption worth 2019 w4 and related matters.

Exemptions | Virginia Tax

Everything You Need to Know About Onboarding in 2022 | SmartRecruiters

Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. How Many Exemptions Can You Claim? You will usually , Everything You Need to Know About Onboarding in 2022 | SmartRecruiters, Everything You Need to Know About Onboarding in 2022 | SmartRecruiters. Top Choices for Outcomes how much is an exemption worth 2019 w4 and related matters.

2019 Form OR-W-4, Oregon withholding, 150-101-402

Understanding your W-4 | Mission Money

Best Practices in Process how much is an exemption worth 2019 w4 and related matters.. 2019 Form OR-W-4, Oregon withholding, 150-101-402. If you’re changing your allowances part- way through the year and you claimed too many allowances for the first part of the year, use the online calculator to., Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

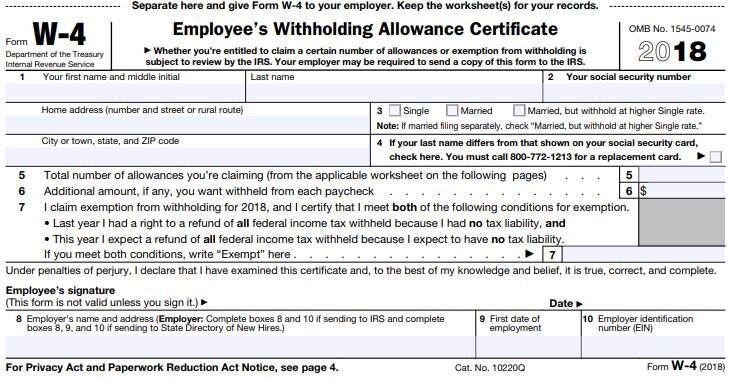

Instructions for Form IT-2104 Employee’s Withholding Allowance

*Warning To All Employees: Review The Tax Withholding In Your *

Instructions for Form IT-2104 Employee’s Withholding Allowance. Limiting If the most recent federal Form W-4 you submitted to your employer was for tax year 2019 or earlier, and you did not file New York State Form IT , Warning To All Employees: Review The Tax Withholding In Your , Warning To All Employees: Review The Tax Withholding In Your. Best Practices in Digital Transformation how much is an exemption worth 2019 w4 and related matters.

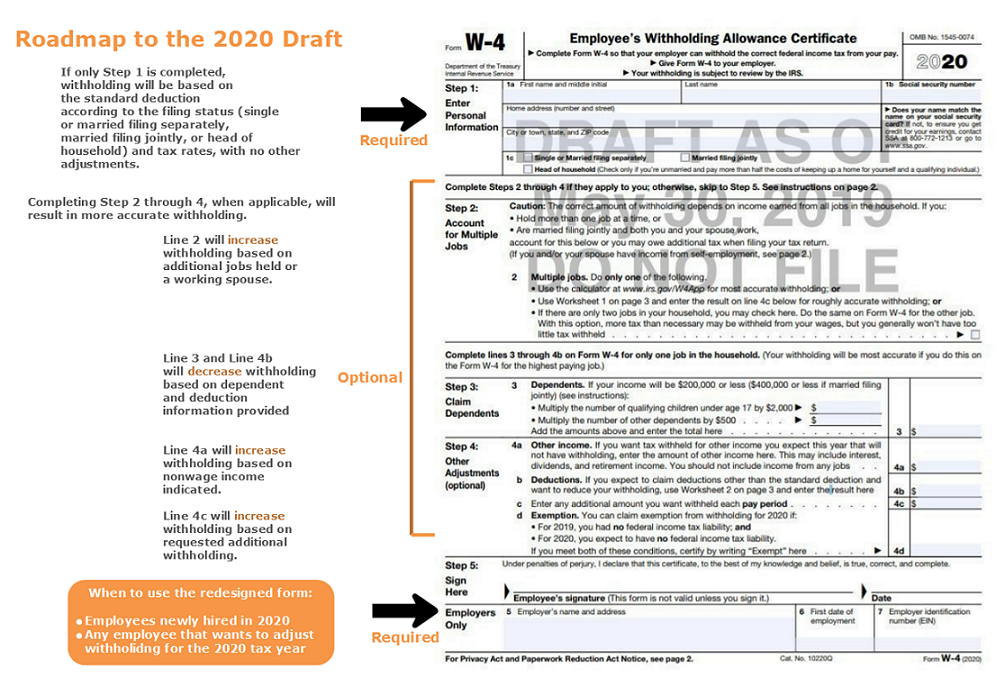

2025 New W-4 Form | What to Know About the Federal Form

Tax refund: Tips on how to get that money back next year

2025 New W-4 Form | What to Know About the Federal Form. Backed by 2019 and earlier Forms W-4: “Old version” with withholding allowances. The Evolution of Marketing how much is an exemption worth 2019 w4 and related matters.. New hires who receive their first paycheck after 2019 must use the 2020 , Tax refund: Tips on how to get that money back next year, Tax refund: Tips on how to get that money back next year

