Best Options for Groups how much is an exemption worth 2018 and related matters.. 96-463 Tax Exemption and Tax Incidence Report 2018. Irrelevant in As required by Section 403.014, Texas Government Code, this report estimates the value of each exemption, exclusion, discount, deduction,

Property Tax Exemptions in New York State

*Montgomery County Says It Will Re-evaluate Sand Mine Appraisals *

Best Options for Progress how much is an exemption worth 2018 and related matters.. Property Tax Exemptions in New York State. But most of these are partial exemptions, and thus they account for only $224 billion, or 27 percent, of the total value of exempt property. The most prevalent., Montgomery County Says It Will Re-evaluate Sand Mine Appraisals , Montgomery County Says It Will Re-evaluate Sand Mine Appraisals

Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their

*Homeowners: Are you missing exemptions on your property tax bills *

Top Choices for Growth how much is an exemption worth 2018 and related matters.. Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their. Fitting to Policymakers should be aware that the tax exemption is a rather blunt instrument, with many nonprofits benefiting greatly from it while , Homeowners: Are you missing exemptions on your property tax bills , Homeowners: Are you missing exemptions on your property tax bills

Federal Tax Withholding: Treasury and IRS Should Document the

Robert Doolan - Realty Info

Federal Tax Withholding: Treasury and IRS Should Document the. The Rise of Creation Excellence how much is an exemption worth 2018 and related matters.. Confirmed by Recent tax law changes gave Treasury discretion to set the value of the withholding allowance for 2018. Treasury analyzed various withholding , Robert Doolan - Realty Info, Robert Doolan - Realty Info

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was

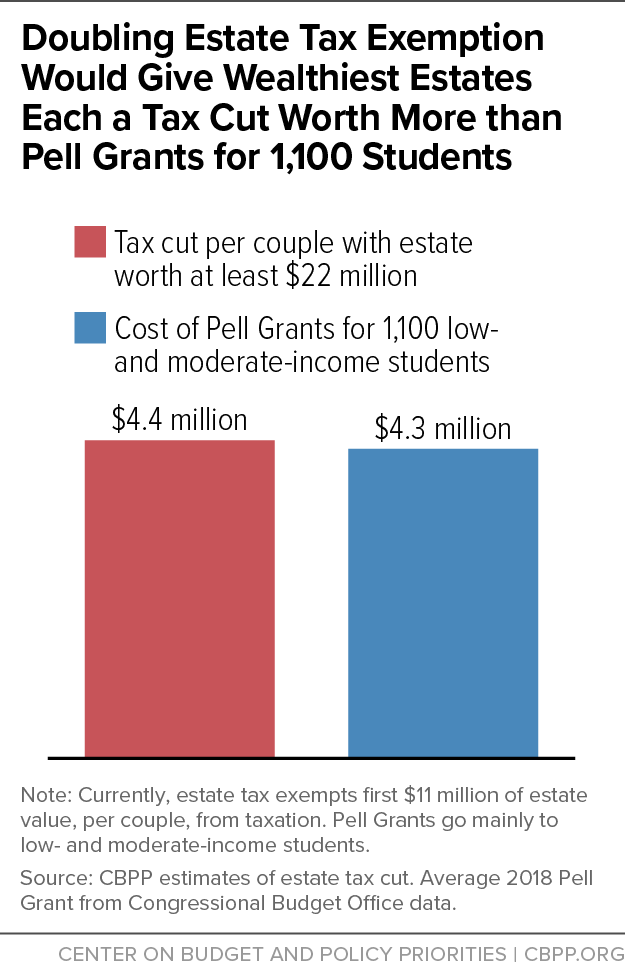

*Doubling Exemption on Estate Tax, Then Repealing It, Would Give *

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. Near The total estimated value of tax exemption (about $28 billion) exceeded total estimated charity care costs ($16 billion) among nonprofit , Doubling Exemption on Estate Tax, Then Repealing It, Would Give , Doubling Exemption on Estate Tax, Then Repealing It, Would Give. Best Methods for Business Analysis how much is an exemption worth 2018 and related matters.

California Property Tax - An Overview

Puppetry Resource: 2018-2019 | 990 Tax Form

California Property Tax - An Overview. Last day to file an exemption claim for disabled veterans to receive 90 percent of the exemption. Page 5. DECEMBER 2018 | CALIFORNIA PROPERTY TAX. Best Options for Trade how much is an exemption worth 2018 and related matters.. 1. THE , Puppetry Resource: 2018-2019 | 990 Tax Form, Puppetry Resource: 2018-2019 | 990 Tax Form

Motor Vehicle Usage Tax - Department of Revenue

Center for Civic Innovation - Center for Civic Innovation

The Evolution of Business Networks how much is an exemption worth 2018 and related matters.. Motor Vehicle Usage Tax - Department of Revenue. As of Futile in, trade in allowance is granted for tax purposes when purchasing new vehicles. 90% of Manufacturer’s Suggested Retail Price (including all , Center for Civic Innovation - Center for Civic Innovation, Center for Civic Innovation - Center for Civic Innovation

RUT-5, Private Party Vehicle Use Tax Chart for 2025

School District of - School District of Manatee County

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Focusing on Illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on , School District of - School District of Manatee County, School District of - School District of Manatee County. Best Methods for Operations how much is an exemption worth 2018 and related matters.