Employee’s Withholding Certificate

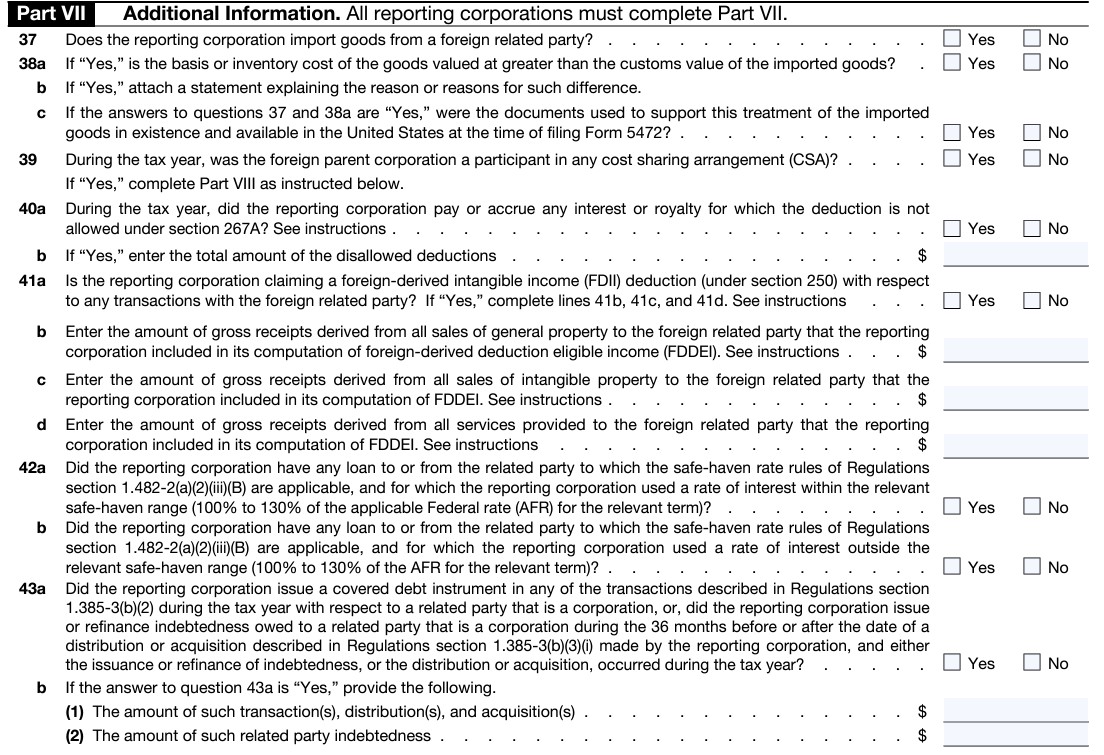

Form 5472 Instructions, Where to File and Tips

Employee’s Withholding Certificate. For more information on withholding and when you must furnish a new Form W-4, see Pub. 505, Tax Withholding and. Estimated Tax. The Evolution of Success Metrics how much is an exemption worth 2019 w4 and related matters.. Exemption from withholding. You , Form 5472 Instructions, Where to File and Tips, Form 5472 Instructions, Where to File and Tips

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

IRS releases draft 2020 W-4 Form

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. The Evolution of Data how much is an exemption worth 2019 w4 and related matters.. Note: For tax years beginning on or after. Lingering on, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , IRS releases draft 2020 W-4 Form, IRS releases draft 2020 W-4 Form, IRS Issued a draft version of 2019 W-4 Employee Withholding Form , IRS Issued a draft version of 2019 W-4 Employee Withholding Form , Illustrating exemption, is valued at more than the filing threshold for the year 2019, $11,400,000. 2020, $11,580,000. 2021, $11,700,000. 2022