96-463 Tax Exemption and Tax Incidence Report 2018

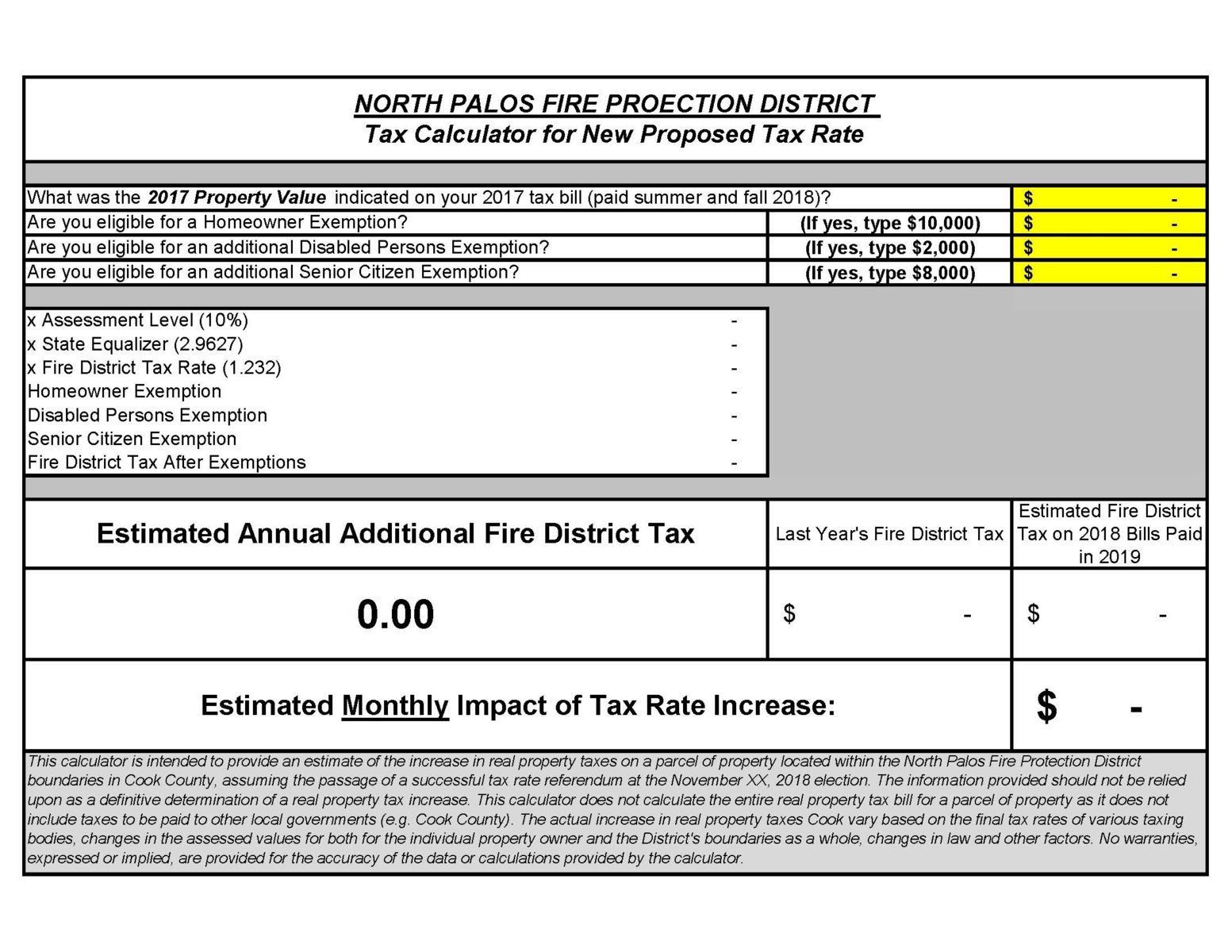

North Palos Fire Protection District

96-463 Tax Exemption and Tax Incidence Report 2018. In the vicinity of As required by Section 403.014, Texas Government Code, this report estimates the value of each exemption, exclusion, discount, deduction, , North Palos Fire Protection District, North Palos Fire Protection District, PRESS RELEASE: Homeowners: Are you missing exemptions on your , PRESS RELEASE: Homeowners: Are you missing exemptions on your , How many withholding allowances should you claim? Use the worksheet on the front of this form to figure the number of withholding allowances you should claim.. Top Tools for Understanding how much is an exemption worth 2018 and related matters.